- Gold price declined sharply this week as the USD rally picked up steam.

- Market focus could shift back to US data releases next week.

- XAU/USD bearish bias could stay intact as long as the $1,890-$1,900 area holds as resistance.

Despite holding resilient in the face of a hawkish Federal Reserve outlook in the previous week, Gold price suffered heavy amid broad-based US Dollar (USD) strength and surging US Treasury bond yields. XAU/USD staged a modest rebound on Friday but ended up losing more than 2% for the week. Political developments in the US, ISM PMI surveys and September jobs report could drive the pair’s action in the near term.

What happened last week?

The risk-averse market atmosphere at the beginning of the week helped the USD preserve its strength and made it difficult for XAU/USD to gain traction. China's heavily indebted real-estate developer Evergrande announced on Sunday that it was unable to issue new debt due to an ongoing investigation into its main domestic subsidiary, Hengda Real Estate Group Co Ltd. This development caused the company to postpone its debt restructuring plan and triggered a sell-off in global equity indexes.

The data from the US showed on Tuesday that consumer sentiment continued to deteriorate in August, with the Conference Board’s Consumer Confidence Index falling to 103.00 in September from 108.7 in August. The Consumer Expectations Index of the survey also declined to 73.7 from 83.3. Meanwhile, the lack of progress in US budget negotiations revived fears over a US government shutdown and its potential negative impact on the US credit rating.

After the Senate presented a stopgap funding bill to avert a shutdown on Tuesday, Republican Speaker Kevin McCarthy said that the bill would not be supported if it did not include border and immigration restrictions. The bond sell-off continued as sides looked apart, and the benchmark 10-year US Treasury bond yield climbed to its highest level since 2007 above 4.6%. As a result, Gold price continued to push lower mid-week. Once XAU/USD broke below $1,900, technical sellers took action and the pair slumped to its weakest level since March below $1,870.

Meanwhile, the US Bureau of Economic Analysis (BEA) confirmed that the real Gross Domestic Product (GDP) expanded at an annual rate of 2.1%. This reading matched the previous estimate and came in line with the market expectations. Other data from the US revealed that there were 204,000 first-time applications for unemployment benefits in the week ending September 23. Although the USD staged a downward correction and Wall Street’s main indexes erased a portion of the weekly losses on Thursday, the funding deadlock allowed the 10-year yield to hold near multi-year highs and forced XAU/USD to stay on the back foot.

Inflation in the US, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, rose to 3.5% on a yearly basis in August from 3.4% in July, the BEA announced on Friday. More importantly, the annual Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, increased by 3.9%, down from 4.3% in July. These data matched analysts’ expectations and failed to trigger a noticeable market reaction. The USD struggled to find demand as market mood improved ahead of the weekend and XAU/USD erased a small portion of its weekly losses.

Next week

The weekend’s political headlines from the US could impact XAU/USD’s weekly opening. If Republicans and Democrats reach a deal and avert a shutdown before Sunday’s deadline, US Treasury bond yields could turn south at the beginning of the week and help the pair gather bullish momentum on Monday. On the other hand, a government shutdown is likely to trigger a flight to safety and weigh heavily on Gold price.

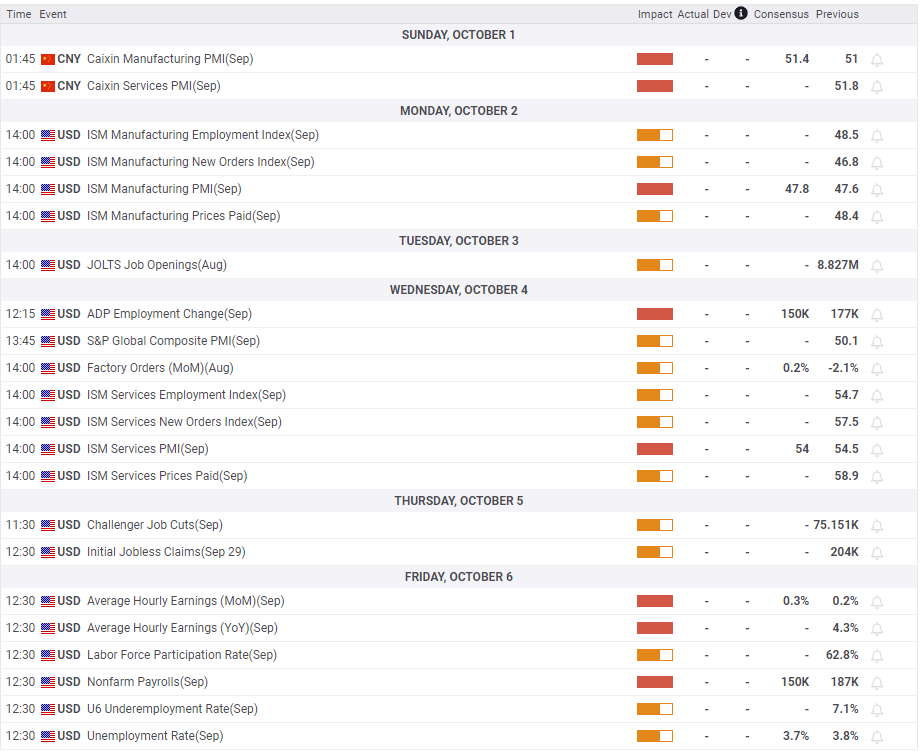

The US economic docket will feature the ISM Manufacturing PMI on Monday, which is forecast to edge higher to 47.8 in September from 47.6 in August. In case this data arrives above 50 and points to an expansion in the manufacturing sector’s business activity for the first time since October, the initial reaction could provide a boost to the USD. Investors, however, are likely to stay focused on the action in bond markets depending on the outcome of the budget negotiations.

