Stellar (XLM) price climbed 12% to $0.43 on Thursday, adding over $1.5 billion to its market capitalization.

Having often mirrored XRP’s movements, XLM’s market-leading performance on Monday signals intense speculative demand.

Bullish traders hold $13 million in long positions, outpacing the $3 million total active shorts by nearly 70%.

Stellar (XLM) outpaces XRP with a strong market surge

Stellar (XLM) saw an impressive 12% price increase on Thursday, reaching $0.43 and adding over $1.5 billion to its market capitalization.

This surge marks a significant decoupling from XRP, a cryptocurrency with which XLM has historically shared a correlated price movement. XLM’s rally comes amid a broader recovery in the crypto market, with Bitcoin (BTC) reclaiming $105,000 and Ethereum (ETH) trading just shy of the $3,300 mark.

Stellar (XLM) vs. Ripple (XRP) Price Action | Source: TradingView

Stellar (XLM) vs. Ripple (XRP) Price Action | Source: TradingView

Unlike previous cycles where XLM mirrored XRP’s price action, Stellar raced ahead on Thursday, with its 12.4% gains outpacing XRP’s 3.1% uptick as seen in the chart above.

However, without a significant news event or network update driving growth, XLM’s double-digit rally on Thursday could be linked to growing speculative demand.

Traders selectively place bullish bets anticipating that altcoin ETFs could spark the first major breakout under United States (US) President Donald Trump’s administration.

Bulls deploy $13M leverage after breaking key resistance

Prior to the 12% gains on Thursday, XLM had registered four consecutive daily red candles.

This represents its longest losing streak since XLM was re-listed on Binance in November 2024.

Looking beyond the price chart, trading metrics observed within Stellar derivatives markets affirm that the current price action is considerably influenced by speculative traders’ activity.

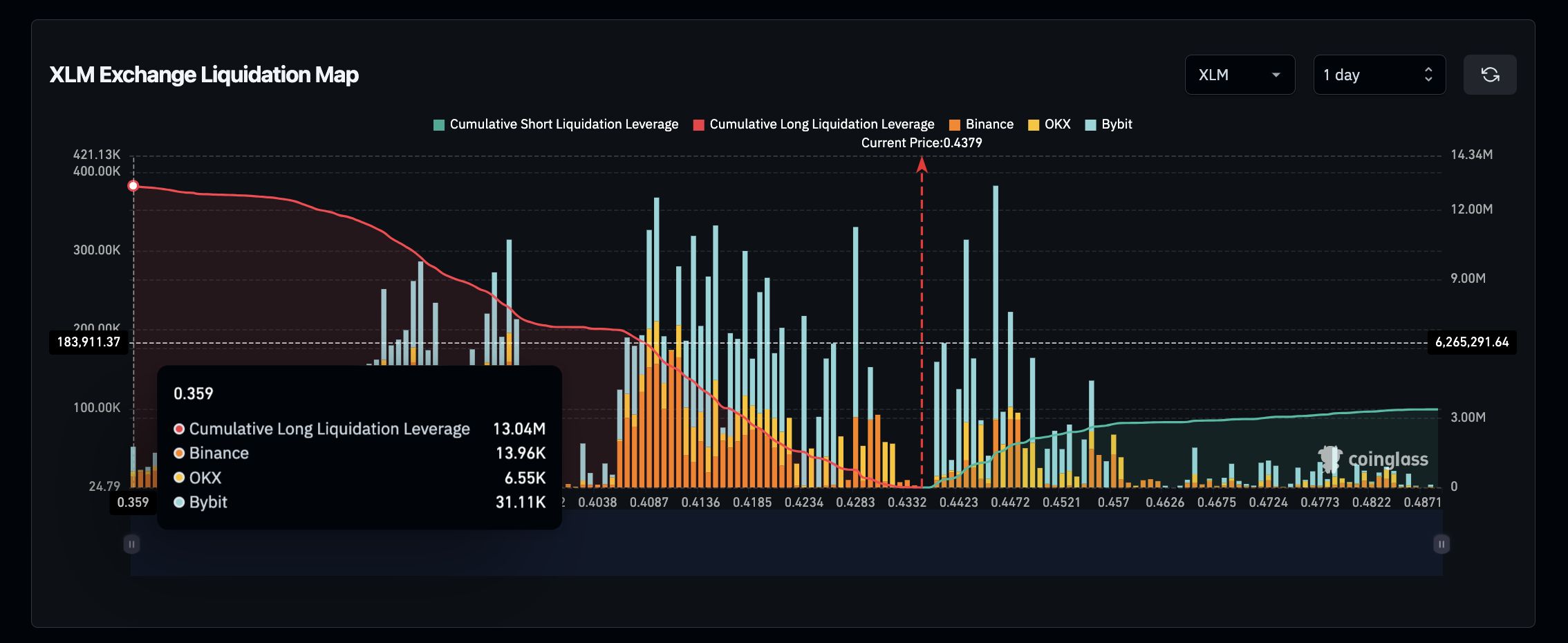

Stellar (XLM) Liquidation Map | Source: Coinglass

Stellar (XLM) Liquidation Map | Source: Coinglass

Coinglass Liquidation Map chart above shows bullish traders have aggressively deployed leverage, with long positions totaling $13 million at press time, dwarfing the $3 million in short interest. This 70% imbalance in favor of longs highlights traders’ confidence in continued upside momentum.

Historically, when leveraged longs dominate after a prolonged period of bearish price action, it is often interpreted as a bottom formation signal. Against this backdrop, XLM price is expected to advance further upwards, if market sentiment and liquidity remain at current levels or better.

Stellar Price Forecast: $0.50 could reinforce bullish momentum

Stellar (XLM) price is displaying a positive outlook after breaking out from a falling wedge pattern, after four consecutive losing days to a bullish reversal structure.

The breakout has driven XLM above $0.43, aligning with an increase in trading volume, which suggests growing investor confidence.

The next key resistance lies at $0.50, which, if breached, could fuel further gains toward the projected target near $0.60.

The Bollinger Bands indicate expanding volatility, with the price rebounding off the lower band and now pushing toward the mid-line.

A sustained move above the middle band ($0.44) would confirm bullish control, while a rejection at this level could signal consolidation before another breakout attempt.

The Relative Strength Index (RSI) at 53.80 suggests there is still room for upside before reaching overbought conditions, reinforcing the potential for continued gains.

On the downside, failure to hold above $0.40 could invite bearish pressure, with the lower Bollinger Band at $0.37 acting as key support. If momentum weakens, XLM may retest this

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA set for 20% rally as bullish bets increase

Cardano (ADA) price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH hold steady while XRP gains momentum

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 for almost two weeks. Ethereum (ETH) price follows in BTC’s footsteps and hovers around $2,680, while Ripple (XRP) shows strength and extends its gains on Monday after rallying 14% last week.

Bitcoin (BTC) vs Gold (XAU): Asset Tokenization expert weighs impact of US Inflation on 2025 price trends

Bitcoin price consolidated at $97,000 on Feb 15, down 6% within the monthly time frame, reeling under bearish headwinds from US tariff wars and rising inflation.

Dogecoin (DOGE) Price mirrors XRP rally as SEC acknowledges Grayscale ETF Filings

Dogecoin price surged 3% on Friday, extending its weekly timeframe gains to 17% as ETF speculation gains traction.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.