- Gold price has come under pressure on a spot basis, but a break of daily resistance this week could be on the cards.

- Meanwhile, mitigation of lower time frame price imbalances could be in play to start the week off.

Before getting into the spot gold price technicals, analysts at TD Securities explained that money managers aggressively liquidated gold longs as a hawkish Fed continues to sap interest in the yellow metal.

''After all,'' the analysts said, ''as the world chases the same hawkish Fed narrative, position squeezes continue to drive price action in the yellow metal.''

''Notwithstanding, proprietary traders are the cohort raising risks of additional liquidations, after having built a massive and complacent position since the pandemic. While the war in Ukraine has sent the bears packing at prop-shops, the cohort's longs have yet to capitulate. This week, prop traders only marginally liquidated their length, whereas the breadth of traders long hasn't budged, suggesting a liquidation event is still forthcoming.''

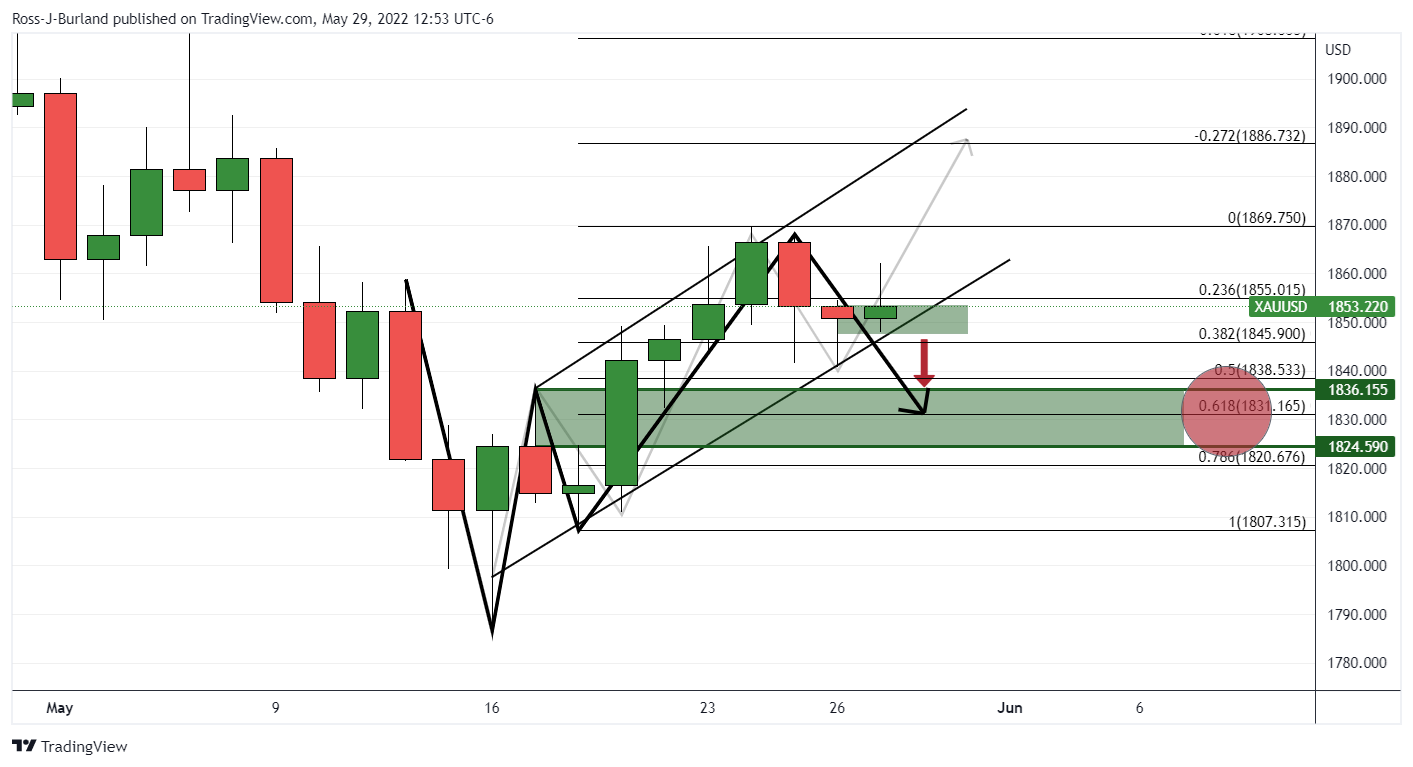

For the technical outlook, as per the prior pre-open analysis for last week, Gold, Chart of the Week: XAU/USD bulls need to hold $1,850 or a 61.8% golden ratio will be next on bear's menu, it was shown that the daily chart's W-formation's neckline near a 61.8% golden ratio was yet to be fully tested:

Gold daily chart, live market

As illustrated, the price moved in on the area and completed the retest of the neckline. This now offers prospects of a move higher from here following the move out of the downside channel. However, the resistance will need to give:

Gold, H1 chart

For the open, the hourly chart could see some initial bids come through to mitigate some of the latest bearish impulse. The 50% mean reversion area aligns with the prior support as a target. However, should resistance hold up, there could be a move into the downside to fully test the demand area in the $1,840s again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.