Last week’s Global Central Bank monetary policy announcements kicked off on Wednesday, in the U.S., with another 25 bps hike, as the Federal Reserve is very possibly approaching the final stages of its rate hike policy. There could be the potential for future rate hikes, but with these smaller hikes (25bps), the Fed’s approached has been a “paused re-assessment” period, which points to the waning stages of this policy. The need for any additional hike, will depend on what the inflation markers show. (i.e. CPI and Wage Growth)

As expected the European Central Bank (ECB) raised their key interest rate by 25 bps on Thursday. Europe is on the similar path as the U.S., still trying to fight inflationary pressures, and have been monitoring the impact of each rate increase, to determine if the current policy approach continues. Again, allowing the inflation markers to determine how long to continue on this path. Early last week, there was news that showed Eurozone corporate loan demand declining rapidly over the last 3 months, through June. This reflects the impact of higher borrowing costs and weaker economic growth. The same is occurring in the mortgage loan sector, which is slowing down the housing market. There is growing sentiment that the ECB is getting closer to their rate hike peak as investors are still expecting the ECB to raise another 25bps, toward 4%, and possibly keep rates at that level for a longer period of time than the Fed will have to. Europe’s job markets are still strong and core inflation, excluding food and energy has remained around 5% for about a year. This still needs to play out.

From a comparative analysis perspective, sighting divergent economies, The Bank of Japan (BOJ) announced steps to maintain their ultra-low interest rate policy, but also made comments suggesting that they will look to make yield curve control (YCC) more flexible. The central bank kept short term interest rates unchanged (- 0.1%), and also for the 10-year JGBs (Japan Government Bonds), the yield will remain around 0%. That being said, the comments regarding JGBs stated that 0.5% cap is now a “suggestion”, not a “rigid limit”. It has set a new rigid limit of 1%. After the announcement, the yield on 10-year JGBs, touched a high of 0.575%, which is the highest level since September 2014. There has been growing speculation that Japan, finally seeing increasing inflation, will look to adjust their YCC policy. Japan’s economy grew at an annualized 2.7% in Q1 2023, outpacing the U.S. economy. As comments, pertaining to YCC band-widening has begun, the market interpretation will be looking for BOJ interest rate increases, which will result in yen appreciation. This makes the Japanese FX and Rates market the global focus for the next 12 months.

