- SEC chair Gary Gensler has indicated Bitcoin spot ETF filings are under review, noting that staff recommendations will have a bearing.

- The comment was in response to Tennessee Senator Bill Hagerty, asking what the commission criteria for approval entails.

- Following the Grayscale ruling, impatience continues to grow, with crypto enthusiasts watching the clock for the financial regulator’s decision.

- Meanwhile, the combined AUM of firms that have filed for Bitcoin spot ETFs is now over $16 trillion, with Franklin Templeton joining the race.

US Securities and Exchange Commission (SEC) chair Gary Gensler has responded to a public inquiry about what it would take for the financial regulator to approve a Bitcoin Spot Exchange Traded Fund (ETF). The concern comes amid growing impatience two weeks after Grayscale won its longstanding litigation against the commission.

Also Read: Grayscale law firm Davis Polk urges SEC to approve Bitcoin spot ETF, citing best use of resources

SEC chair response to Senator Hagerty

Amid growing uncertainty and with the market craving an impulse, Tennessee Senator Bill Hagerty asked SEC chair Gary Gensler “what the SEC needs to see in order to approve a BTC Spot ETF.” His question sprouted from Grayscale’s resounding victory on August 29 in its lawsuit against the SEC, when the court determined that the SEC's denial of Grayscale's spot ETF proposal was "arbitrary and capricious" given the commission's failure to explain why similar products are treated differently.

NEW: @SenatorHagerty, referencing the @Grayscale ruling, asked Gensler what the @SECGov needs to see in order to approve a $BTC Spot ETF.

— Eleanor Terrett (@EleanorTerrett) September 12, 2023

Gensler replied: "We’re still reviewing that decision. We have multiple filings...we're reviewing them and looking forward to staff's…

Speaking during the Senate Banking Hearing, Gensler said:

We’re still reviewing that decision. We have multiple filings...we're reviewing them and looking forward to staff's recommendations.

Staff recommendations would most likely be the opinions from individual commissioners, presented as an evaluation of whether the issuers pass the checks of protection against manipulation, efficacy, and investor protection. Another perspective that the commissioners may have to consider is the issue of conflicting services, with Gensler being on record saying it would lead to “limited risk monitoring” during a July 12 Webinar.

Gensler was asked today in a webinar about Coinbase being at center of ETF filings. He couldn't comment on the filings but went pretty negative on crypto exchanges saying they operate "conflicting services" and have "limited risk monitoring" Here's full quote via @TheBlock__ pic.twitter.com/iCVl906GyF

— Eric Balchunas (@EricBalchunas) July 12, 2023

In the latest of Gensler’s comments about crypto, the SEC chair says the industry is full of fraud, abuse, and misconduct.

JUST IN: SEC Chair Gary Gensler says crypto is full of fraud, abuse and misconduct. pic.twitter.com/YzZNbbjrF0

— Watcher.Guru (@WatcherGuru) September 12, 2023

The five-member team comprises three Democrats (Gary Gensler, Caroline Crenshaw, and Jaime Lizárraga) and two Republicans (Hester Pierce, and Mark Uyeda). This explains why former SEC staff John Reed Stark said a Republican taking office after the 2024 elections would bode well for crypto, as it would give Republicans a majority in the commission. Under the current regime of President Joe Biden, the Democrats have the majority, with Biden having appointed Gensler himself.

US SEC hell-bent on delays even after Grayscale victory

The crypto market had received the victory very well, interpreting it as a step closer to a positive decision from the commission. Two weeks later, there is still no forthright or directional bias from the SEC, with several records of delayed decisions.

The record of delayed orders comprises WisdomTree, Invesco, Valkyrie, Fidelity, VanEck, Bitwise, and BlackRock. Meanwhile, the markets’ eyes remain peeled for around October 15, when the commission could likely provide a joint decision for all seven applicants. It is worth mentioning that with Franklin Templeton joining the Bitcoin Spot ETF campaign, the combined assets under management (AUM) of firms in the race goes above $16 trillion, with BlackRock boasting a staggering $9 trillion.

Between Blackrock, Fidelity, Invesco, and now Franklin Templeton -- the combined AUM of firms that have filed for Bitcoin spot ETFs is now over $16 trillion.

