- Ethereum Merge could occur by summer 2022, reveals co-founder Vitalik Buterin at Web3.0 ETH Developer Summit in Shanghai.

- Buterin believes that ETH merge on the Ropsten testnet will mark a key development milestone for the altcoin.

- Technical analysts believe the Ethereum price could hit $2,800 as a potential bearish retest before renewing its downtrend.

Update: The cryptocurrency community continues to await the Ethereum Merge with a mix of hype and anxiety. The recent price collapse in the whole crypto market, including Ethereum price, which lost about 50% of its value in the past two months, has moved the focus back to this key technical milestone for the second biggest blockchain. ETH co-founder Vitalik Buterin is pushing for this merge to happen in August, but he has admitted that the event could be delayed again to the fall months. The upcoming test on Ropsten testnet on June 8 will be key to determining a more precise timeline on the ETH Merge. Ethereum price is trading in the green on Monday, the third consecutive day of gains after bottoming last week below $2,000.

Ethereum Merge is one of the most awaited events in the ETH community. The Merge has been delayed several times over the past year, and the final date for the key event is here, according to co-founder Vitalik Buterin.

Ethereum Merge will arrive in the summer of 2022

Ethereum Merge is considered a milestone for the altcoin as it transitions from Proof-of-Work to Proof-of-Stake, after a long wait. After several delays over the past year, Vitalik Buterin, the co-founder of Ethereum, announced the date for “The Merge.” At a Web 3.0 ETH Developer Summit, he told attendees that “The Merge” is the largest event in the altcoin’s development roadmap in 2022. Ethereum developers have been working on Proof-of-Stake for almost seven years now and that all the work will come together in the summer of 2022.

Also read: Can Ethereum price hold as Vitalik Buterin sells 30,000 ETH?

Preston Van Loon, an Ethereum core developer, announced that “The Merge” would make its debut as early as August this year while speaking at the Permissionless panel.

Ropsten testnet is getting merged on June 8!

— prestonvanloon.eth @ Permissionless (@preston_vanloon) May 18, 2022

Merging Ropsten is a huge testing milestone towards Ethereum's mainnet merge later this year. https://t.co/X7eLIMA72g

Loon said,

As far as we know, if everything goes to plan, August—it just makes sense. If we don’t have to move [the difficulty bomb], let’s do it as soon as we can.

Vitalik Buterin acknowledged the announcement and said it depends on the problems that arise during development; if everything is up to plan, summer of 2022 is the ideal time for the Ethereum mainnet to migrate from Proof-of-Work to Proof-of-Stake. Buterin was quoted as saying,

If everything goes well, the plan is for the Merge to happen in the summer. If there are no problems, then the Merge will happen in August. If there are problems, September is possible, and October is possible. Ethereum will finally become a Proof-of-Stake network.

Vitalik Buterin

Parithosh Jayanthi, from the DevOps team, at the Ethereum Foundation, merged the pull request on GitHub today, May 20, 2022, and this code is the one that will be implemented at the Ethereum Merge.

Anthony Sassano, co-founder of an ETH research tool, recently commented on the Ethereum Merge. He said,

I believe there will be three public testnets run through the transition and if all goes smoothly then mainnet will be scheduled shortly after.

Sassano’s estimate was that Ethereum Merge could occur as early as August 2022 and Buterin’s announcement has made the summer of 2022, the official timeline.

Ethereum Merge progress made so far

The foundation of Ethereum Merge was laid down by the “Beacon Chain.” The Phase 0 on technical roadmaps, a chain that introduced staking on the network and serves as a consensus layer for the Ethereum blockchain.

