- SUI gains over 8% on Monday, breaking above the $3 level.

- The total value locked (TVL) on the Sui blockchain climbed 5% in the past 24 hours, reaching $1.43 billion.

- Technical and on-chain indicators support a bullish outlook, positioning SUI for double-digit gains.

SUI, the native token of the Layer 1 blockchain, is rallying on Monday, attempting a break out of its downward trend that started on January 6. The token eyes further gains riding on bullish catalysts.

SUI gains likely with following catalysts

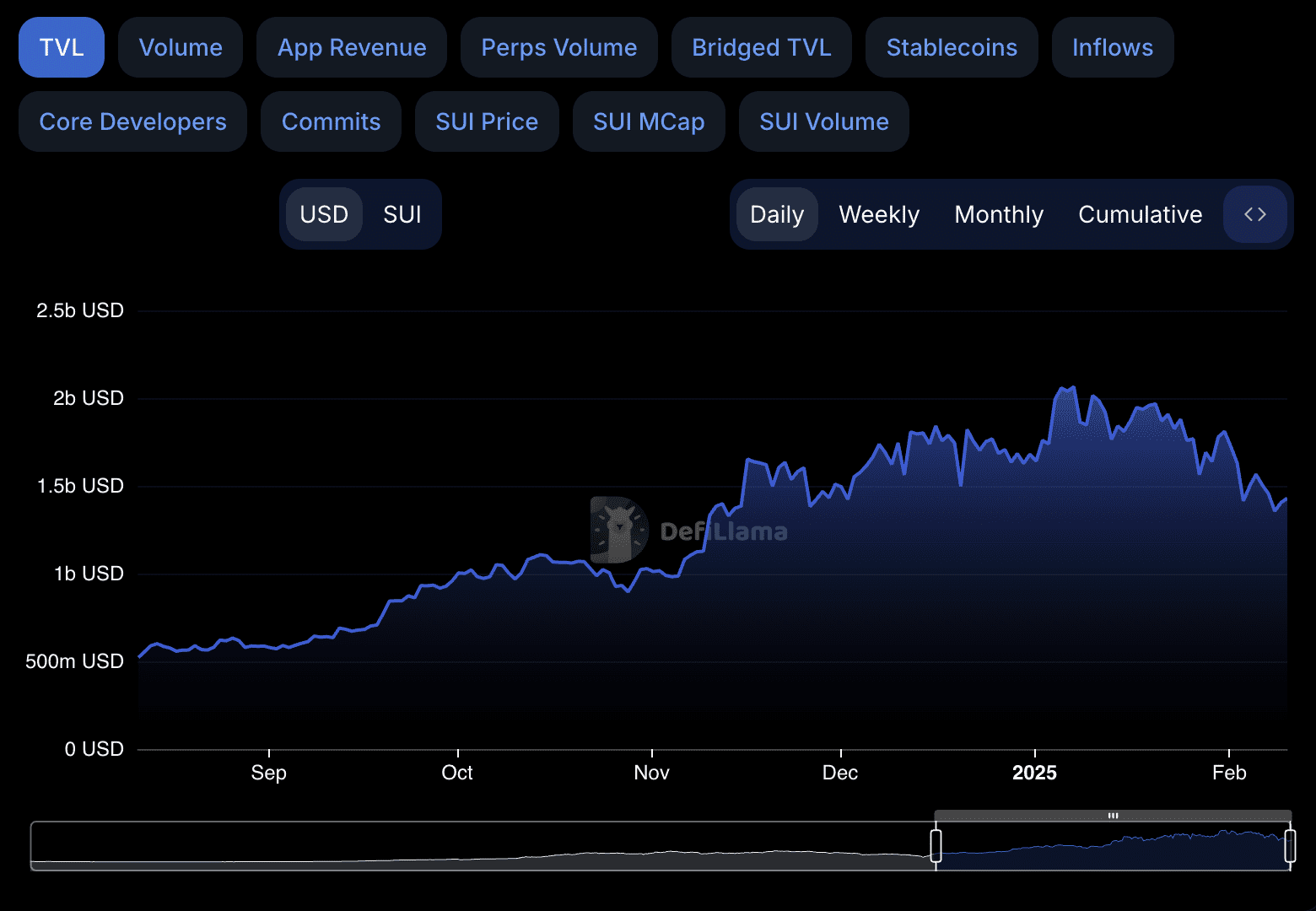

The total value of tokens locked (TVL) on SUI has climbed 5%, up to $1.43 billion, according to DeFiLlama data. SUI’s TVL has dropped from its January 7 peak of $2.065 billion, seen in the chart below.

A recovery in TVL implies an increase in investor confidence and demand for the token among traders.

SUI TVL | Source: DeFiLlama

On-chain indicators across derivatives exchanges support a thesis for further gains in the token. The total funding rate aggregated by SUI across derivatives exchanges turned positive for the first time since last week.

The total open interest, indicative of the value of all open derivatives contracts, has climbed to $352.55 million as sentiment among traders shifts this week.

Sui on-chain metrics | Source: Santiment

SUI could rally 23%, break out of a downward trend

The SUI/USDT daily ptice chart shows that the key momentum indicator, Relative Strength Index (RSI) is sloping upwards and reads 38. The Moving Average Convergence Divergence (MACD) indicator signals a waning underlying negative momentum in the SUI price trend.

SUI could find support in the imbalance zone between $2.85 and $3.02, a Fair Value Gap (FVG) on the daily timeframe.

SUI faces resistance in the FVG between $3.0758 and $4.0105. The target is the upper boundary of the imbalance zone at $4.0105.

SUI/USDT price chart

A failure to break into the imbalance zone this week could imply a decline in the support zone and a correction to the $2.85 support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Solana plunges as ETF speculators bet billions on XRP and DOGE

Solana (SOL) price tumbles as low as $180 on Monday, down over 9% in three consecutive days of losses. Bearish dominance in the SOL derivatives markets suggests the downtrend could extend in the week ahead.

Shiba Inu Price Analysis: SHIB whale demand declines 88% amid two-week consolidation phase

Shiba Inu (SHIB) price opened trading around the $0.000016 mark on Monday, having consolidated within a 5% tight range over the last two weeks.

Solana-based meme coin LIBRA controversy heats up, Argentina President hit by lawsuit

Argentina’s President Javier Milei faces charges of fraud for the promotion of LIBRA meme coin on the Solana blockchain. An on-chain intelligence tracker links LIBRA meme coin to MELANIA and claims that the creator extracted $100 million from the former.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. US Bitcoin spot ETF data recorded a total net outflow of $580.2 million last week.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.

[17.55.05, 10 Feb, 2025]-638748009658924257.png)