CPI

A few people asked me yesterday whether the strong CPI in January is too obvious, and my response was that it should be but for some reason it isn’t. Same thing in December: The seasonality was obvious, yet the number created a massive market response. Again, this time the strong January number was pretty obvious, and bonds have been smoked. EMH is vaguely true, but not on micro events like this.

Obviously the “Bessent wants lower 10-year yields” trade will have to wait as the economic data refuses to cooperate. I would guess we see more hot February data and then a rapid cooling as the DOGE cuts have some impact on the labor market and tariffs hit confidence, and inflation seasonality dissipates rapidly. Until then, it’s a sketchy moment for bond longs.

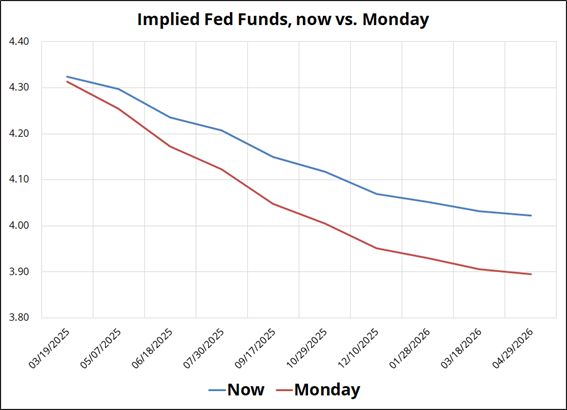

You can explain away the CPI bump by looking at weather, seasonality, tariff frontloading, and many other factors, but the Fed was already uncertain about the path of inflation and the balance of risks remains tilted away from the elusive 2% target. Here’s Fed pricing.

With the Fed on hold, rate differentials still pointing to higher USDCAD, my bias towards nothing good on tariffs for Canada during the prorogation period, and this strong CPI release, I like higher USDCAD. It has formed a nice base at 1.4250 so the stop loss is 1.4224. Trade in sidebar.

There is a big M&A flow out there (CAD-positive), potentially, as TD sold its stake in Schwab. The money will be raised via a secondary offering and the jury is out as to how much of it will need to be converted back to CAD. That said, I think the market can absorb the flow here, if it happens, and the timing and size is highly uncertain anyway. But just something to be aware of.

German elections

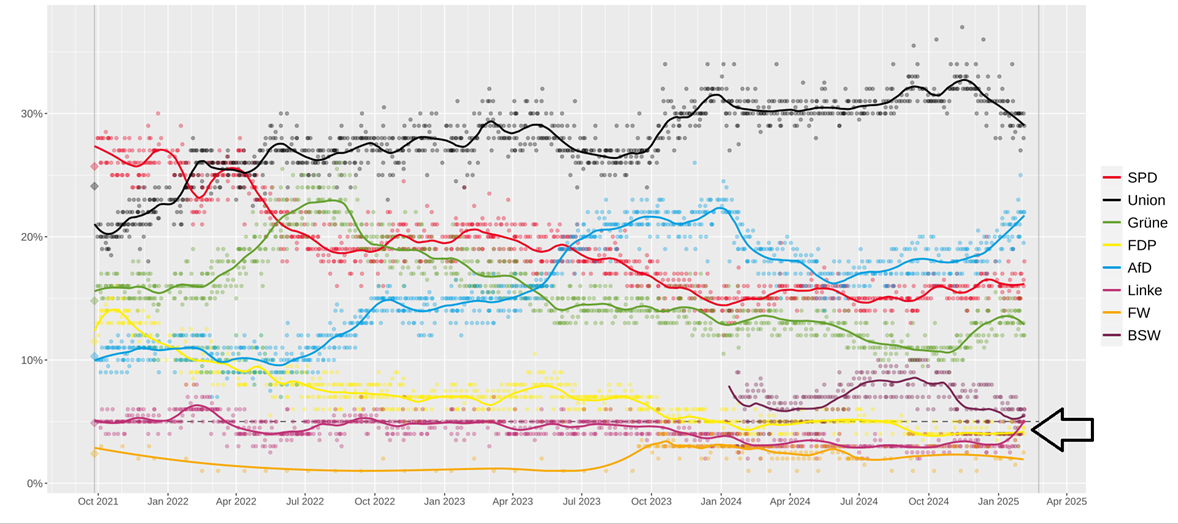

The German Federal Election on February 23 is not getting all THAT much airtime but is on the radar as the date approaches. Here is the latest polling situation.