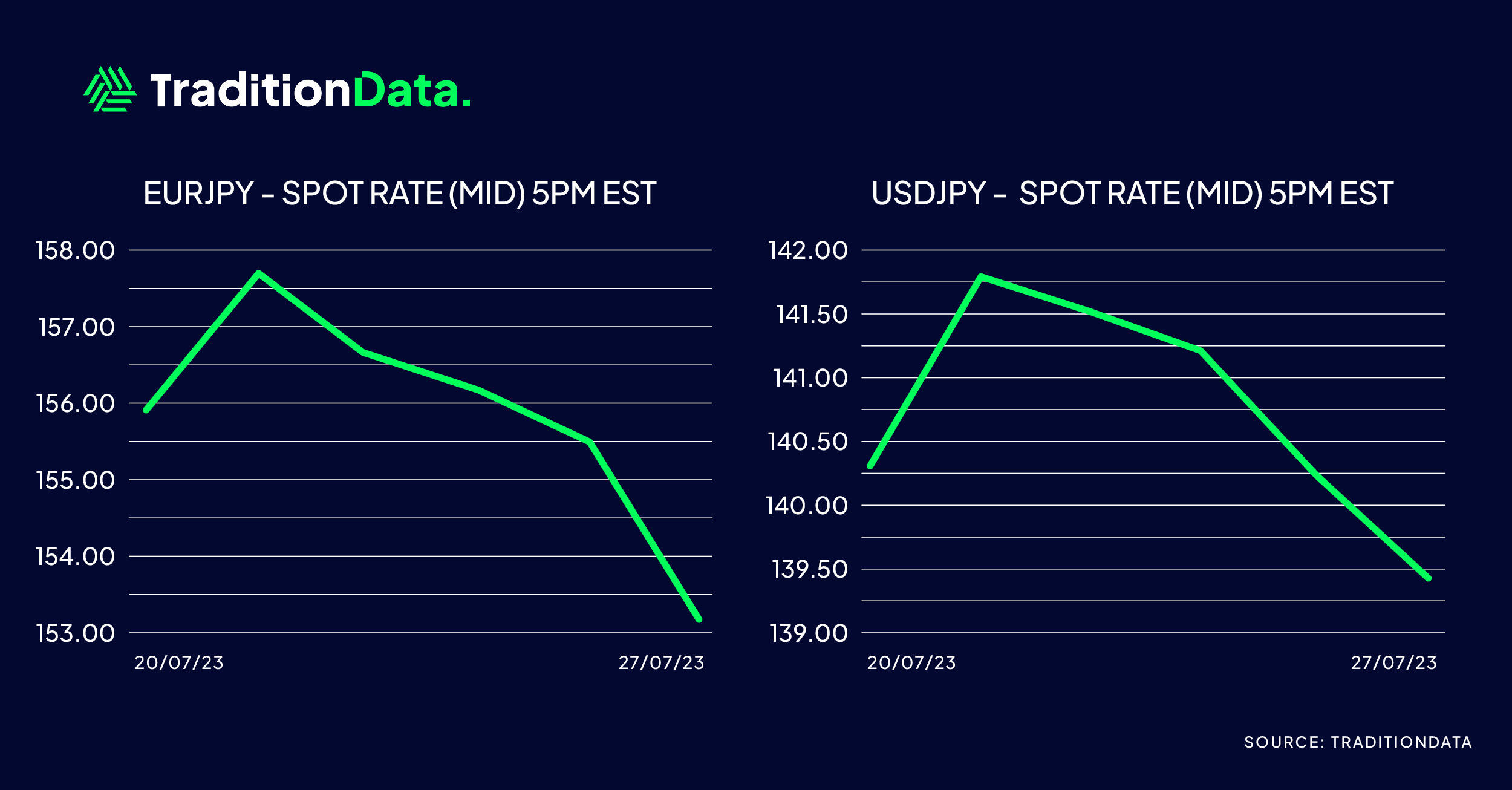

The Japanese Yen has been one of the worst performing currencies globally this year, depreciating against most of the other major currencies, such as the US dollar, British pound and Swiss franc. There is certainly a case to be made for the yen to recover, along with a growing sentiment amongst market participants that the BOJ will look to bridge the interest rate gap between the U.S and Japan. The FX markets could begin to see a longer term trend of yen appreciation.

The attached charts, using TraditionData’s market data, shows yen appreciation last week vs USD and EUR. The widening of the band in YCC related to JGBs is also a market data product at the forefront of TraditionData’s fixed income offering.

The information contained herein is the property of Compagnie Financière Tradition S.A. or any of its subsidiaries (together “Tradition”). Any review, disclosure, dissemination, distribution or copying of the information, whether in full or in part, is strictly prohibited and only intended for confidential use by the designated recipient(s). All content is provided “as is”, without warranty of any kind, either express or implied, including without limitation, warranties of merchantability, fitness for a particular purpose, and non-infringement. Nothing herein constitutes investment advice or an offer, or solicitation of an offer to buy or sell any financial product. Any data consists of purely indicative prices and should not be relied upon to revalue any commercial positions held by any recipient. To the maximum extent of the law, Tradition specifically does not make any warranties or representations as to the appropriateness, quality, timeliness, accuracy or completeness of the information and shall not be liable for any inaccuracy, error, omission, interruption, timeliness, incompleteness, deletion, defect, failure of performance, alteration or use of any of the content displayed, regardless of cause, or for any damages resulting therefrom. Tradition services are not available to private or retail clients. This information is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to any applicable law or regulation. Copyright © Compagnie Financière Tradition S.A., 2023. Commercial in Confidence.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.