- Bitcoin Ordinals hype fades, spotlight shifts to gaming tokens Sandbox, Decentraland, Axie Infinity and ImmutableX.

- Play-to-earn gaming tokens are positioned to fuel a recovery in the SUI ecosystem.

- Expert analysts support the narrative that gaming and metaverse play-to-earn tokens will likely drive the next crypto bull run.

The Bitcoin Ordinals hype has faded with a decline in transaction volume on the BTC network. The narrative of gaming tokens and how they drive the adoption of virtual assets among market participants gained relevance with the recent price rallies in Play-to-Earn (P2E) tokens.

Also read: Vitalik Buterin warns against risks of overloading the Ethereum network

Sandbox, Decentraland, Axie Infinity erase losses from past week

Play-to-earn (P2E) gaming tokens Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS) and Iluvium (ILV) cut losses from the past week. Recovery is likely for the P2E ecosystem tokens as the narrative of gaming tokens fueling the next crypto bull run gains popularity.

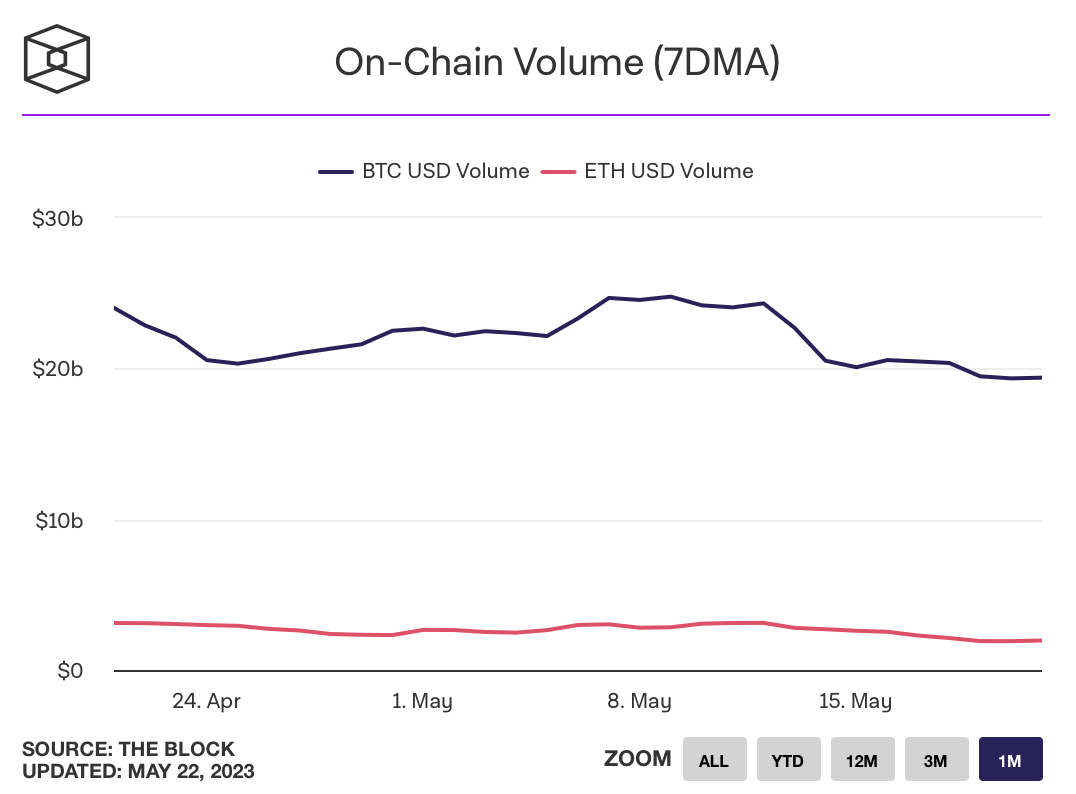

Further, BRC-20 token standards, Bitcoin Ordinals, are slowly losing their popularity among traders, which becomes evident from BTC’s declining transaction volume.

Bitcoin transaction volume 7-day moving average

Pentosh1, a crypto analyst and trader, recently shared his bullish thesis about gaming ecosystem tokens in a tweet.

I strongly feel that gaming will provide the most upside next bull run.

— Pentoshi euroPeng (@Pentosh1) May 19, 2023

It’s someting almost anyone from any culture can relate to that’s easy to understand and digest

Most people don’t care about 99% of what crypto projects pretend to solve

The expert’s argument is that most market participants aren’t as interested in the problems being solved by crypto protocols, and gaming is the avenue that increases adoption and utility in the ecosystem.

Interestingly, while most large market capitalization cryptocurrencies like Bitcoin, Ethereum and Binance Coin witnessed a pullback, SAND, MANA, AXS and ILV wiped out their losses.

Gaming tokens are likely to fuel a recovery in SUI

SUI, the native token of the Sui ecosystem, is likely to begin its recovery soon with games like Cards of Ethernity, Final Stardust and Cosmocadia adding new users to the protocol. The SUI blockchain is attracting gaming enthusiasts.

The SUI protocol mainnet went live three weeks ago and the asset has nosedived 51% from its all-time high of $2.16. Higher adoption of the SUI ecosystem by gamers is likely to drive demand higher and likely fuel a SUI price recovery.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.