Bitcoin (BTC $26,731) slipped from $27,000 on Sept. 21 as the dust settled on the latest United States macroeconomic events.

BTC/USD 1-hour chart. Source: TradingView

Bitcoin: “Rangebound until proven otherwise”

Data from Cointelegraph Markets Pro and TradingView showed BTC price strength waning prior to the Wall Street opening, down by around 1.5% on the day.

Bitcoin had delivered a cool reaction to the Federal Reserve’s interest rate pause, and Chair Jerome Powell’s speech and press conference likewise failed to spark major volatility.

Contrary to the expectations of many, BTC price action acted as if no catalysts were present at all. Later, news that payouts to creditors of defunct exchange Mt. Gox had been delayed by another year also went unnoticed by markets.

“The Fed’s announcement of a rate pause caught exactly no-one by surprise,” popular trader Jelle summarized to X (formerly Twitter) subscribers.

Price is still in the same spot, but at least now we don’t have FOMC hanging over our heads. Rangebound until proven otherwise.

BTC/USD annotated chart. Source: Jelle/X

Jelle’s underlying longer-term roadmap remained bullish, suggesting an exit higher from the current structure, in play for more than a year, was still possible.

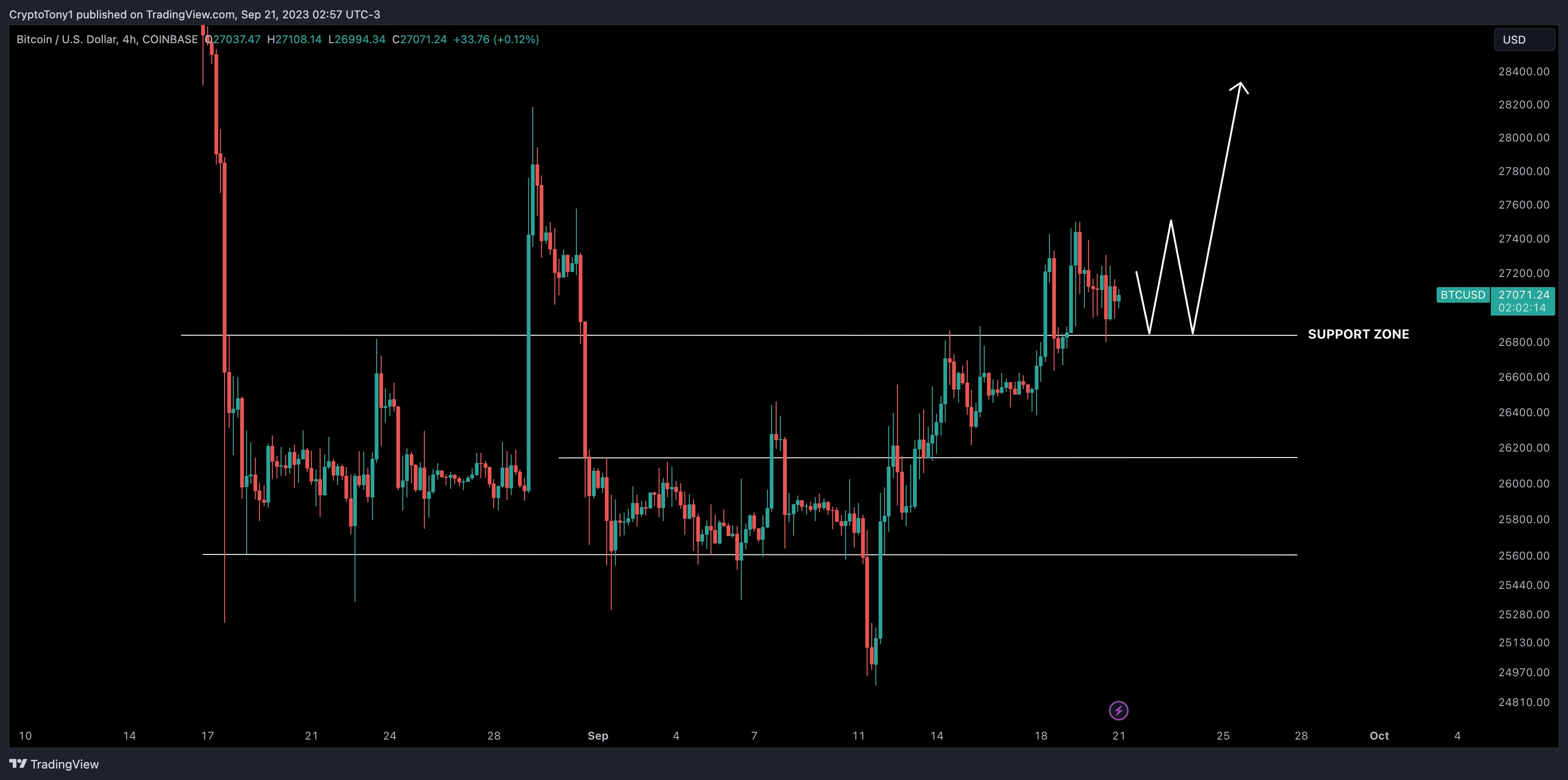

Continuing, fellow trader Crypto Tony reiterated the importance of maintaining $26,800 into the weekly close.