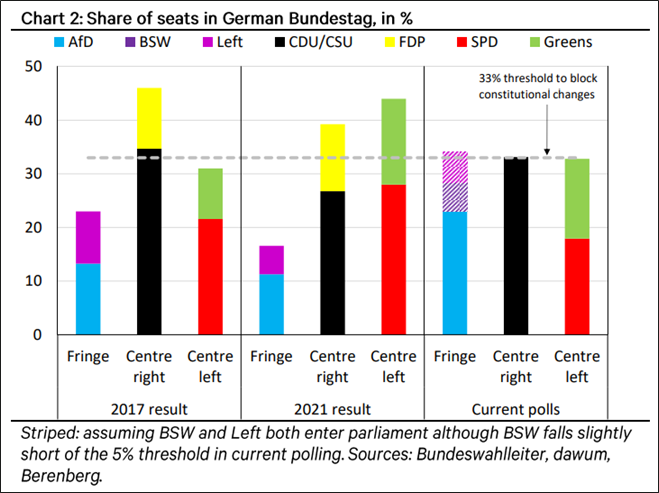

Berenberg wrote a good piece about the tail risk of a fiscal veto for the fringe parties as the small Left party gains in the polls (see black arrow in my graphic, “Linke” means “Left”). While a removal of the debt brake doesn’t necessarily mean a massive fiscal stimulus is coming for Germany, the non-elimination of it would lead to unwanted fiscal tightening. The Berenberg piece says that a “fiscal veto for the fringe parties remains a tail risk, in our view. However, the tail has become fatter.”

At right you can see how tight the race for parliamentary influence might be using various assumptions.

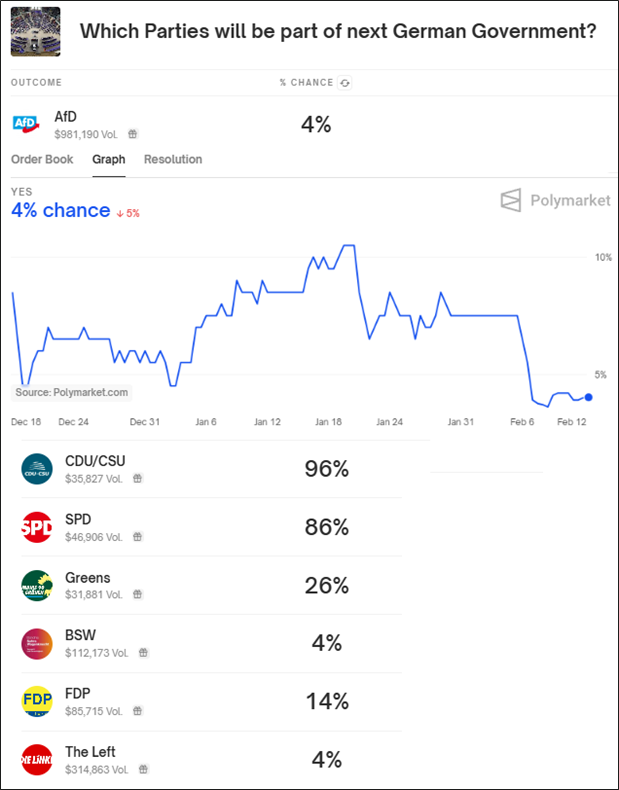

Polymarket also sees the fringe coalition as a small tail, and the AfD’s odds have been dropping as the market had them as 10% likely to be part of the government a month ago and now that contract trades at 4%. The order book is liquid; the bid/offer is 3.8%/4.2% on the AfD contract.

Here are all the odds:

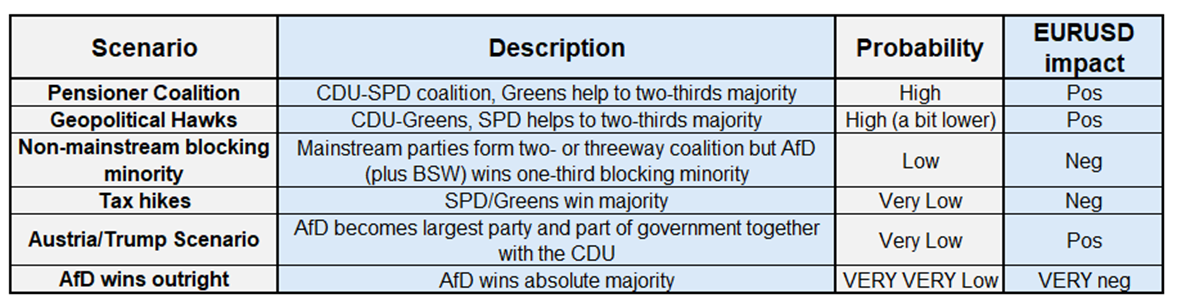

The problem with handicapping the result is that the coalition negotiations could last for months. So, the focus will be on the performance of the AfD as that’s the really obviously currency-negative variable. Here’s a scenario analysis from Citi (via Morningstar):

Have an oval day.

This material is solely for informational and discussion purposes only. Spectra Markets is not a registered investment advisor or commodity trading advisor. This material should not be viewed as a current or past recommendation or an offer to sell or the solicitation to enter into a particular position or adopt a particular investment strategy. Spectra Markets does not provide, and has not provided, any investment advice or personal recommendation to you in relation to any transaction described in this material. Spectra Markets is affiliated with Spectra FX Solutions LLC, an introducing broker that is registered with the NFA; Spectra FX Solutions LLP, which is a registered entity with the U.K.’s Financial Conduct Authority; and SpectrAxe, LLC, a swap execution facility that is registered with the CFTC. The disclosures for Spectra FX Solutions LLC and Spectra FX Solutions LLP related to the separate businesses of Spectra FX can be found on our website.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.