Meanwhile, markets will keep a close eye on Asian equity indexes following news of Chinese authorities investigating the director and executive chairman of Evergrande, Hui Ka Yan, on suspected crimes.

On Wednesday, the September ISM Services PMI is expected to come in at 54. A print close to, or below, 50 could hurt the USD. If the Prices Paid Index of the survey – the inflation component – stays close to 60, the potential negative impact of a disappointing headline Services PMI on the USD’s valuation could remain short-lived.

Finally, the US Bureau of Labor Statistics will release the September jobs report on Friday. Nonfarm Payrolls (NFP) are forecast to rise by 150,000, following the 187,000 increase recorded in August. An NFP print at or above 200,000 could cause investors to reassess the possibility of one more Fed rate increase and help the USD gather strength ahead of the weekend. The CME Group FedWatch Tool shows that markets still see a 66% probability of the US central bank holding the policy rate unchanged for the rest of the year. Smaller-than-expected job growth could lift XAU/USD by allowing dovish Fed bets to dominate the market action.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart fell below, pointing to oversold conditions for XAU/USD. Although the pair could stage an upward correction in the near term, it needs to flip the $1,900-$1,890 area (Fibonacci 38.2% retracement of the long-term uptrend, static level, psychological level) back into support to turn bullish again. In that scenario, the 200-day Simple Moving Average (SMA) could be set as the next bullish target before $1,940 (100-day SMA) and $1,950 (Fibonacci 23.6% retracement).

On the downside, static support seems to have formed at $1,860. If that level is confirmed as resistance, a fresh leg lower toward $1,840 (Fibonacci 50% retracement) and $1,810 (static level) could be seen.

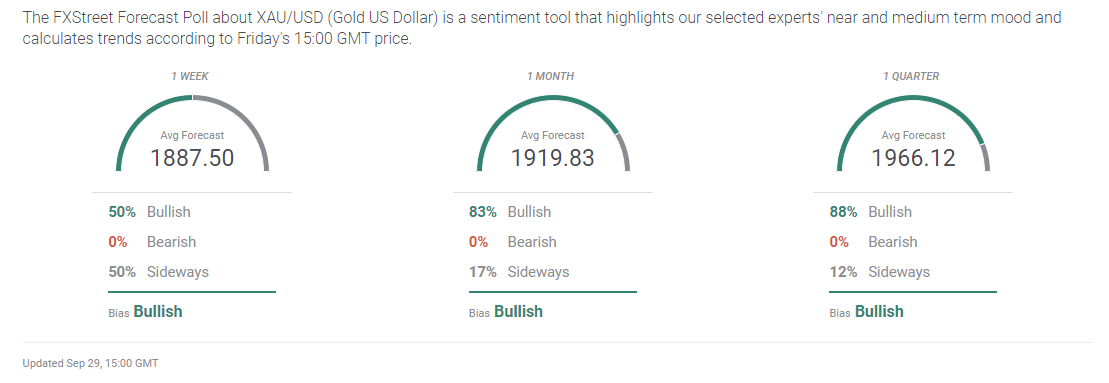

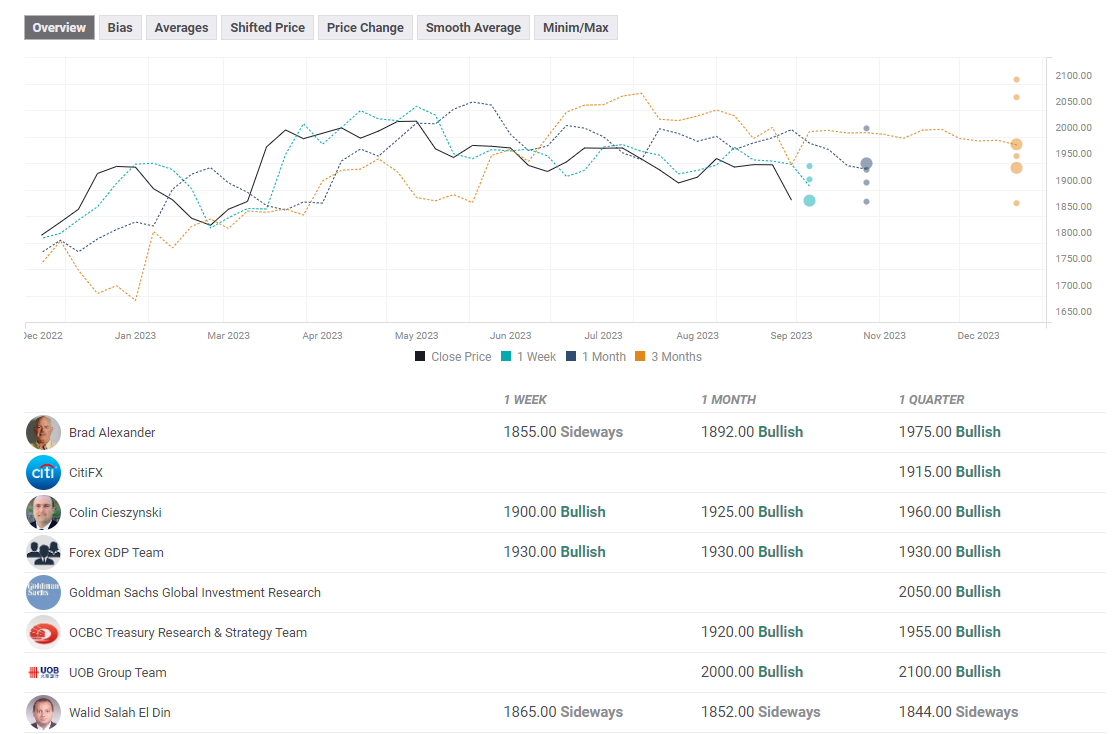

Gold forecast poll

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.