“So my plan was to long while we remained above $26,800 and thus far that is what we are doing,” he commented on the day.

Certainly came down a bit so up to the bulls now to end this week on a bullish high.

BTC/USD annotated chart. Source: Crypto Tony/X

BTC monthly close focus sharpens

Covering the impetus for the post-Fed drop, trader Crypto Ed suggested that the prior tap of month-to-date highs could be a cause for suspicion.

Related: Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

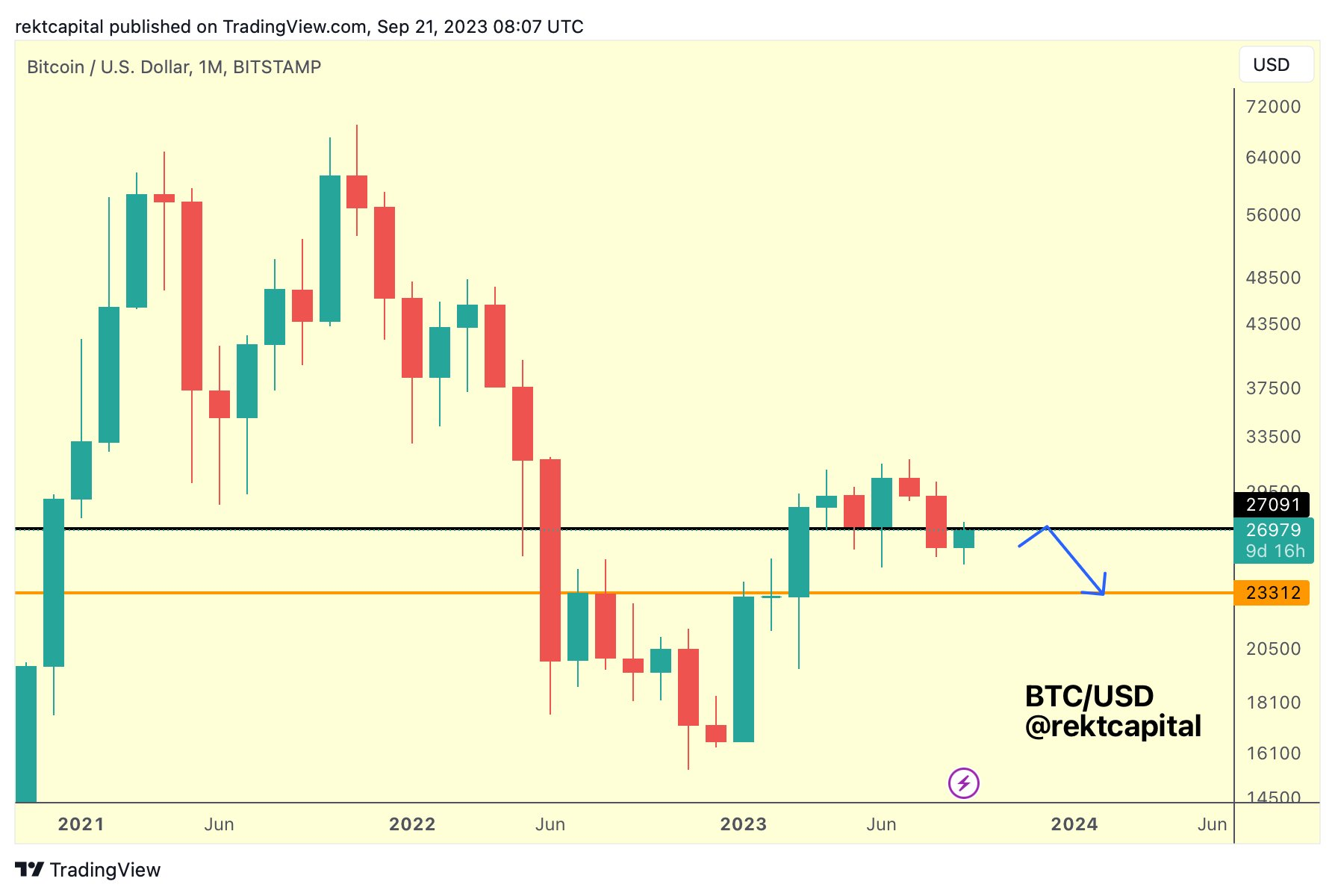

On longer timeframes, trader and analyst was also conservative, preserving his existing theory of BTC price downside to come.

On the monthly chart, he added, support at $27,150 had flipped to resistance.

“The BTC Monthly level of ~27150 was lost as support last month,” part of his commentary from the past 24 hours read.

Now $BTC is rejecting from the same level ~$27150 is acting as resistance for the time being.

BTC/USD annotated chart. Source: Rekt Capital/X

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.