- USD/CHF found support at the ascending trendline for the third time, hinting at a potential reversal and further upside.

- Safe haven flows and policy divergence between the Fed and SNB are influencing the Swiss Franc's value.

- A break above 0.90680 on the H4 chart could signal a bullish reversal.

USD/CHF fell yesterday as the CHF benefitted from safe haven demand. The US dollar had been attracting haven demand in 2024, but yesterday saw traditional haven's benefit, namely the Swiss Franc and Japanese Yen. The move failed to last however, with buyers immediately pushing the pair back above the psychological 0.9000 handle.

The US Dollar Index gapped up overnight on tariff chatter which helped USD/CHF maintain momentum above the 0.9000 handle. The DXY however, has found it hard to push above the 108.00 handle and this could leave USD/CHF vulnerable to further downside.

US Dollar Index (DXY) daily chart, January 28, 2025

Swiss exporters hope for further CHF weakness

The Swiss export industry has been hoping for a weaker Swiss Franc and will hope that the trendline bounce will lead to further upside. The downside however, is that as tariff chatter ramps up and comes to fruition the Swiss Franc may strengthen due to safe have flows. The question will be whether the SNB will intervene?

Policy divergence may also hurt the Swiss Franc

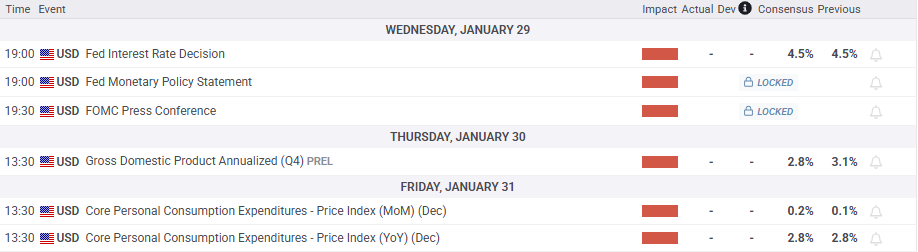

Market participants have also seen concerns raised about policy divergence between the US Federal Reserve and the Swiss National Bank (SNB). There has been chatter that the Fed may announce a pause in tomorrow's FOMC meeting of its rate cutting cycle. On the other hand the SNB may continue to cut rates as inflation has been lagging of late. The SNB may use further rate cuts to stir up demand and push inflation into the SNB range of 0%-2%.

This is another factor which could weigh on the Swiss Franc in the months ahead. I do however believe that expecting the Fed to announce a pause is premature. I think the Fed will keep rates steady but leave the door open for further rate cuts in the second half of the year.

After the FOMC meeting tomorrow we still have US GDP data on Thursday and then the Feds preferred inflation gauge, the PCE data on Friday.

Technical analysis

This is a follow-up analysis of my prior report “USD/CHF Technical Outlook: Bulls in Charge as Potential Double Top Pattern Forms” published on 13 January 2025. Click here for a recap.

From a technical standpoint, USD/CHF topped out on Monday January 13 before beginning its move lower.

Since then USD/CHF has made its way lower before yesterday's brief spike below the psychological 0.9000 handle saw the pair complete its third touch of the ascending trendline. A third touch of the trendline usually hints at another leg to the upside and potentially fresh highs.

USD/CHF daily chart, January 9, 2025

Dropping down to a four-hour chart and the trend remains bearish as USD/CHF failed to take out the swing high from Monday at 0.90680.

There is also a descending trendline on the H4 timeframe which may come into play.

First however, a four-hour candle close above 0.90680 will be the first sign that bulls are back in charge. A trendline break after that will only reinforce this belief and could lead to a swift move back toward recent highs above resistance at 0.9157.

A break lower for USD/CHF will require a candle close below the 0.9000 psychological level on the daily timeframe. We did have one yesterday on the H4 chart as you can see below, but that was followed by a swift recovery and bounce back above.

USD/CHF Four-Hour Chart, January 28, 2025

Support

- 0.9040

- 0.9000

- 0.8980

Resistance

- 0.9068

- 0.9087

- 0.9157

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.