- Bitcoin price is at risk of consolidating and staying below $30,000 for a long time as stock markets sell-off.

- Ethereum price reemerges above $1,955, but $2,000 might be too much of an ask.

- XRP price tries to stay above $0.40, but the pressure is building for price action to submerge.

Bitcoin price, Ethereum and other cryptocurrencies are on the backfoot after the massive slaughter that happened on the trading floor on Wall Street yesterday. Instead of cleaning up the pink sheets from the floor, the cleaning staff are probably busy sweeping up plenty of burned-out traders that got annihilated overnight as the Dow Jones printed its worst performance since June 2020. Expect the pain to not at all be over yet as bear territory looms for several asset classes, and for cryptocurrencies that are set to enter their worst trading period in history, ‘winter is coming’.

Bitcoin price at risk of saying goodbye to $30,000, for a long time

Bitcoin (BTC) price tanked another 5% on Wednesday as investors threw in the towel on their positions in equities and cryptocurrencies. Whilst buying the dip looked to be a sound plan a few weeks ago, it now looks to be fraught with insecurity. As Bitcoin price recovers, a dead-cat-bounce is likely to unfold that will see price action lower in the next two trading days.

BTC price has dented investors’ confidence and could see more outflows as its volume bleeds further. To make matters even worse, more regulatory crackdowns are being announced by the US State Department, and greater numbers of investors and companies are looking at their ESG rankings, which, admittedly, cryptocurrencies do not perform well at given their massive energy consumption from mining This could result in a bearish weight that keeps Bitcoin price below $30,000 for a very long time. With that pressure, $28,695 will see a squeeze, and on a break, a nosedive is predicted down towards $24,718 or 13% of losses.

BTC/USD daily chart

A reversal to the upside is always possible, however, certainly in these crazy markets where volume is becoming slimmer by the day as investors shift their money to the sidelines. A quick reversal is always possible in thin markets as bulls ramp up prices on sudden high demand. In such a scenario, BTC price could first break back above $30,000 and re-enter the distribution zone between $31,584 and $32,050 before jumping back up to $36,709 longer term.

