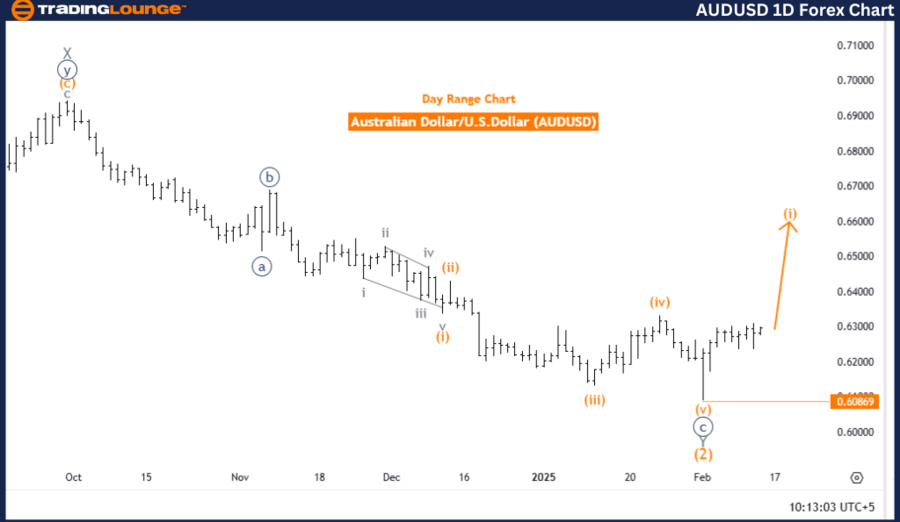

Australian Dollar/US Dollar (AUD/USD) Day chart.

AUD/USD Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Orange wave 1.

-

Position: Navy Blue Wave 1.

-

Direction next lower degrees: Orange wave 2.

-

Invalidation level: 0.60869.

Details:

The AUDUSD daily chart shows a bullish trend with an impulsive wave structure currently unfolding. The market is in orange wave 1, which is part of the broader navy blue wave 1. This indicates the beginning of a new trend, with upward momentum driving price action.

The presence of orange wave 1 within navy blue wave 1 suggests the early phase of a larger bullish wave cycle. Strong buying pressure is evident, increasing the potential for gains in the Australian Dollar against the U.S. Dollar. The conclusion of previous corrective phases has provided a foundation for continued upward movement.

The next expected move is orange wave 2, which will follow the completion of the current wave. This phase may bring a corrective pullback before the market resumes its uptrend. However, the primary trend remains bullish.

The key invalidation level for this wave structure is 0.60869. A drop below this level could invalidate the current bullish outlook. As long as prices remain above this level, the uptrend remains intact with further upside potential.

Summary:

The AUDUSD daily chart signals a strong bullish trend, with orange wave 1 of navy blue wave 1 currently active, confirming the start of a new upward movement. The invalidation level to monitor is 0.60869, ensuring that the bullish scenario remains valid as long as prices stay above this level. The next stage in the wave structure is orange wave 2, which may introduce a temporary correction before the uptrend resumes.

Australian Dollar/U.S. Dollar (AUDUSD) 4-Hour Chart.

AUD/USD Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Gray wave 3.

-

Position: Orange wave 1.

-

Direction next higher degrees: Gray wave 3 (started).

-

Invalidation level: 0.60869.

Details:

The AUDUSD 4-hour chart confirms a bullish trend with an impulsive wave structure currently in progress. The market has entered gray wave 3, following the completion of gray wave 2 within orange wave 1. This development strengthens the continuation of upward momentum in price movement.

The completion of gray wave 2 marks the end of a corrective phase, leading to the start of a new impulsive move. Gray wave 3 is now active, representing a strong upward trend that typically suggests sustained buying pressure and potential price increases.

The next higher degree wave remains in alignment with gray wave 3, reinforcing the overall bullish outlook. This wave structure indicates that the market is in the early phase of an extended uptrend, suggesting further strength in the Australian Dollar against the U.S. Dollar.

The key invalidation level for this wave structure is 0.60869. If the price falls below this level, the bullish outlook may need reconsideration. However, as long as the price remains above this level, the bullish trend remains valid, with further gains expected.

Summary:

The AUDUSD 4-hour chart reflects a strong bullish trend, with gray wave 3 now in play after the completion of gray wave 2. This setup supports the continuation of upward momentum. The key invalidation level to monitor is 0.60869, ensuring that the bullish scenario stays intact as long as prices remain above this level.

Technical analyst: Malik Awais.

AUD/USD Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.