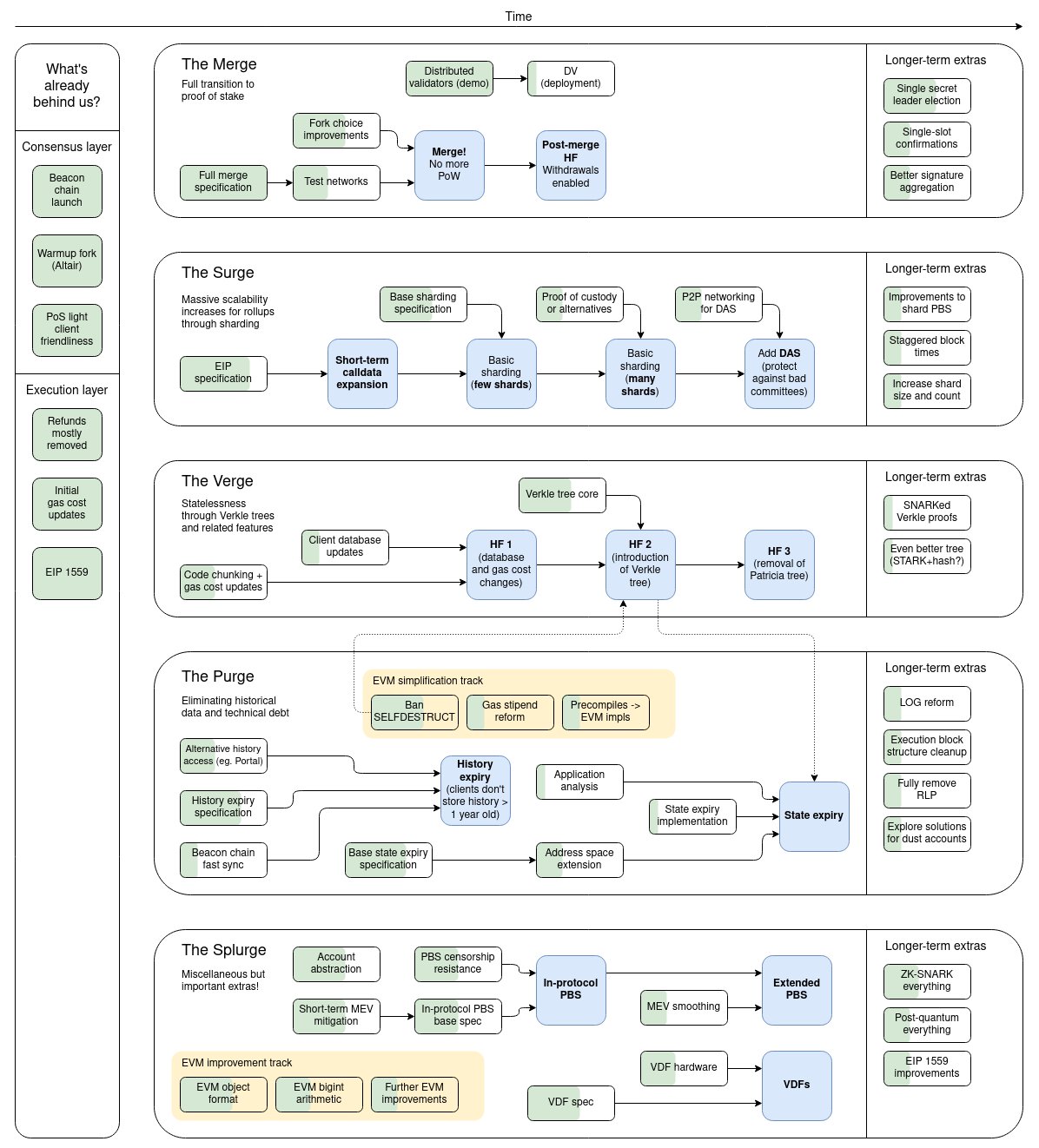

Vitalik Buterin published a plausible roadmap for Ethereum’s future, find it below.

Ethereum Roadmap

The Beacon Chain went live on December 1, 2020, allowing the entire network to become more energy efficient, and enabling staking. Since its launch, the Proof-of-Stake Beacon chain has been running parallel to the Ethereum mainnet, and remains neutered. The Ethereum Merge would combine the mainnet with the Beacon chain, thereby changing the consensus mechanism to PoS. The launch of the Beacon Chain was followed by three key events.

