- Cardano price extends its rally on Monday after gaining more than 13% last week.

- On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached its highest in over a month.

- The technical outlook and funding rates data suggest a rally continuation, targeting 20% additional gains.

Cardano (ADA) price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month. The technical outlook and funding rates data suggest a rally continuation, targeting 20% additional gains.

Cardano bulls aim for 20% gains

Cardano price found support around its 61.8% Fibonacci retracement level (drawn from the August 5 low of $0.27 to the December 3 high of $1.32) at $0.67 last week. It rose 13.21%, closing above the weekly resistance level of $0.74. At the start of this week on Monday, it continued to rally by 4.7%, trading at around $0.80.

If the weekly level at $0.74 holds as support, it could extend the rally by 22% from its current levels to retest its January 30 high of $0.98.

The Relative Strength Index (RSI) on the weekly chart reads 53, bouncing off from its neutral level of 50 last week and indicating a maintenance of bullish momentum.

ADA/USDT weekly chart

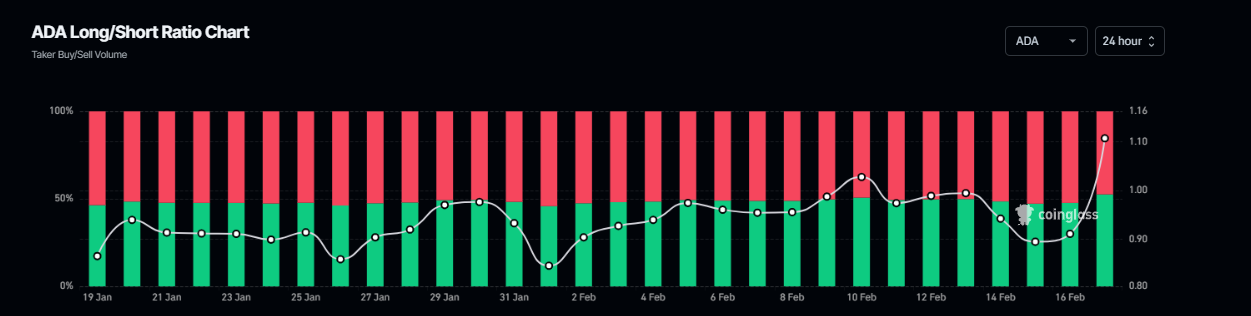

Another bullish sign is Coinglass’ ADA long-to-short ratio, which reads 1.09, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the asset price to rise.

ADA long-to-short ratio chart. Source: Coinglass

According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the price of ADA will slide further is fewer than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their open interest rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

In the case of ADA, the metric increased from -0.0007% on Sunday to 0.0016% on Monday, reflecting a positive rate and indicating that longs are paying shorts. This scenario often signifies bullish sentiment in the market, suggesting potential upward pressure on Cardano’s price.

ADA OI-Weighted Funding Rata chart. Source: Coinglass

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA set for 20% rally as bullish bets increase

Cardano (ADA) price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH hold steady while XRP gains momentum

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 for almost two weeks. Ethereum (ETH) price follows in BTC’s footsteps and hovers around $2,680, while Ripple (XRP) shows strength and extends its gains on Monday after rallying 14% last week.

Bitcoin (BTC) vs Gold (XAU): Asset Tokenization expert weighs impact of US Inflation on 2025 price trends

Bitcoin price consolidated at $97,000 on Feb 15, down 6% within the monthly time frame, reeling under bearish headwinds from US tariff wars and rising inflation.

Dogecoin (DOGE) Price mirrors XRP rally as SEC acknowledges Grayscale ETF Filings

Dogecoin price surged 3% on Friday, extending its weekly timeframe gains to 17% as ETF speculation gains traction.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.