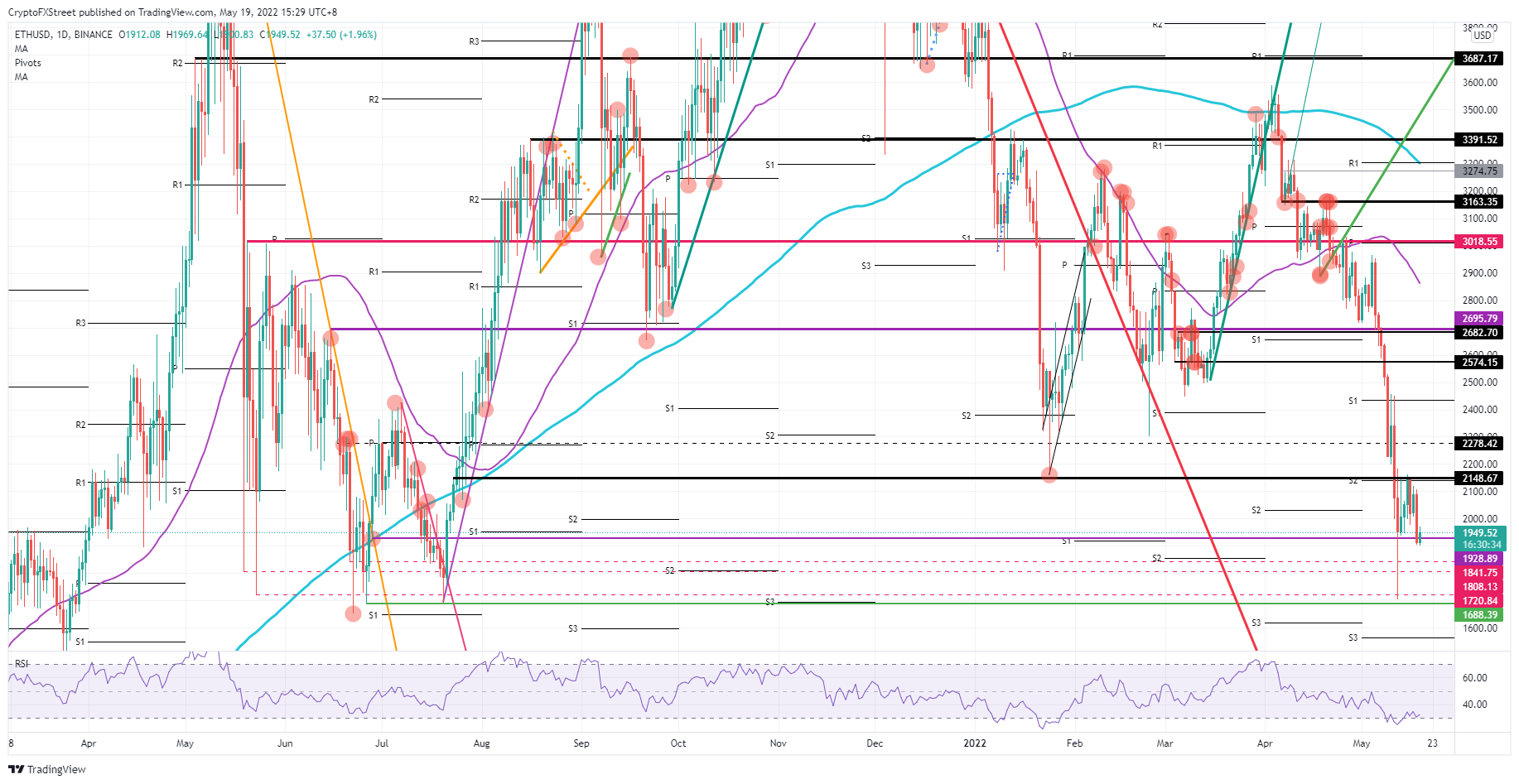

Ethereum price has a last glance at $2,000 before price action tanks to lower regions

Ethereum (ETH) price has signalled that the game is over for now. The sell-off mentioned in the Bitcoin comments was the final push investors needed to apply the wise market maxim ‘Sell in May and Go Away’. It almost looked like everyone was selling yesterday as bear market territory loomed in almost every asset, which had its reflection in cryptocurrencies, where ETH price tanked 8%, falling back below $2,000.

ETH price sees bulls trying to get their noses back above $2,000, but it looks heavy. Certainly, not only market sentiment weighs, but more and more existential questions are being raised over how sustainable the whole crypto mining industry can be. With all this luggage, a revaluation of ETH price is at hand, with $1,928.89 as the first level to watch, followed by $1,841.75 to the downside, and intermediary support at $1,688.39 providing a safety net.

ETH/USD daily chart

As trading sessions hand over, it could become one of those trading days when we see a complete 180-degree shift in sentiment going into the US session. A tailwind could spill over into cryptocurrencies and lift ETH price back above $2,000, with the next profit target set at $2,148.67. In case ETH price could close above there, further recovery is possible towards $2,278.42, printing 18% gains in the recovery.