- Berlin upgrade (April 2021): Optimized gas cost and increased support for multiple transaction types

- London hard fork (August 2021): Introduced EIP1559, burning of base fees in transactions

- Altair hard fork (October 2021): Scheduled upgrade for Beacon Chain

After these milestone events in the history of Ethereum’s development, the altcoin’s network inched closer to “The Merge.” The initial announcement from the development team set June 2022 as the date for this event to go live on the Ethereum mainnet. Later it was pushed to August 2022, however, after problems that arose during development and the testing phase were cited.

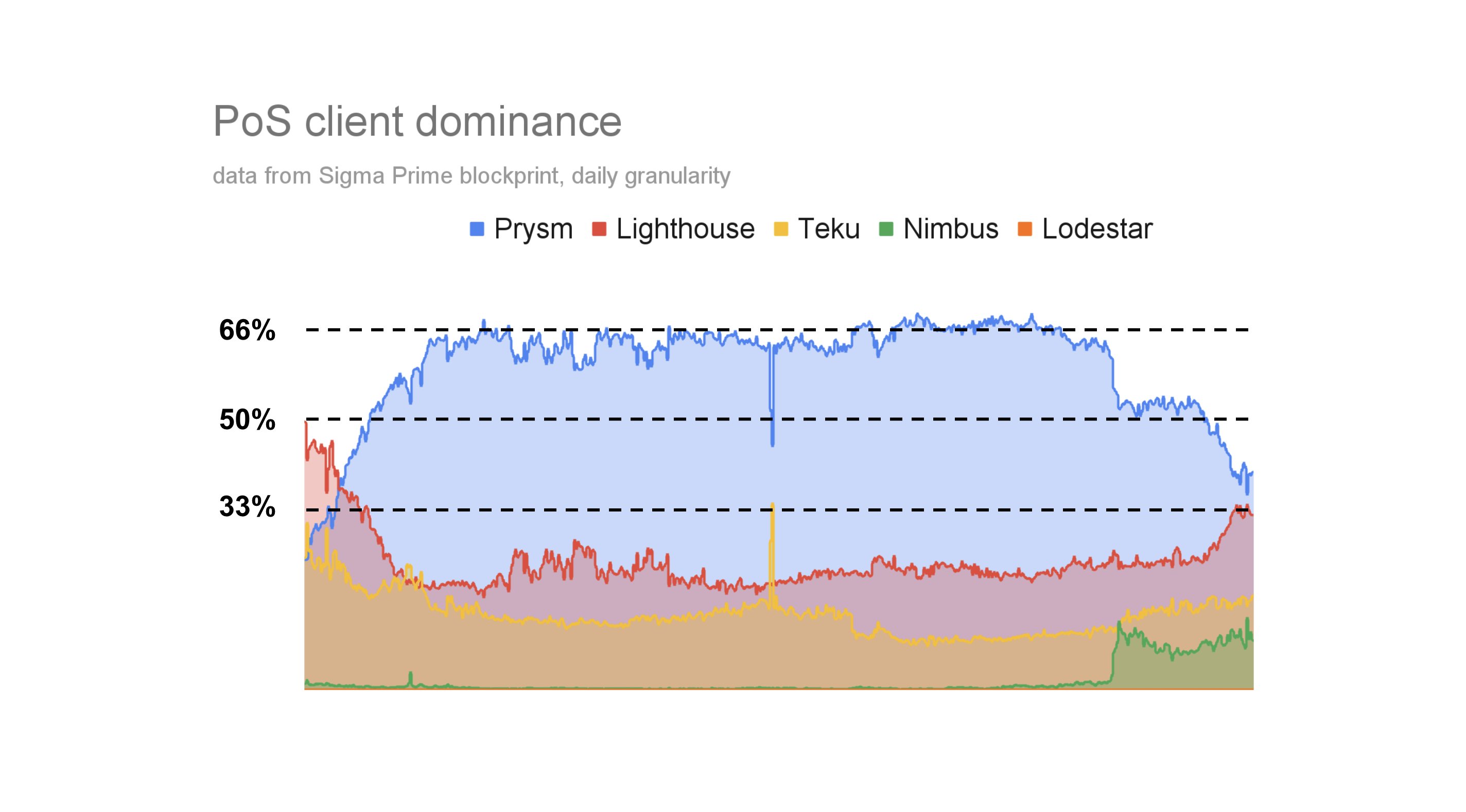

Justin Drake, researcher at the Ethereum foundation, has a bullish outlook on “The Merge.” Drake recently published a chart that offers insights on Proof-of-Stake dominance by Ethereum clients, software that allows nodes to read blocks on the altcoin’s blockchain.

