- Crypto scam revenue exceeded $12 billion in 2024, according to Chainalysis.

- The rise of AIand illicit marketplaces is supporting the professionalization of scams in the US and worldwide.

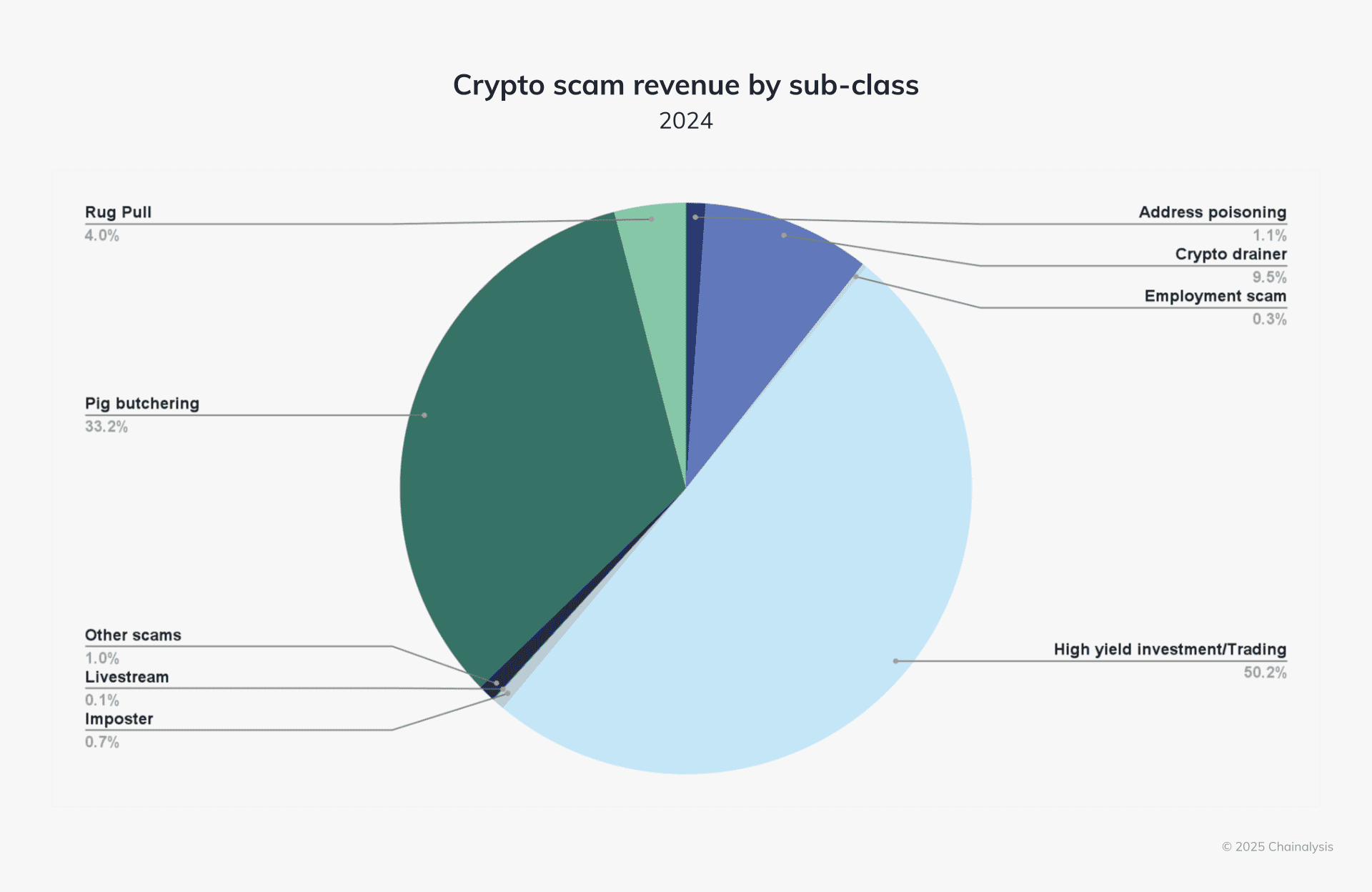

- High-yield investment scams accounted for over 50% of total scam revenue in 2024.

Crypto intelligence tracker Chainalysis tracked nearly $10 billion in funds lost to scams in the crypto ecosystem. The data firm projected that scam revenue would exceed $12 billion as the list of illicit addresses grew.

The firm published a preview of its 2025 Crypto Crime Report on Thursday listing the key sources of crypto scams and the volume of funds stolen from victims in 2024.

Crypto ATMs, high-yield investment scams and pig butchering drain victims

High-yield investment schemes (HYIS) are typically unregistered investments run by unlicensed individuals, defrauding investors and contributing to scam revenue tracked by Chainalysis. HYIS accounted for over 50% of the total scam revenue despite the year-on-year decline, according to the report.

Pig butchering scams, in which individuals are targeted and defrauded by being convinced to invest in ponzi schemes via large scam compounds in Southeast Asia, led the scam economy with a 40% year-on-year increase in scam revenue. The report traced a 210% rise in deposits made by victims to illicit addresses traced to such schemes in 2024.

Crypto ATMs wiped out over $65 million within the first half of 2024, primarily targeting the elderly. Even as agencies like the FBI and the Federal Trade Commission (FTC) issued warnings, the scams continued to grow in the United States (US) and abroad.

Crypto crime operations turned more sophisticated than in previous years, streamlining operations as a one-stop-scam-shop and money laundering services.

Crypto scam revenue by sub-class | Source: Chainalysis

Andrew Fierman, Head of National Security Intelligence at Chainalysis, commented on the professionalization of the scam ecosystem and how it has significantly lowered the barrier for entry for illicit actors.

“With the ability to purchase Personally Identifiable Information, AI technology, and falsified documentation in just a few clicks, scammers can launch operations quickly at minimal cost. While this ease of access fuels fraud, it also creates a major opportunity for the public and private sectors to leverage advanced blockchain analytics to disrupt these networks and recover funds,” Fierman said in the report.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Solana plunges as ETF speculators bet billions on XRP and DOGE

Solana (SOL) price tumbles as low as $180 on Monday, down over 9% in three consecutive days of losses. Bearish dominance in the SOL derivatives markets suggests the downtrend could extend in the week ahead.

Shiba Inu Price Analysis: SHIB whale demand declines 88% amid two-week consolidation phase

Shiba Inu (SHIB) price opened trading around the $0.000016 mark on Monday, having consolidated within a 5% tight range over the last two weeks.

Solana-based meme coin LIBRA controversy heats up, Argentina President hit by lawsuit

Argentina’s President Javier Milei faces charges of fraud for the promotion of LIBRA meme coin on the Solana blockchain. An on-chain intelligence tracker links LIBRA meme coin to MELANIA and claims that the creator extracted $100 million from the former.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. US Bitcoin spot ETF data recorded a total net outflow of $580.2 million last week.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.