-

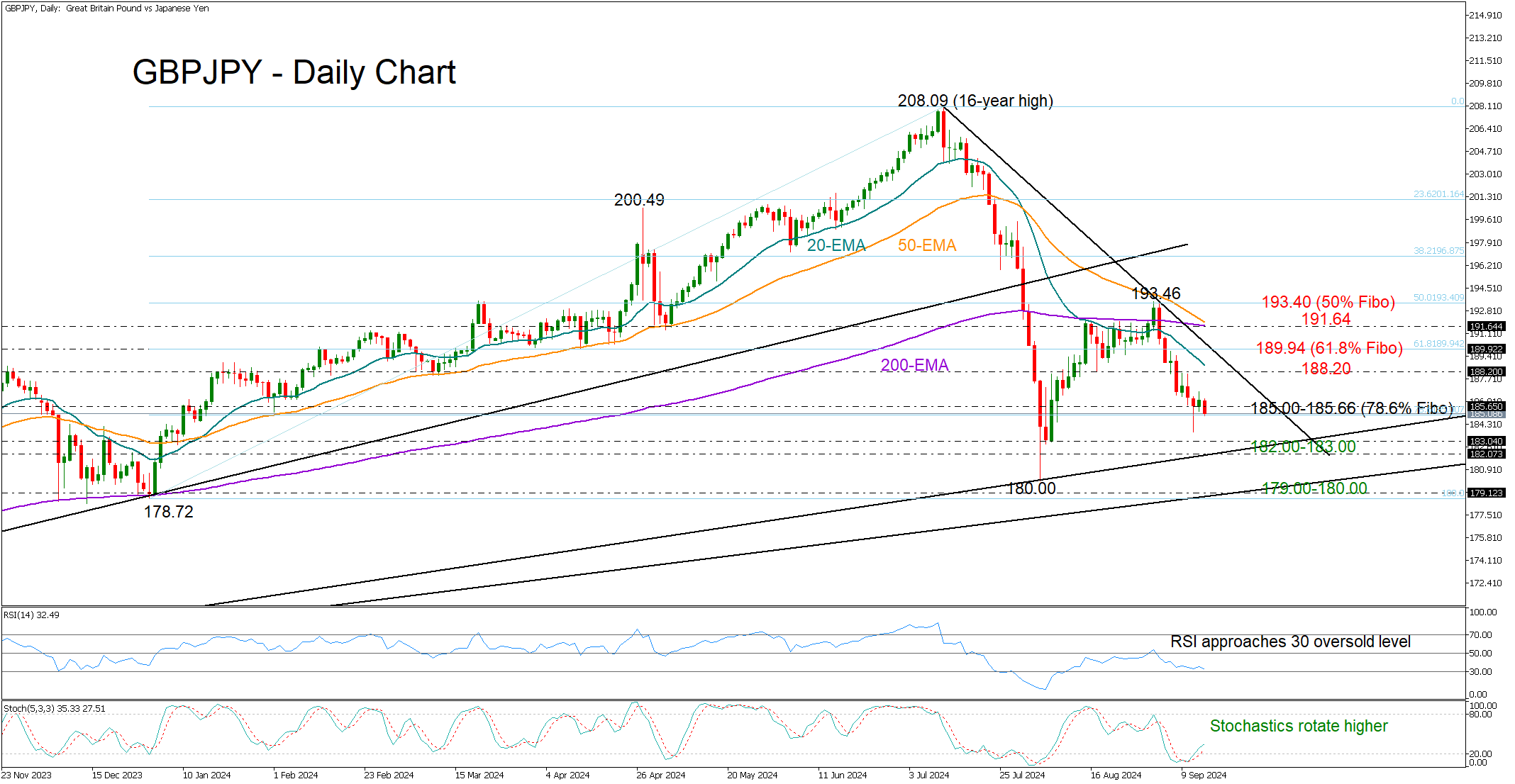

GBPJPY resumes negative momentum, but hopes for a pivot remain.

-

Sellers need a close below 185.65 to take full control.

GBPJPY came under renewed downside pressure after closing Thursday’s session with mild gains around 186.00.

The pair shifted from a recent low of 183.70 earlier this week, forming a hammer candlestick and giving hope for a potential upward reversal. If the bears manage to close below 185.00-185.65 today, the candlestick pattern may not be a reliable signal despite the RSI and stochastic oscillator being near oversold levels.

A continuation lower could retest August’s base of 183.00, while slightly beneath that, the price could meet the support trendline, which joins the lows from 2022 and 2024 at 182.00. Breaking that floor too, the sell-off could pick up steam towards the 180 psychological level or closer to the extension of the ascending trendline last seen in Q1 2023 at 179.00.

To improve the short-term outlook above September’s high of 193.46, the bulls will have to put in a lot of effort. The 20-day exponential moving average (EMA) could be the first obstacle near 188.20. Then, some congestion might occur around 189.84, where the 61.8% Fibonacci retracement of the 2024 uptrend is placed. Further up, the door will open for the 50- and 200-day EMAs currently seen around 191.64.

Overall, GBPJPY has not escaped downside risks, though it could postpone any further selling if it manages to close above 185.00-185.65 once again.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Cardano set for 20% rally as bullish bets increase

Cardano price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.