Ethereum PoS client dominance

Ethereum, the key to the future of PoS

Ethereum’s transition to Proof-of-Stake is expected to be a watershed moment for ETH holders and the community for the following key reasons:

- Higher energy efficiency: The Ethereum blockchain has been criticized consistently for its high use of energy. The change in consensus mechanism reduces hardware requirements and barriers to entry would reduce energy use and increase efficiency in the altcoin’s network.

- Reduce risk of centralization: Transition to Proof-of-Stake would lead to a higher number of modes and distribution, securing the altcoin’s network with its low energy requirement. 51% attack becomes exponentially more expensive and In the event of a hack, the community could resort to social recovery.

After the successful completion of the Ethereum Merge, stakers will be assigned to validate transactions on the altcoin’s mainnet. Mining will no longer be required, therefore miners will likely invest their earnings into staking, and be a part of the Proof-of-Stake ecosystem of Ethereum. The merge is a set of upgrades that would make the altcoin faster and cheaper to use. Currently, the Ethereum network suffers from slow transaction times and high costs. A token swap worth $1 on Uniswap could cost a user $50 in transaction fees if the Ethereum network is hit by congestion.

Though “The Merge” won’t directly resolve high gas prices, it will set the stage for a set of upgrades that eventually cut costs on the altcoin’s blockchain. Post the event, developers will be able to run smart contracts on the mainnet using the new consensus mechanism, PoS. The Ethereum community and investors will be able to withdraw ETH staked on the staking contract. This feature won’t go live immediately after the event. After the post-merge cleanup upgrade is successful, investors will be able to begin withdrawals. Currently, there is no fixed timeline for the same.

Ethereum Triple Halving narrative comes into play

The Ethereum Triple Halving narrative predicts a massive rally in ETH price as the altcoin heads closer to “The Merge.” The narrative was first proposed by Nikhil Shamapant, an Ethereum researcher and analyst. Shamapant argued that Ethereum’s transition from PoW to PoS could act as a catalyst, similar to Bitcoin’s halving, and trigger a breakout in the altcoin.

The London hard fork and its implementation of EIP-1559 was a key stepping stone in the ETH Triple Halving narrative. With the successful burn implementation, Ethereum is now inching closer to a transition to PoS on its mainnet, and Shamapant believes this will result in a 90% reduction in ETH issuance.

This reduction is the equivalent of three consecutive Bitcoin halving events, therefore it is referred to as the Triple Halving. A reduction in a cryptocurrency’s supply historically drives a shortage, resulting in a price rally in the asset.

According to Shamapant’s narrative, the merge’s successful completion in the summer of 2022 will therefore set Ethereum Triple Halving in play, and fuel a massive rally in ETH.

Ethereum Merge date reveal triggers ETH price rally to $2,800

@AltcoinSherpa, a leading technical analyst, argues that Ethereum’s market structure continues to remain bearish. However, he would not be surprised to see something like a bearish retest in the mid-term as the altcoin climbs to $2,800 and ETH heads towards the Ethereum Merge. The analyst considers it ideal to wait for lows in Ethereum price to be tapped again before entering a trade. @AltcoinSherpa, therefore, has a bullish outlook on Ethereum in the short term but predicts another price drop in the altcoin in the long term.

ETH/USD Price Chart

FXStreet analysts have evaluated the Ethereum price trend and capped the altcoin’s upside at $2,200 if the altcoin fails to break out of its downtrend. However, Ethereum enjoys a high correlation with Bitcoin, and some analysts predict a recovery in ETH, with upside capped at $2,500 if BTC makes a comeback above $33,000.

For more on Ethereum’s technical prospects, watch this video:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.