- Ripple (XRP), Ethereum (ETH), and Cardano (ADA) all posted double-digit gains in the last 24 hours.

- The global crypto market's aggregate valuation increased by 2.1% to $2.3 trillion as US President Trump postponed tariffs imposed on Mexico and Canada.

- Technical indicators highlight key levels to watch as investors begin to reallocate capital following the upturn in market sentiment.

Crypto market rebounds as Trump pauses tariffs on Mexico and Canada but not China

The crypto market rebounded sharply, adding over $190 billion to its aggregate valuation on Tuesday per Coingecko data as US President Donald Trump postponed tariffs imposed on Mexico and Canada.

This decision triggered a rally in top Layer-1 cryptocurrencies such as XRP, ETH, and ADA, which led to the recovery phase.

The global crypto market experienced a rough start to February, facing multiple bearish catalysts that suppressed investor confidence.

One key trigger was the DeepSeek vs. OpenAI dispute in late January, which sent shockwaves through AI-related stocks, wiping out over $600 billion from NVIDIA’s market cap.

The spillover effect impacted the broader crypto sector, as investors feared potential AI market instability would slow blockchain adoption.

Further exacerbating market jitters, President Trump announced sweeping tariffs on imports from China, Mexico, and Canada, raising fears of retaliatory economic measures.

Anticipating price increases on consumer goods, US investors began pulling funds from risk assets such as stocks and cryptocurrencies, bracing for economic turbulence.

This led to a sharp selloff, with Bitcoin (BTC) plummeting by 11% between January 31 and February 4, dropping below the $90,000 mark for the first time in 20 days.

The broader crypto market suffered as well, with over $2.2 billion in liquidations recorded across derivatives markets within a single day.

Total Crypto Market Cap Feb 4, 2025 | TradingView

Total Crypto Market Cap Feb 4, 2025 | TradingView

The chart above shows how the crypto market plunged 20% in three consecutive losing days between January 31 and February 3.

However, markets found relief on Monday when Trump announced a pause on the tariffs targeting Mexico and Canada, easing concerns about inflation and trade disruptions.

Despite the White House notably maintaining the tariffs on Chinese imports, the immediate rollback on North American trade restrictions was enough to restore investor confidence.

This led to a swift rebound in the crypto market, with a 5.6% increase in overall market capitalization within hours of the announcement.

Layer-1 coins lead $200B market rebound as investors remain cautious

Notably, Layer-1 tokens such as Ripple (XRP), Ethereum (ETH), and Cardano (ADA) outperformed the broader market, posting double-digit gains in the past 24 hours.

The preference for major Layer-1 assets over smaller-cap altcoins indicates that investors are opting for safer, more established blockchain projects amid ongoing macroeconomic uncertainty.

Historically, when large-cap assets attract more inflows than riskier alternatives, it suggests that market participants are prioritizing stability, positioning for market gains while also keeping an eye out for potential macro risks.

