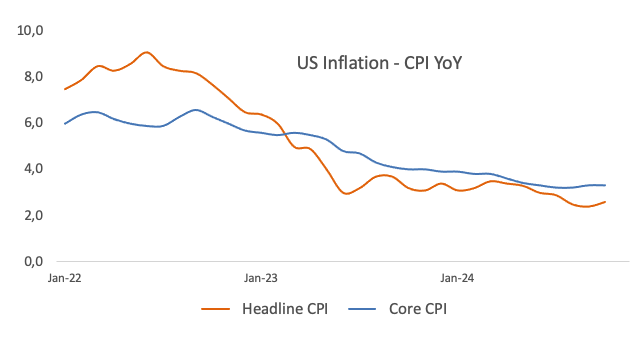

Inflation in the US, as measured by the change in the Consumer Price Index (CPI), rose to 2.7% on a yearly basis in November from 2.6% in October, the US Bureau of Labor Statistics (BLS) reported on Wednesday. This reading came in line with the market expectation. On a monthly basis, the CPI rose 0.3% following the 0.2% increase recorded in October.

Follow our live coverage of the market reaction to the US inflation data.

The core CPI, which excludes volatile food and energy prices, rose 3.3% on a yearly basis to match October's increase and analysts' estimate. The monthly core CPI rose 0.3% in November.

Market reaction to US inflation data

These figures don't seem to be having a significant impact on the US Dollar's valuation. At the time of press, the USD Index was up 0.15% on the day at 106.55.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | 0.16% | 0.38% | 0.01% | 0.25% | 0.24% | 0.00% | |

| EUR | -0.12% | 0.05% | 0.29% | -0.10% | 0.13% | 0.11% | -0.12% | |

| GBP | -0.16% | -0.05% | 0.23% | -0.15% | 0.09% | 0.06% | -0.17% | |

| JPY | -0.38% | -0.29% | -0.23% | -0.36% | -0.13% | -0.15% | -0.38% | |

| CAD | -0.01% | 0.10% | 0.15% | 0.36% | 0.24% | 0.21% | -0.02% | |

| AUD | -0.25% | -0.13% | -0.09% | 0.13% | -0.24% | -0.02% | -0.26% | |

| NZD | -0.24% | -0.11% | -0.06% | 0.15% | -0.21% | 0.02% | -0.23% | |

| CHF | -0.00% | 0.12% | 0.17% | 0.38% | 0.02% | 0.26% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

This section below was published as a preview of the US Consumer Price Index (CPI) data at 03:00 GMT.

- The US Consumer Price Index is set to rise 2.7% YoY in November.

- The core CPI inflation is seen steady at 3.3% last month.

- The Fed is expected to cut interest rates by 25 bps in December.

The US Consumer Price Index (CPI) report for November, a key measure of inflation, will be unveiled on Wednesday at 13:30 GMT by the Bureau of Labor Statistics (BLS).

Markets are buzzing in anticipation, as the release could trigger significant swings in the US Dollar (USD) and influence the Federal Reserve's (Fed) plans for interest rates in the months ahead.

What to expect in the next CPI data report?

As measured by the CPI, inflation in the US is expected to increase at an annual rate of 2.7% in November, slightly higher than the 2.6% growth reported in the previous month. Core annual CPI inflation, which excludes volatile food and energy prices, is projected to remain steady at 3.3% during the same period.

On a monthly basis, the headline CPI and core CPI are forecasted to rise by 0.3%.

Previewing the October inflation report, TD Securities analysts said: “We look for core inflation to stay largely unchanged in November, registering another firm 0.3% m/m advance. Rising goods prices are expected to explain most of the strength in the series, while slowing housing inflation is likely to provide some relief. On a y/y basis, headline CPI inflation is expected to inch higher to 2.7% while core inflation likely stayed unchanged at 3.3%.”

In his latest remarks at an event hosted by the New York Times on December 4, Federal Reserve Chair Jerome Powell shared that the central bank's approach to future interest rate adjustments could take a more measured pace, thanks to the economy's stronger-than-anticipated performance this year.

Reflecting on the economic growth, Powell noted that the resilience had surpassed earlier forecasts, allowing the Fed to adopt a more cautious stance as it works toward finding a "neutral" rate policy. He acknowledged that "the economy is strong, and it’s stronger than we thought in September," even as inflation has been running slightly higher than anticipated.

Powell explained that this backdrop is shaping the Fed's outlook as it prepares for its upcoming meeting on December 17-18, a session that markets had widely expected to result in another rate cut.

How could the US Consumer Price Index report affect EUR/USD?

The upcoming Trump administration is expected to adopt a stricter stance on immigration, a more relaxed approach to fiscal policy, and a reintroduction of tariffs on imports from China and Europe. Together, these factors are likely to exert upward pressure on inflation, potentially prompting the Fed to pause or even halt its ongoing easing cycle, thereby providing additional support to the US Dollar (USD).

However, with the gradual cooling of US labour market conditions and the likely persistence of sticky inflation, the November inflation report is unlikely to significantly alter the Fed’s stance on monetary policy.

Currently, markets are pricing in an approximately 85% probability that the Fed will lower rates by 25 basis points in December, according to the CME Group’s FedWatch Tool.

Pablo Piovano, Senior Analyst at FXStreet, provides a brief technical outlook for EUR/USD, arguing: “The December high of 1.0629 (December 6) serves as the initial resistance, followed by the intermediate 55-day SMA at 1.0776 and the more significant 200-day SMA at 1.0842.”

Pablo adds: “On the downside, if the spot price breaks below the December low of 1.0460, it could pave the way for a potential test of the 2024 bottom at 1.0331 (November 22).”

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from the Bank for International Settlements. Following the Second World War, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold until the Bretton Woods Agreement in 1971, when the Gold Standard went away.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays defensive below 1.0500 amid light trading

EUR/USD struggles to capitalize on recent upside and oscillates in a narrow range below 1.0500 in European trading on Monday. However, the pair's downside remains cushioned by persistent US Dollar weakness and an upbeat mood. Focus shifts to central bank talks.

GBP/USD ranges near 1.2600 as US Dollar steadies

GBP/USD keeps its range near 1.2600 in the early European session on Monday. The pair stays support amid a subdued US Dollar price action following Friday's disappoining US Retail Sales data. Thin trading is likely to extend as US markets are closed in observance of Presidents' Day.

Gold: Bulls have the upper hand near $2,900 amid trade war fears and weaker USD

Gold regained positive traction on Monday amid sustained USD weakness. Concerns about Trump’s tariffs further benefit the safe-haven XAU/USD pair. The fundamental and technical setup underpin prospects for additional gains.

Five fundamentals for the week: Peace talks, Fed minutes and German election stand out Premium

US President Donald Trump remains prominent, especially in a week when high-level peace talks kick off. Nevertheless, the Commander-in-Chief competes with the world's most powerful central bank, and other events are of interest as well.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.