Markets at all-time highs often leave investors with a tough decision — should you jump in now or wait for a pullback? The fear of "buying at the top" is real, but sitting on the sidelines can mean missing out on long-term growth. Instead of trying to time the market, investors can consider Dollar-Cost Averaging (DCA) as a more measured approach.

What is Dollar-cost averaging (DCA)?

Dollar-Cost Averaging (DCA) is an investment strategy where you divide your total investment amount into smaller, regular contributions over time. Instead of investing a lump sum all at once, you invest the same fixed amount on a regular schedule, regardless of the market’s price movements.

By consistently investing, DCA smooths out the impact of market volatility. This approach allows you to buy whole shares, purchasing more when prices are low and fewer when prices are high, resulting in a balanced average cost.

How does DCA work?

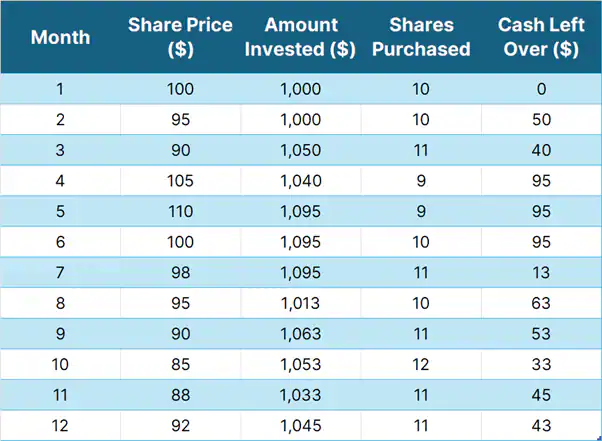

To understand how DCA works, let’s consider a simple example:

-

Imagine you have $12,000 to invest in a stock or an exchange-traded fund (ETF).

-

Instead of investing the entire amount on day one, you decide to invest $1,000 each month for 12 months.

-

Since you can only buy whole shares, any leftover cash is carried over to the next month. Here’s how it might play out:

Source: Saxo

Summary:

-

Total invested = $12,000.

-

Total shares purchased = 125 shares (all whole shares).

-

Cash remaining = $43 (carried over).

-

Average cost per share = $96.00.

If you had invested the full $12,000 at the start of the year when the share price was $100, you would have purchased 120 shares. But by using DCA, you bought more shares during the dips, ending up with 125 shares at a lower average cost per share of $96.00.

Why should investors Use DCA?

DCA offers a systematic approach to investing, especially during periods of uncertainty. Here’s why it works so well:

-

Reduces emotional decision-making: It’s difficult to predict market tops or bottoms. DCA eliminates the pressure to "get the timing right." By following a set schedule, you avoid the emotional trap of chasing highs or selling lows.

-

Lowers the risk of investing at the top: When you invest in regular intervals, you reduce the risk of putting a large amount into the market just before a correction.

-

Takes advantage of market dips: When prices fall, your regular investment amount buys more shares, giving you a lower average cost per share.

-

Builds discipline and consistency: Investing on a schedule turns investing into a habit, making it easier to stay on track with long-term goals.

When should you use DCA?

DCA works well in a range of market conditions, but it is particularly useful in the following situations:

-

When markets are at all-time highs: Many investors worry about buying at the peak, but DCA provides a way to "ease into" the market rather than going all in.

-

When you're nervous about volatility: If you expect markets to be choppy, DCA allows you to spread your investment over time and potentially benefit from price drops.

-

When you have a lump sum to invest: Instead of investing it all at once, splitting it into smaller, consistent payments can make you feel more comfortable about market uncertainty.

DCA can be applied to both stocks and ETFs, making it a versatile strategy for different types of portfolios.

Pros and cons of DCA

Like any investment strategy, DCA has its strengths and limitations. Here’s a balanced view:

Benefits of DCA

-

Lowers the risk of "bad timing" by spreading investments over time.

-

Reduces stress since you don't have to worry about short-term market fluctuations.

-

Makes it easier to start investing, especially if you’re hesitant about current market levels.

-

Can be automated with investment apps and platforms, creating a “set-it-and-forget-it” system.

Drawbacks of DCA

-

If markets rise steadily, you may have been better off investing the full amount at the beginning.

-

It requires patience, as you are only partially invested at any point in time.

-

If you have a long-term horizon and the market is expected to grow, lump-sum investing could generate higher returns.

How DCA compares to lump sum investing

One of the biggest debates among investors is whether to invest a lump sum all at once or to stagger it using DCA. Research has shown that lump-sum investing tends to outperform DCA in the majority of market scenarios because markets generally trend higher over time.

However, DCA is more about managing risk and emotions than about maximizing returns. If you are concerned about volatility or feel anxious about investing a large sum all at once, DCA allows you to participate in market growth while reducing your exposure to sharp corrections.

Practical tips to start using DCA

-

Set a schedule: Decide how frequently you will invest (e.g., monthly or bi-weekly) and commit to the plan.

-

Choose an investment vehicle: DCA works well with ETFs, index funds, and individual stocks. ETFs are particularly useful because they offer diversification.

-

Automate your contributions: Many brokerage platforms allow you to set up recurring contributions, so you don't have to worry about missing a month.

-

Stick with the plan: It can be tempting to "pause" investments during market declines, but remember that DCA works best when you maintain consistency.

Read the original analysis: Worried about investing at market highs? Dollar-cost averaging (DCA) can help

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Editors’ Picks

EUR/USD struggles to build on previous week's gains, stays below 1.0500

EUR/USD stays under modest bearish pressure and trades below 1.0500 on Monday. The cautious market mood supports the US Dollar and limits the pair's upside, while trading action remains subdued, with US markets remaining closed on Presidents' Day.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD fluctuates in a tight channel near 1.2600 in the second half of the day on Monday. Trading volumes are likely to remain thin as financial markets in the US enjoy a log weekend in observance of the Presidents' Day holiday.

Gold clings to modest daily gains near $2,900

Gold regains its traction and trades in positive territory near $2,900 following Friday's sharp decline. Although financial markets in the US remain closed on Monday, investors will scrutinize political headlines and comments from Fed officials.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.