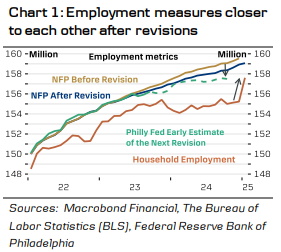

Labour markets conditions have remained solid since our last update. Nonfarm payrolls (NFP) growth slowed down to 143k in January, but data for the past two months was revised up by 100k. The annual benchmark revisions to NFP data from April 2023 to March 2024 were less negative than expected, landing at -598k (cons: -818k). The unemployment rate continued lower to 4.0%, but the figure might have been distorted by the updated population controls. Household employment and the size of the labour force (which are used to calculate the unemployment rate) jumped up by around 2.2m as the population estimate was revised higher. While the seemingly conflicting revisions complicate the interpretation of monthly changes in employment data, in the big picture the different employment metrics are simply being revised closer to each other after diverging unusually far apart over past years. (chart 1).

December JOLTs job openings were to the weak side, declining to 7.6m (cons: 8m, prior: 8.2m) after the solid rebound in November. That said, the ratio of unfilled vacancies per unemployed remains close to pre-pandemic levels. The number of layoffs has also remained at historically low levels, which means there are no acute signs of labour markets weakening for the time being.

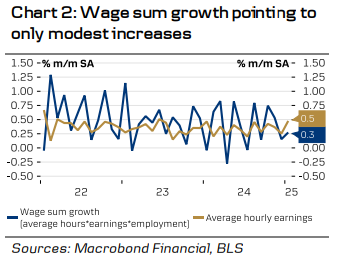

Wage growth accelerated more than expected, increasing 0.5% m/m SA and 4.1% y/y, but this largely reflected a drop in average hours worked from 34.3 to 34.1 in January. Looking at the wage sum growth measure, the development was more modest (chart 2).

That said, wage growth remains its above pre-pandemic levels, with risks skewed towards higher wage pressure. Productivity growth weakened towards the end of 2024, at 1.2% q/q SA AR (cons: 1.4%) - close to the pre-pandemic trend - while unit labour costs accelerated to 3.0% q/q SA AR. This makes it more difficult for firms to pay higher wages without upside pressure on costs. Firms would either need to absorb this into their margins or pass more of the wage increases onto selling prices, putting upward pressure on inflation and acting as a concern for the Fed.

Notably, data from the University of Michigan showed that consumers' 1y inflation expectations continued to rise to 4.3%, which could also lead to further pressure on wages, if workers begin to demand higher wages again.

While the ISM and PMI employment indices point to employment strengthening, these volatile data should be viewed with caution. The widely followed "jobs plentiful"-index from NFIB fell to its lowest level since last September, but it may be influenced by respondents' perception of Trump. Other leading indicators have shown a noticeable difference in optimism between Republican respondents and more pessimistic Democrats.

Overall, labour market conditions remain solid, underscored by healthy labour demand and low layoff numbers. Looking ahead, we anticipate some slowing in employment growth, setting the scene for the Fed to deliver further rate cuts. However, risks are tilted towards more persistent wage pressures amid weaker productivity, higher unit labour costs and rising inflation expectations from consumers.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.