Bajaj Finance Elliott Wave technical analysis

-

Function: Larger Degree Trend Higher (Intermediate Degree Orange).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Minor Wave 3 Grey.

-

Details: Minor Wave 3 Grey is advancing higher against 6460.

-

Invalidation point: 6460.

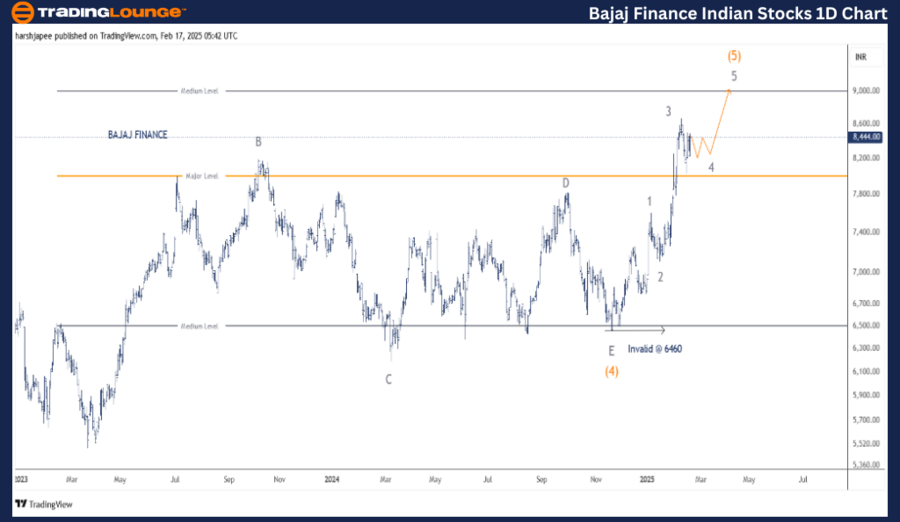

Bajaj Finance daily chart technical analysis and potential Elliott Wave counts

The BAJAJ FINANCE daily chart shows that bulls are driving prices higher towards at least 9000 levels, marking the completion of the larger degree uptrend (Intermediate Wave (5) Orange).

A potential Minor Wave 4 could be forming as an expanded flat or triangle before the final push higher. Previously, Intermediate Wave (4) ended around 6460 in November 2024, following a multi-year triangle that started in March 2023. Since then, Intermediate Wave (5) has been unfolding as an impulse, with the stock still having one more leg towards the 9000–9200 zone.

Bajaj Finance Elliott Wave technical analysis

-

Function: Larger Degree Trend Higher (Intermediate Degree Orange).

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Minor Wave 3 Grey

-

Details: Minor Wave 3 Grey is advancing higher against 6460, potentially completing at 8665 or near completion. If correct, a triangle Wave 4 could be developing before Wave 5 pushes higher towards 9000 levels.

-

Invalidation Point: 6460.

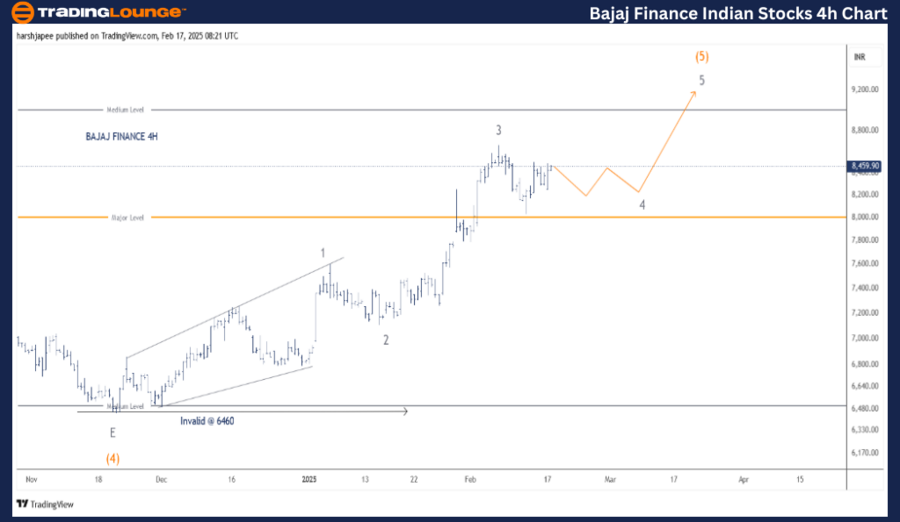

Bajaj Finance four-chart technical analysis and potential Elliott Wave counts

The BAJAJ FINANCE 4H chart highlights sub-waves within Intermediate Wave (5) Orange following the completion of Wave (4) as a triangle near 6460 in November 2024.

The thrust of Wave (5) is unfolding as an impulse, with a projection to break through the 9000 level swiftly.

- Minor Wave 1 formed as a leading diagonal, terminating around 7600.

- Wave 2 was a sharp correction, ending near 7120.

- Wave 3 pushed higher to 8665.

If this structure holds, Wave 4 may form a triangle before the final push. Prices must stay above 7600 for bulls to maintain the impulse wave.

Conclusion

BAJAJ FINANCE continues to progress higher within Minor Wave 3 of Intermediate Wave (5), aiming for 9000 levels in the coming sessions.

Bajaj Finance Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD remains side-lined around 1.0480

Price action in the FX world remains mostly subdued amid the lack of volatility and thin trade conditions following the US Presidents' Day holiday, with EUR/USD marginally down and flat-lined near 1.0480.

GBP/USD keeps the bullish bias above 1.2600

GBP/USD kicks off the new trading week on a positive foot and manages to reclaim the 1.2600 barrier and beyond on the back of the Greenback's steady price action.

Gold resumes the upside around $2,900

Gold prices leave behind Friday's marked pullback and regain some composure, managing to retest the $2,900 region per ounce troy amid the generalised absence of volatility on US Presidents' Day holiday.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.