- Bitcoin Cash price finds resistance at the 50-week EMA of around $350, signaling an impending decline.

- On-chain data shows that BCH's OI-Weighted Funding Rate is negative, suggesting a bearish trend.

- A weekly candlestick close above $378 would invalidate the bearish thesis.

Bitcoin Cash (BCH) has faced multiple rejections by the 50-week Exponential Moving Average (EMA) of around $350.2. This week, it experienced a 9% decline to trade at $324.2 on Thursday. On-chain data highlights the continuation of the downward trend as BCH's OI-Weighted Funding Rate is negative.

Bitcoin Cash is set for a downleg if it closes below key support level

Bitcoin Cash's price has faced multiple rejections by the 50-week Exponential Moving Average (EMA) of around $350.2. This week, it experienced a 9% decline to trade at $324.2 on Thursday and is approaching the support zone, which ranges from $299.7 to $280.6. This zone is significant for weekly and monthly support.

If BCH closes below $280.6 and breaks below the ascending trendline (drawn by connecting multiple lows from early June 2023), it could crash 23% to retest the December 11, 2023, weekly low of $210.1.

The weekly chart's Relative Strength Index (RSI) and the Awesome Oscillator (AO) have slipped below their respective neutral levels of 50 and zero. This suggests continued momentum favoring bears, potentially leading to a further decline in the Bitcoin Cash price.

BCH/USDT weekly chart

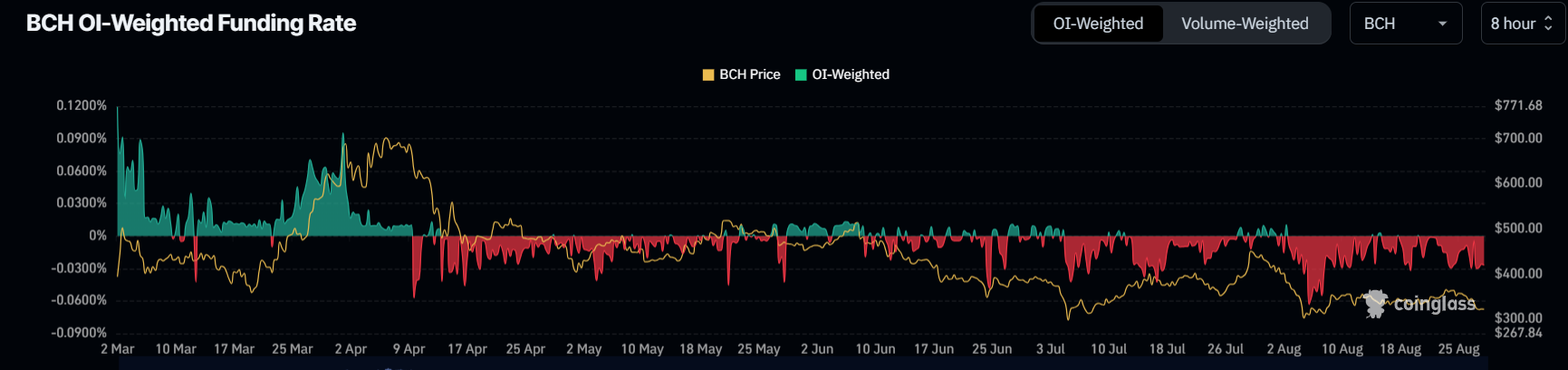

Coinglass's OI-Weighted Funding Rate data is a crucial metric for traders and analysts to assess market sentiment and predict future price movements. This metric relies on funding rates from futures contracts, weighted by their open interest. A positive rate (longs pay shorts) typically signals bullish sentiment as long positions compensate shorts. Conversely, a negative rate (shorts pay longs) indicates bearish sentiment, with shorts compensating longs.

In BCH's case, this metric stands at -0.026%, reflecting a negative rate and indicating that shorts pay longs. This scenario often signifies bearish sentiment in the market, suggesting potential downward pressure on Bitcoin Cash's price.

BCH OI-Weighted Funding Rate chart

However, if BCH breaks above the 50-week EMA and closes above the $378 weekly resistance level, it could indicate that bullish sentiment could still make a comeback. Such a development could trigger a 19% rally in Bitcoin Cash's price to revisit its July 29 weekly high of $459.2.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA set for 20% rally as bullish bets increase

Cardano (ADA) price extends its rally on Monday after gaining more than 13% last week. On-chain metrics suggest a bullish picture as ADA’s long-to-short ratio reached the highest level in over a month.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH hold steady while XRP gains momentum

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 for almost two weeks. Ethereum (ETH) price follows in BTC’s footsteps and hovers around $2,680, while Ripple (XRP) shows strength and extends its gains on Monday after rallying 14% last week.

Bitcoin (BTC) vs Gold (XAU): Asset Tokenization expert weighs impact of US Inflation on 2025 price trends

Bitcoin price consolidated at $97,000 on Feb 15, down 6% within the monthly time frame, reeling under bearish headwinds from US tariff wars and rising inflation.

Dogecoin (DOGE) Price mirrors XRP rally as SEC acknowledges Grayscale ETF Filings

Dogecoin price surged 3% on Friday, extending its weekly timeframe gains to 17% as ETF speculation gains traction.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.