— Will Clemente (@WClementeIII) September 12, 2023

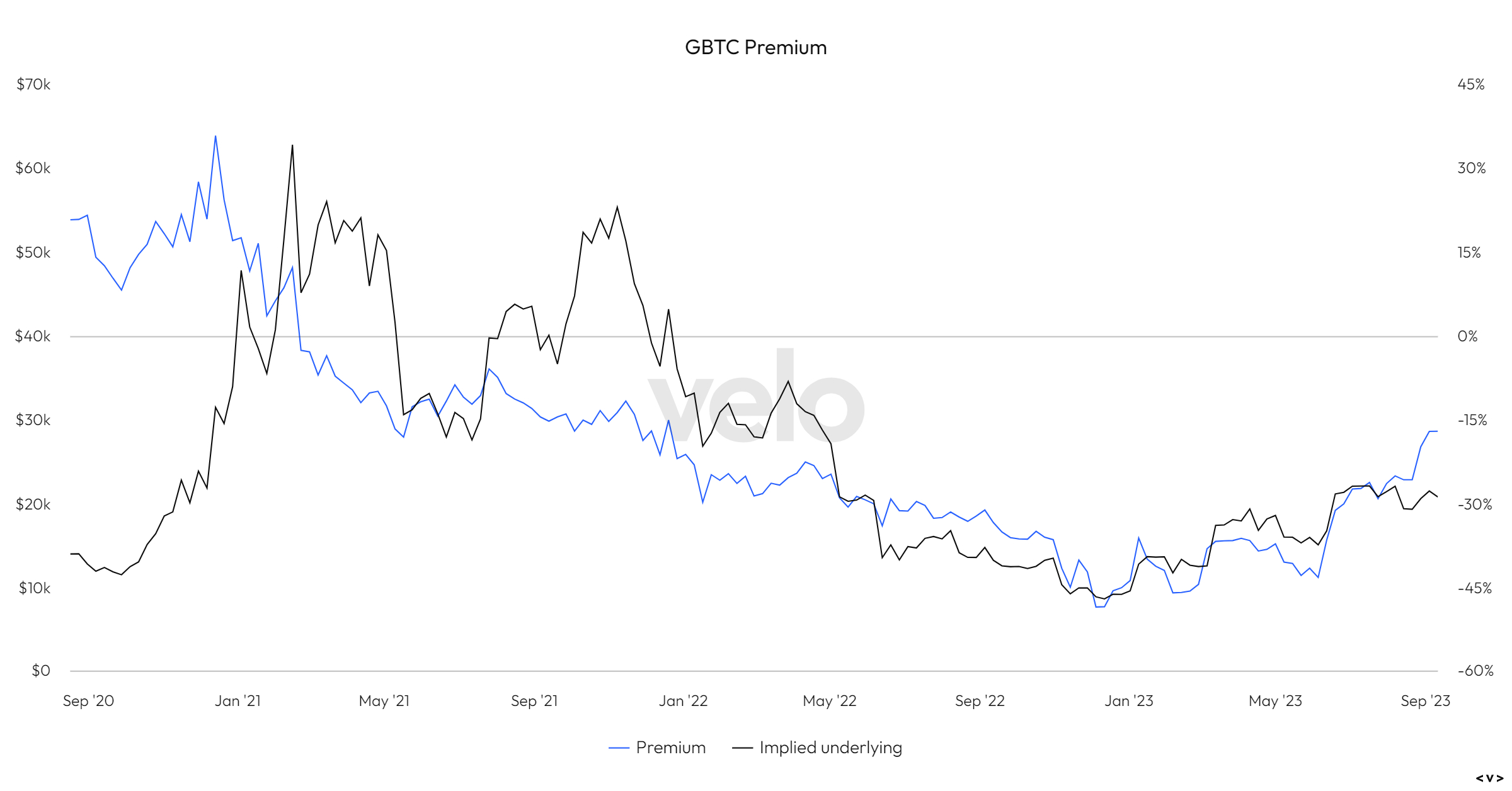

Franklin Templeton asset manager is the latest entrant, with an AUM of $1.5 trillion to its name. The addition has the GBTC discount closing in further, now trading at just a 17% discount to NAV.

GBTC discount

This is the closest that the trust has tracked the underlying Bitcoin since December 2021.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.