-

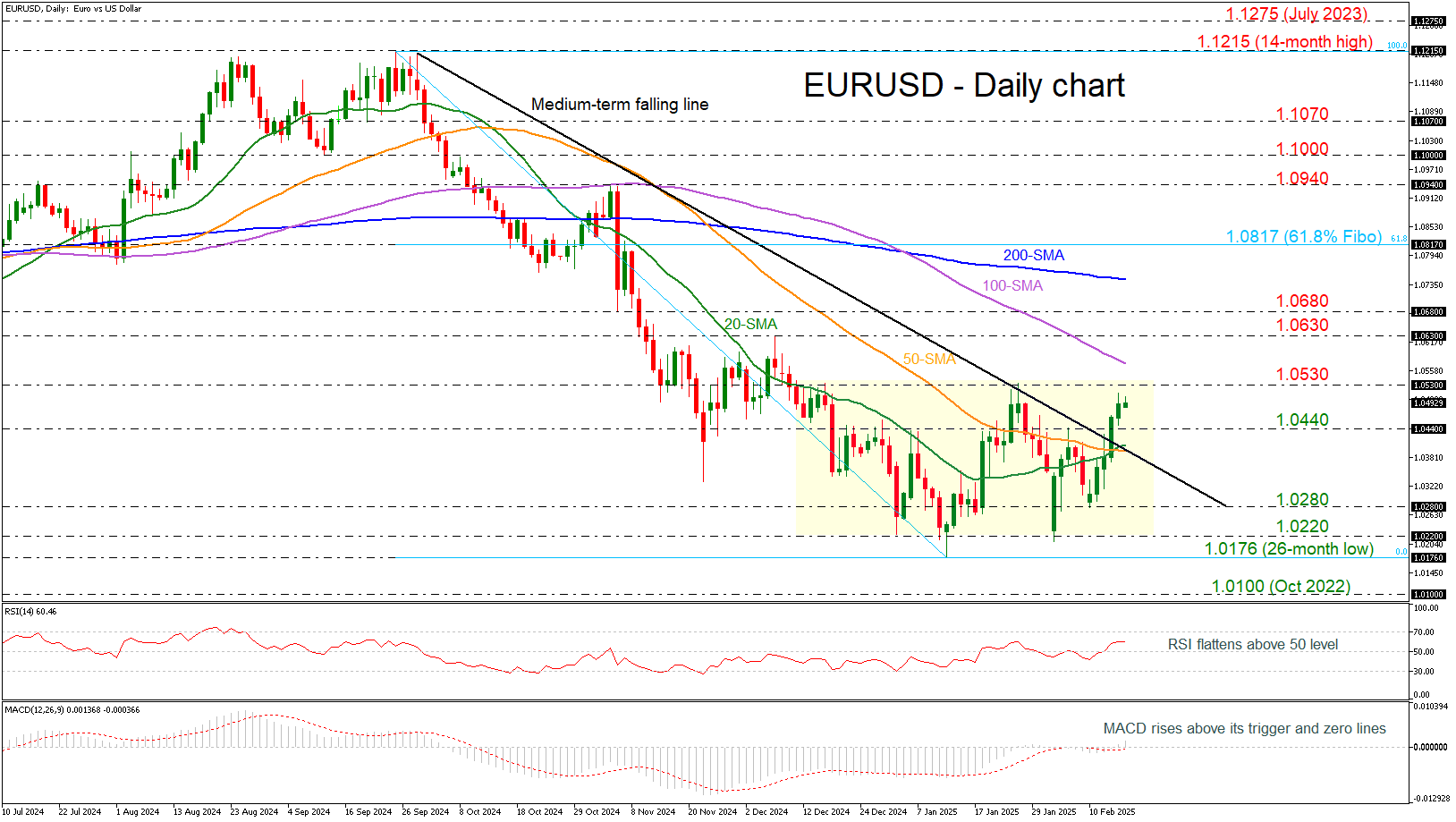

EUR/USD surpasses downtrend line.

-

20- and 50-day SMA post bullish cross.

-

RSI flattens but MACD ticks up.

EUR/USD has advanced considerably in the short-term timeframe, recording five consecutive green days and surpassing the medium-term descending trend line. Also, the 20- and 50-day simple moving averages (SMAs) posted a bullish crossover, mirroring the latest upswing. However, the pair has still been developing within a trading range of 1.0220-1.0530 over the last two months.

In case of steeper increases and a successful break of the 1.0530 roof, then the market could find the next resistance at the 100-day SMA at 1.0570, ahead of the 1.0630–1.0680 restrictive region. Further upside movements could take the bulls towards the 200-day SMA at 1.0746 and the 61.8% Fibonacci retracement level of the down leg 1.1215-1.0176 at 1.0817, which would act as a significant turning point for the market.

Conversely, a decline below the 1.0440 support and the downtrend line, aligning with the short-term SMAs at 1.0400, could reinforce the neutral bias once more, leading to a test of the 1.0280 support. Below that, the lower boundary of the consolidation area at 1.0220 could be a tough obstacle for the bears, but penetration of this area could send investors to the 26-month low of 1.0176.

The technical oscillators are showing some neutral-to-positive vibes. The RSI is flattening above the neutral threshold of 50, while the MACD is extending its positive momentum above its trigger and zero lines.

To sum up, EUR/USD has been in a neutral-to-bullish bias in the short- to medium-term timeframes as it is attempting to remain above the downtrend line, but the sideways channel still holds.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Cardano set for 20% rally as bullish bets increase

Cardano price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.