- US-Russian talks about Ukraine are closely watched and will impact the Euro and Oil.

- The FOMC Meeting Minutes will likely show a hawkish view, cooling markets.

- Over the weekend, the German federal election is set to determine next week’s opening.

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

1) Peace is not imminent, market moves are

America's top diplomat, Marco Rubio, is heading to Saudi Arabia, where he will not only talk about the Middle East but also meet Russian officials to discuss a deal with Ukraine. While President Trump said his Ukrainian counterpart Volodimir Zelenskiy will be involved, his country – and the old continent – are lagging, not leading.

Nevertheless, this talk has consequences. First, while Europe is worried and feels excluded, it benefits in the short run from prospects of cheap Russian energy flowing again. Moreover, Trump's demand for more military spending means opening government coffers, which is good for growth.

In the longer term, the Russian threat will still remain prominent, and rising debt could come to haunt the old continent, but his week, any progress in talks would boost the Euro (EUR).

It would also weigh on Oil prices. Why? Even if sanctions on Russian energy exports remain intact, enforcement might fall in the short term, weighing on prices.

Smiles on Rubio's face would be Euro bullish and Oil bearish. Reports of difficult talks would do the opposite.

2) RBA may stage "hawkish cut"

Tuesday, 03:30 GMT. Finally, the Reserve Bank of Australia (RBA) is set to join its peers in cutting interest rates. Borrowing costs have been dropping in other developed economies, from its neighbor New Zealand to the US, the UK and beyond.

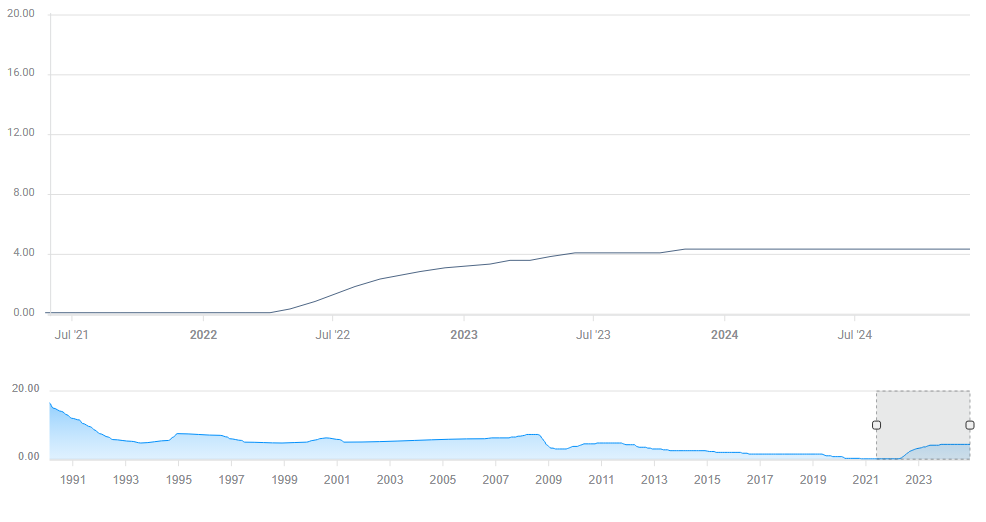

RBA interest rates. Source: FXStreet.

RBA Governor Michelle Bullock's hawkish approach – backed by a robust economy – kept rates at 4.35% throughout 2024. The expected drop to 4.10% would come on the back of lower inflation. However, while this first cut is unlikely to be the last, the RBA may wait before the next move.

Several commercial banks expect four rates this year, but I think Bullock and her colleagues will convey an upbeat message, pushing back market expectations for so many cuts. The RBA may lean on expectations for China to grow faster, raising demand for Australian metals.

3) FOMC Meeting Minutes to remind markets the Fed is not in a hurry

Wednesday, 19:00 GMT. "No rush" – that was the message from Jerome Powell, Chair of the Federal Reserve (Fed), in his recent testimony in Congress. With a bump up in inflation and a strong jobs market, the next rate cut will have to wait.

This message will likely be repeated in the Federal Open Markets Committee (FOMC) Meeting Minutes. The central bank's protocols from the latest event are set to show hawks are in control. While that wouldn't be a shock in itself, it is out of line with more recent market expectations.

Weak Retail Sales figures in January, released on Friday, triggered hopes the Fed could still cut rates twice this year, and a reminder of the bank's hesitance to move would hit market sentiment. Gold and Stocks could suffer, while the US Dollar (USD) would benefit. The reaction may remain limited.

4) US Flash PMIs take America's pulse after weak consumption data

Friday, 14:45 GMT. Are US shoppers struggling? The downbeat Retail Sales report for January caused worries that consumption, some two-thirds of the US economy, is struggling. However, it could also be a one-off.

Preliminary S&P Global's forward-looking Purchasing Managers Indexes (PMIs) for February provide an updated look at the state of the economy. Both the services and manufacturing PMIs came out just above 50 in January – pointing to minimal expansion.

A drop below 50, especially the Services PMI where consumption is, would weigh on the US Dollar and support Gold and Stocks on hopes for two rate cuts this year. Upbeat figures would do the opposite.

5) German election may trigger a "buy the rumor, sell the fact" response

Sunday, results are due before the market opening. According to the polls, the extreme right Alternative für Deutschland (AfD) is set to gain substantial ground, eating the share of mainstream parties. In the previous election, the AfD failed to meet the polls’ expectations. Projections now are even higher for the party led by Alice Weidel, especially after several high-profile attacks by asylum seekers, which strengthened its anti-immigration message.

I expect the AfD to underperform its polls, leading to a "buy the rumor, sell the fact" response that will support the Euro and buoy European markets. But that is only one part of the reaction.

The ruling center-left Social Democratic Party (SPD) and the center-right Christian Democratic Union (CDU) – which is poised to win – both rule out any collaboration with the AfD. So do all other parties.

But, can they cobble up a coalition quickly? With the US and Russia rushing to talk about Ukraine, leadership in Germany is critical. A big victory for the CDU, led by Friedrich Merz, would be positive for markets, which want a business-friendly leader. That would help convince the SPD or the Greens to join.

However, a more fragmented outcome would trigger longer coalition talks and hobbling markets.

Final thoughts

US President Trump completes one month in office this week, and the pace of announcements remains relentless. That implies rapid market responses and increasing volatility.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD struggles to build on previous week's gains, stays below 1.0500

EUR/USD stays under modest bearish pressure and trades below 1.0500 on Monday. The cautious market mood supports the US Dollar and limits the pair's upside, while trading action remains subdued, with US markets remaining closed on Presidents' Day.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD fluctuates in a tight channel near 1.2600 in the second half of the day on Monday. Trading volumes are likely to remain thin as financial markets in the US enjoy a log weekend in observance of the Presidents' Day holiday.

Gold clings to modest daily gains near $2,900

Gold regains its traction and trades in positive territory near $2,900 following Friday's sharp decline. Although financial markets in the US remain closed on Monday, investors will scrutinize political headlines and comments from Fed officials.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.