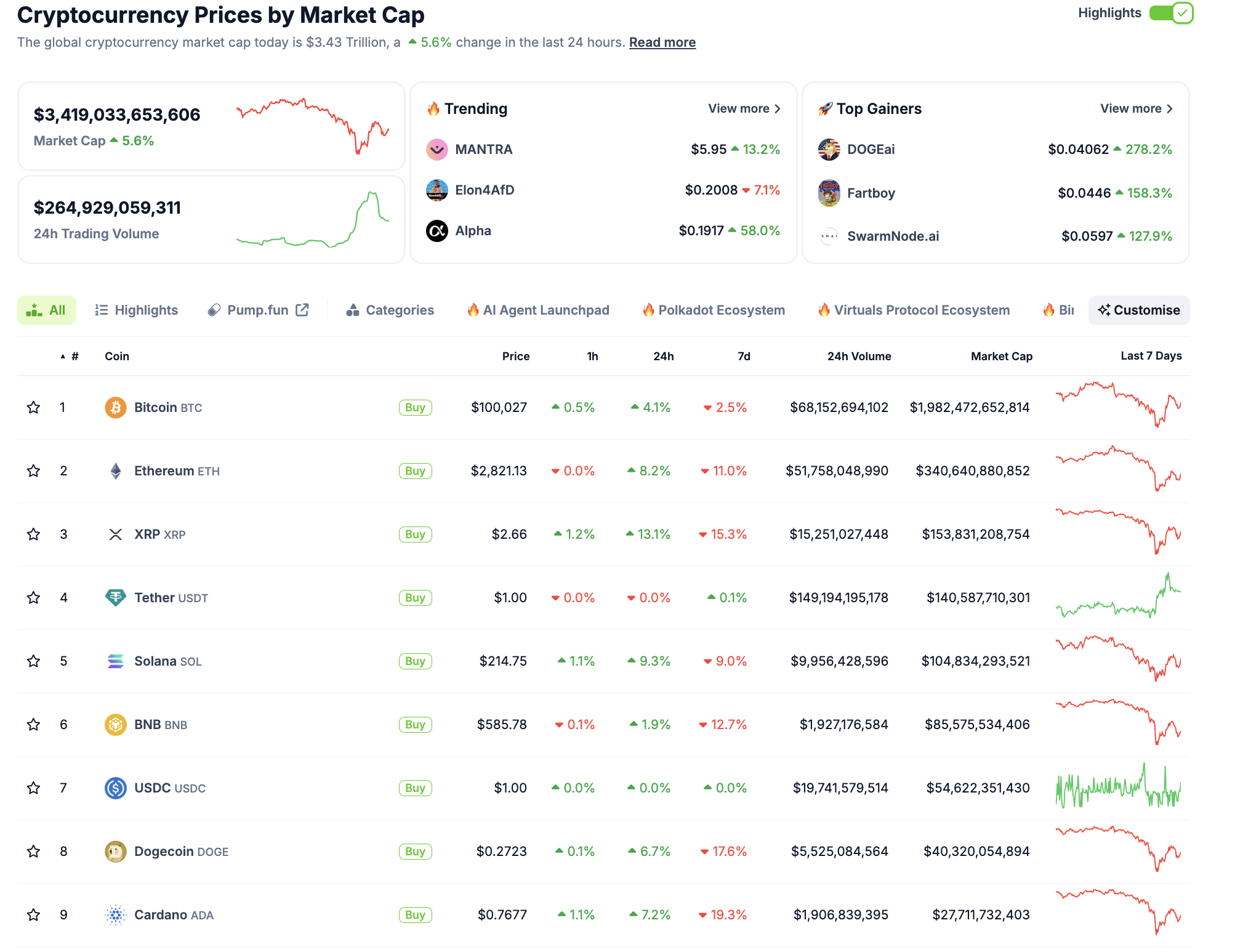

Crypto Market Performance snapshot, Feb 4, 2025 | Source: Coingecko

According to the latest market data, the total crypto market capitalization surged 5.6% within 24 hours, reaching $3.43 trillion.

Bitcoin (BTC) rebounded above $100,000 with a 4.1% daily gain, while Ethereum (ETH) climbed 8.2% to $2,821. XRP saw the largest Layer-1 gain of 13.1%, trading at $2.66. Meanwhile, Cardano (ADA) posted a 7.2% gain and Solana (SOL) rose by 9.3%, reinforcing the narrative that investors are concentrating liquidity in major blockchain ecosystems.

Trading volume also reflected this shift, with Bitcoin and Ethereum leading with $68.1 billion and $51.7 billion in 24-hour volumes, respectively. Notably, stablecoins such as USDT and USDC maintained price stability, suggesting that while capital is rotating into major Layer-1 assets, some investors are keeping liquidity on standby in case of market fluctuations.

As markets now await China's response to US trade restrictions, traders are closely watching key support and resistance levels for XRP, ETH and SOL to gauge the sustainability of the current rally. Further analysis will follow in the next phase of price action.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA set for 20% rally as bullish bets increase

Cardano (ADA) price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH hold steady while XRP gains momentum

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 for almost two weeks. Ethereum (ETH) price follows in BTC’s footsteps and hovers around $2,680, while Ripple (XRP) shows strength and extends its gains on Monday after rallying 14% last week.

Bitcoin (BTC) vs Gold (XAU): Asset Tokenization expert weighs impact of US Inflation on 2025 price trends

Bitcoin price consolidated at $97,000 on Feb 15, down 6% within the monthly time frame, reeling under bearish headwinds from US tariff wars and rising inflation.

Dogecoin (DOGE) Price mirrors XRP rally as SEC acknowledges Grayscale ETF Filings

Dogecoin price surged 3% on Friday, extending its weekly timeframe gains to 17% as ETF speculation gains traction.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.