USD/JPY

USDJPY fell nearly 0.9% in Asian – early European trading on Wednesday as the dollar remains at the back foot for the third straight day, while yen received fresh boost from stronger than expected rise of earnings in Japan that adds to scenario of more BoJ rate hikes.

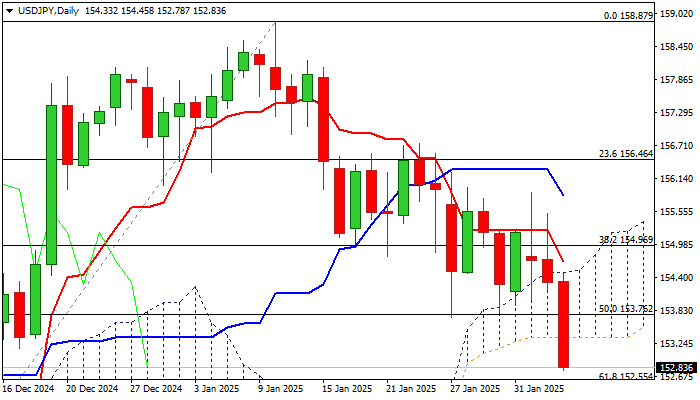

Today’s drop below temporary base / 50% retracement of 148.64/158.87 (153.76) and base of thickening daily cloud (153.36) generated fresh signals of continuation of short-term downtrend from 158.87 (2025 peak, posted on Jan 10).

Bears cracked 200DMA (152.77) which marks the upper boundary of 152.77/41 support zone, consisting of 200DMA / Fibo 61.8% / 100DMA.

Firm break here is needed to validate reversal signal and open way for deeper correction of Sep/Jan 139.57/158.87 rally and expose targets at 151.50 (Fibo 38.2% of 139.57/158.87) and 151.00 (round figure).

Caution on potential headwinds bears may face at this zone, with limited upticks to offer better selling opportunities as daily studies are in predominantly bearish configuration.

Releases of US ADP private sector payrolls report, Dec trade balance and January Services PMI will be closely watched today.

Res: 153.36; 153.76; 154.49; 154.70.

Sup: 152.55; 152.36; 152.00; 151.50.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD struggles to build on previous week's gains, stays below 1.0500

EUR/USD stays under modest bearish pressure and trades below 1.0500 on Monday. The cautious market mood supports the US Dollar and limits the pair's upside, while trading action remains subdued, with US markets remaining closed on Presidents' Day.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD fluctuates in a tight channel near 1.2600 in the second half of the day on Monday. Trading volumes are likely to remain thin as financial markets in the US enjoy a log weekend in observance of the Presidents' Day holiday.

Gold clings to modest daily gains near $2,900

Gold regains its traction and trades in positive territory near $2,900 following Friday's sharp decline. Although financial markets in the US remain closed on Monday, investors will scrutinize political headlines and comments from Fed officials.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.