Markets are largely expecting the first 25bp rate cut from the Reserve Bank of Australia (RBA) next week on 18 February. We agree, but it'll be a close call.

We expect a cut, but it’s not a done deal

The market is pricing in the first 25bp rate cut from the Reserve Bank of Australia (RBA) next week on 18 February. While this is in line with our view and we place a 60% probability to it, we think the decision to cut or pause will be a close one – and it’s therefore not a done deal. Key to our thinking is that the wage pressures have eased more than expected and household consumption growth has been weaker than expected, which should give the RBA more comfort to ease. However, the unemployment rate is still below the central bank’s target, which could result in more uncertainty on the pace and timing of rate cuts.

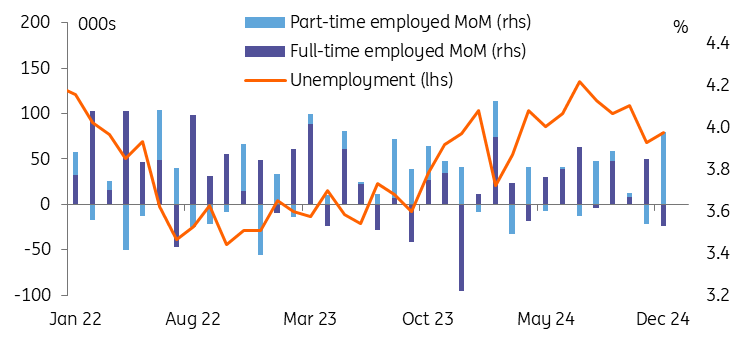

Weak employment details support our call for a rate cut in February. For December 2024, despite the strong headline employment growth number, the increase largely came from the part-time sector. Even on a trend basis, we can see a weakening trend of full-time employment growth, while the pace of part-time employment growth has improved. Part-time jobs – which are almost by definition more poorly paid, and often come with lower job security, perks and other benefits – will have a smaller impact, job-for-job, on household spending than full-time employment growth.

Wage growth has eased

Moreover, wage growth slowed to 3.5% in the third quarter of 2024 from 4.1% in the second quarter. Lower wage growth is broadly driven by slower growth across awards, enterprise bargaining agreements (EBAs) and individual arrangements and the recovery in household consumption is therfore likely to remain muted.

Headline CPI corrected meaningfully from 3.8% in June 2024 to 2.4% in the third quarter, slightly below the mid-point of the central’s bank’s CPI target of 2-3%. High services inflation, which has been a bigger challenge, has also corrected further than expected, suggesting substantial progress on containing inflation.

Employment and unemployment in Australia

Source: ING, Macrobond

We expect 100bp of cuts in 2025

The AUD cash rate future curve fully prices in a 25bp rate cut in February, and a total of 83bp of easing by the end of the year. That follows a dovish shift in rate expectations, with markets having added almost 50bp of additional cuts for 2025 since mid-November. While that is partly justified by the domestic macro developments discussed above, US protectionism is playing a major role, as markets are expecting that the RBA will need to cut rates to support an economy because of slower exports, especially to China.

In our February ING Monthly, we discuss our views on US protectionism. Our baseline expectation is that the US will increase duties on its global partners this year, with China remaining a main target. This clouds the Australian outlook, and we expect a reaction from the RBA in terms of monetary easing.

While we acknowledge the risk of inflationary bumps slowing easing plans, we currently forecast a total of 100bp of RBA easing in 2025 (including this February cut), taking rates to a terminal level of 3.35%.

Australian Dollar still largely a function of US tariffs

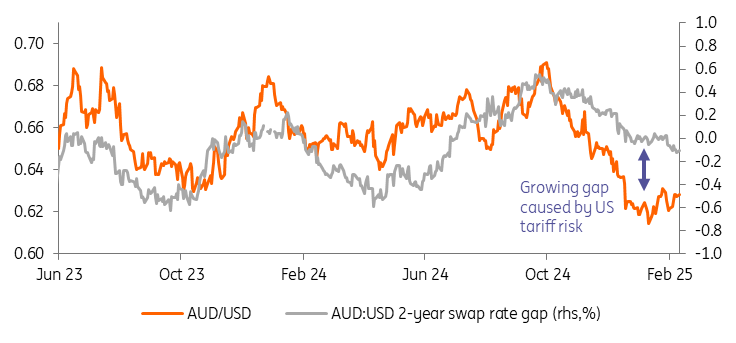

While the dovish repricing in the AUD curve has undoubtedly been a contributor, the AUD/USD decline has largely followed growing risk of US protectionism. As shown in the chart below, the AUD:USD short-term swap rate gap (which tracks the RBA-Fed differential) has not declined too aggressively since the US election. It is currently at -10bp, a level that in June 2024 was paired with AUD/USD around 0.66 compared to the current 0.63.

We don’t see much of a reprieve for AUD/USD; we continue to see US President Donald Trump stepping up the tariff threat, and the RBA should keep its options open to cut rates on the back of economic risks. As we don’t think the peak of US protectionism impact on the market has been reached, we retain a bearish bias on AUD/USD to 0.60 into this summer.

AUD/USD diverging from rate differential

Source: Refinitiv, ING

Read the original analysis: Reserve Bank of Australia to cut rates amid turbulent conditions

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.