- Concerns about US President Donald Trump’s trade war cooled down at the end of the week.

- Federal Reserve President Jerome Powell reaffirmed the central bank’s hawkish stance.

- European Central Bank officials see more rate cuts in the upcoming months.

- EUR/USD flirts with the 1.0500 mark and has scope to extend its recovery.

The EUR/USD pair gapped lower for a second consecutive week, falling to 1.0276 on Monday, yet managed to change course mid-week, finishing it at around 1.0500 and near fresh two-week highs.

US President Trump shakes markets again

The US Dollar (USD) seesawed at the rhythm of sentiment, surging amid risk-aversion as United States (US) President Donald Trump anticipated a fresh round of tariffs ahead of the markets’ opening. The White House imposed a 25% tariff on all steel and aluminium imports into the US on Tuesday, with no exceptions.

Fears took over the FX board, spurring demand for the safe-haven Greenback, yet USD strength was short-lived, as tepid US data and encouraging headlines pushed it lower across the FX market.

The US reported that the Consumer Price Index (CPI) rose by more than anticipated in January, fueling speculation the Federal Reserve (Fed) will keep interest rates at current levels for longer. Inflation, as tracked by the CPI, rose by 3.0% in the year to January, while the core annual reading increased by 3.3%, above the previous 3.2% and the expected 3.1% reading, according to the Bureau of Labor Statistics (BLS).

Additionally, the mood improved following market talks, indicating a potential agreement between Russia and Ukraine with the help of the US.

Then, on Thursday, President Trump announced his plan for reciprocal tariffs against all major trading partners that impose tariffs on the US and non-tariffs on goods imported from the US. Additionally, he said his government is considering countries that charge a VAT on foreign goods as a form of tariff, and hence, could result in reciprocal levies.

Finally, he added that Commerce Secretary Howard Lutnick will be working on a reciprocal plan and announce the details moving forward.

Optimism took over markets

The absence of details, along with a delay in the imposition of new tariffs, kept financial markets in optimistic mode, helping EUR/USD reach the aforementioned high.

Other than that, Fed Chairman Jerome Powell testified before Congress about monetary policy and repeated that the central bank is in no rush to trim interest rates any time soon.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said.

Additionally, Powell noted the US is in a “pretty good place” with the economy, but also that policymakers would want to make more progress on inflation. About the latter, he mentioned progress while adding it is still “somewhat elevated.”

His hawkish words were no surprise, as Powell delivered the same message after the Fed’s January monetary policy meeting.

Finally, on Friday, the US released January Retail Sales, which fell by 0.9% in the month, much worse than the -0.1% anticipated. December's figure, in the meantime, was upwardly revised to 0.7% from the previous estimate of 0.4%. The negative headline put additional pressure on the USD.

European noise continues

European data, in the meantime, came short of encouraging. The February Sentix Investor Confidence index resulted in -12.7, improving from the -17.7 posted in January. Industrial Production in the European Union (EU) fell by 1.1% on a monthly basis in December, while the Q4 Gross Domestic Product was revised to -0.1% QoQ from 0.0% previously estimated.

Meanwhile, Germany confirmed the January Harmonized Index of Consumer Prices (HICP) at 2.8% YoY as previously estimated.

Also, European Central Bank (ECB) officials were on the wires with their usual cautious tone. President Christine Lagarde said on Monday that conditions for a recovery remain in place, yet noted that there are risks on both the upside and the downside to inflation.

ECB policymaker and Bank of France head Francois Villeroy de Galhau said that US President Trump’s trade policies will most likely have a negative impact on the economy. Policymaker Boris Vujčić noted on Thursday that the market is pricing in three more rate cuts this year and added that those expectations are not unreasonable.

The Fed’s hawkish path and the ECB’s dovish one clearly favor a EUR/USD rally to fresh highs.

What’s next in the docket

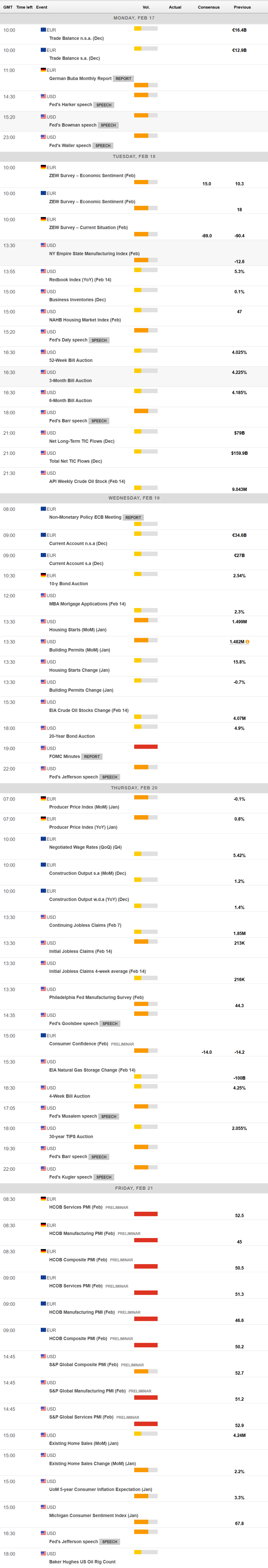

The macroeconomic calendar will feature some interesting data in the upcoming days. A slew of Fed speakers will hit the wires on Monday, while the Federal Open Market Committee (FOMC) will release the Minutes of the January meeting on Wednesday. Friday will bring the Hamburg Commercial Bank (HCOB) and the S&P Global preliminary estimates of the February Purchasing Managers’ Indexes (PMIs) for all major economies.

As usual, comments from US President Trump on tariffs and speculation on how such levies could affect the economy and, hence, future Fed’s decision, will lead the market’s ways.

EUR/USD technical outlook

The EUR/USD pair flirts with the 1.0500 mark, yet the long-term technical picture shows bulls are not yet in the driver’s seat. Technical indicators in the weekly chart keep advancing, albeit within negative levels. Indicators have completely corrected oversold conditions and maintain their upward slopes, in line with a continued advance. At the same time, the pair is developing below all its moving averages, with a firmly bearish 20 Simple Moving Average (SMA) providing dynamic resistance at around 1.0560 while extending its slide below directionless 100 and 200 SMAs.

The technical picture in the daily chart is quite similar, with an increased bullish potential yet additional confirmations needed to support a fresh leg north. The Momentum indicator is pressuring its midline from below yet with a limited directional slope. At the same time, the Relative Strength Index (RSI) indicator advances at around 60, albeit at a moderated pace. Finally, EUR/USD extends gains above a mildly bullish 20 SMA, the latter at around 1.0400, but remains below a bearish 100 SMA acting as dynamic resistance at 1.0585.

Initial support comes at around 1.0440, where the pair topped on February 5, followed by the 1.0400 threshold. Below the latter, the pair can extend its slide towards the 1.0320 region, with the next support level at 1.0276, the weekly low. Resistance, on the other hand, comes at 1.0527, January's monthly high, with further gains exposing 1.0639, December's monthly high.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Cardano set for 20% rally as bullish bets increase

Cardano price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.