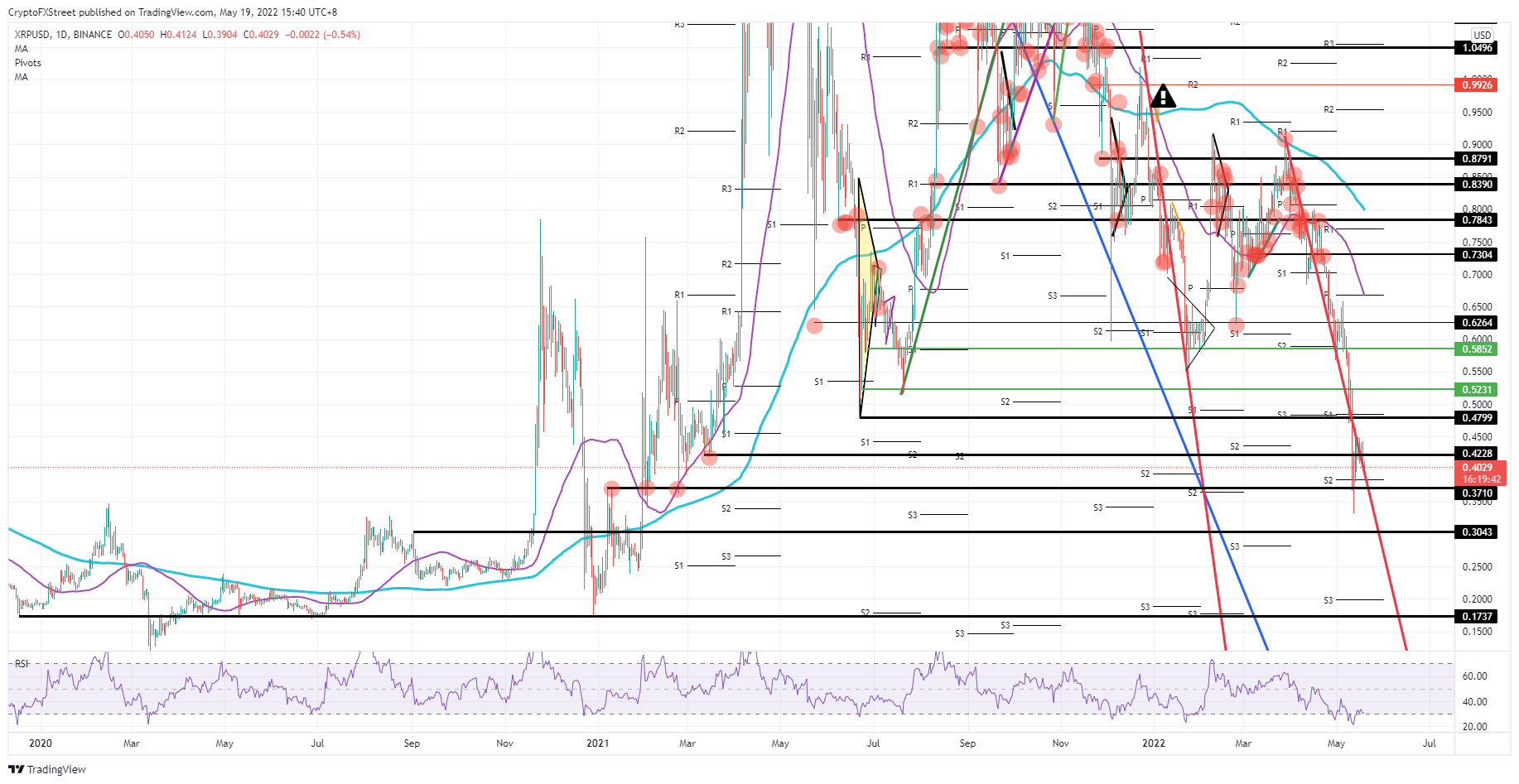

XRP price slips back below the technical marker and is set to slide below $0.37

Ripple (XRP) price fell below $0.42 in a correction on Wednesday as the stock market rout overpowered bulls in their attempt to continue Tuesday’s. A similar reflection in the Relative Strength Index (RSI), which is taking a nudge back to the oversold border and, with another move, will be trading below there. As price action remains subdued, do not expect a fierce turnaround anytime soon, as investors will mull over what to do next.

XRP price is thus on the cusp of dropping back to $0.37, with the monthly S2 support level as a floor. As price pressure mounts further, a squeeze could be in effect and see a nosedive move once bulls fold on defending the level. That would trigger a sell-off towards $0.30 and print new lows since February 2021.

XRP/USD daily chart

Alternatively, a bounce off a supportive level could reverse the slide, with the S2 as the best candidate at $0.37. That would trigger a rebound and a rally higher towards the monthly S1 at $0.48, just shy of the $0.50 marker. With a daily close above, the scene would be set for another rally towards $0.52 or even $0.58 as investors fall over each other to get in on the action.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.