- Bitcoin price initially reacted positively to Federal Reserve chair Jerome Powell's speech, rising to $27,140, before coming back down to $26,800.

- Powell stated that inflation is far above Fed's objective, but the central bank remains committed to returning to the 2% target.

- Concerns surrounding the US government defaulting on its debt are high, but interest rates are expected to refrain from rising by 25 bps.

The Federal Reserve chair Jerome Powell during his speech at the "Perspectives on Monetary Policy" panel before the Thomas Laubach Research Conference on May 19, shared his opinion on what is expected from the Fed going forward.

Opening with inflation, Powell noted that the current inflation is far above the objective set by the Federal Reserve of 2%. He stated that inflation poses significant hardship, particularly to those at the margins of society, and the central bank remains "strongly committed" to returning to this goal from the present 4.93%.

Adding to the same, Powell said,

"Price stability is the foundation of a strong economy; responsibility of central bank to maintain it."

Powell, during the speech, also noted that the interest rate may not need to rise as high. The Fed chair stated that tighter financial conditions mean "our policy rate may not need to rise as much as it would have otherwise to achieve our goals."

Concerns surrounding the next meeting are high as the market is expecting the Federal Reserve to refrain from hiking interest rates.

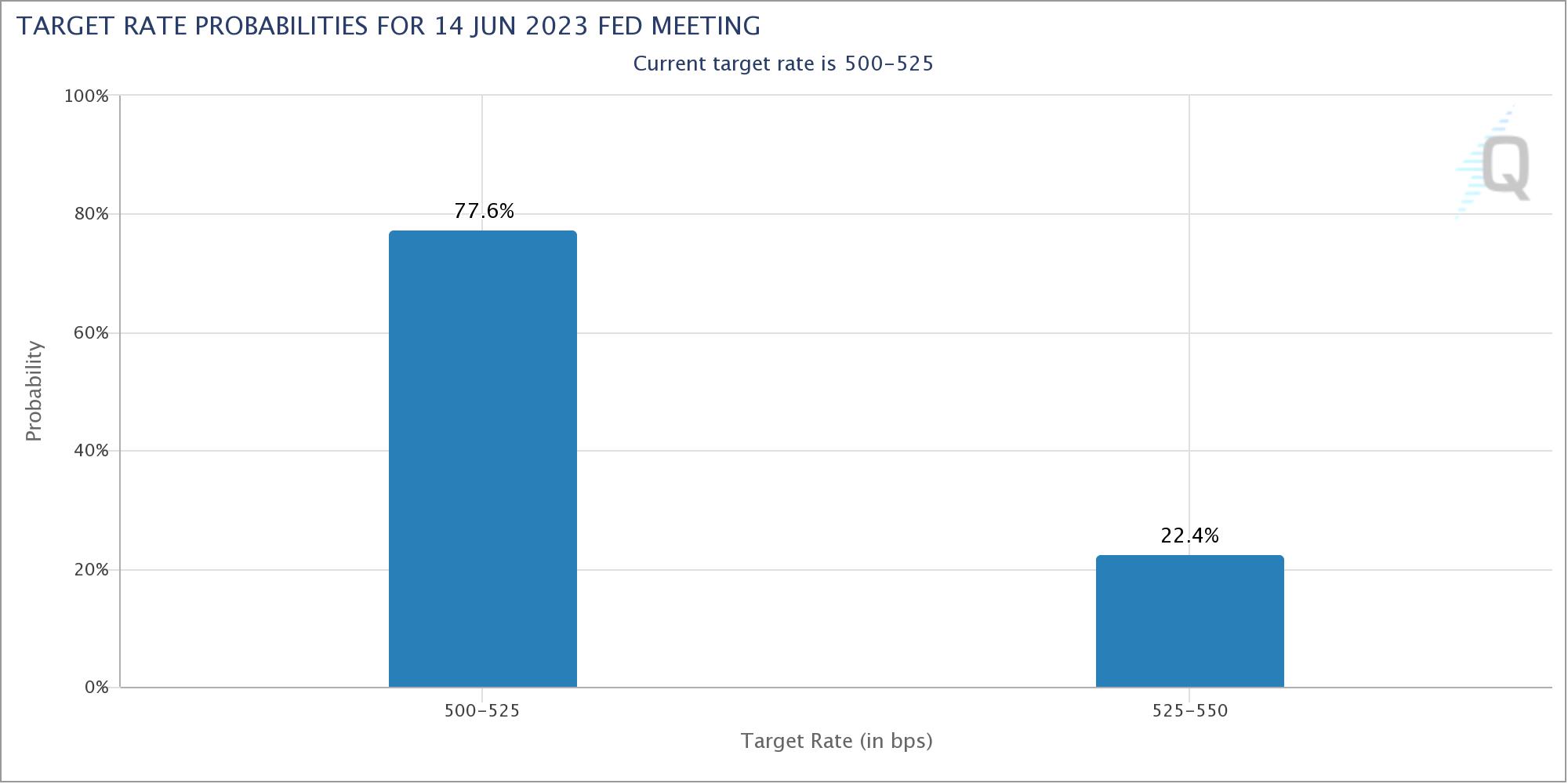

According to the FedWatch tool, the probability of the Fed sticking with the current Fed Funds target of 5% - 5.25% is 77.6%, though down from last week's 84.5%. The probability of a 25 basis points (bps) hike is still at a low of 22.4%.

Interest rate hike probability

The biggest threat to stable interest rates is the debt ceiling. While US President Joe Biden stated last week that he is sure the country will avoid an unprecedented and potentially catastrophic debt default, fear remains static.

This is because the US government's debt defaults could send interest rates skyrocketing, severely impacting the country's economy.

This rise in interest rate could also impact the crypto market negatively since borrowing becoming more expensive could lead to a decline in investments in riskier assets.

Bitcoin price shows mixed reactions

The immediate reaction of the biggest cryptocurrency in the world to Federal Reserve Chair Jerome Powell's speech was mostly bullish as Bitcoin price shot up to over $27,200. However, at the time of writing, BTC is maintaining its presence above the 100-day Exponential Moving Average (EMA), trading at $26,873.

BTC/USD 1-day chart

Following a 2% decline on May 18, Bitcoin price slid below $27,000, which has been acting as a crucial technical and psychological support level since mid-March. Keeping above this level is important for BTC in order to rise back above $28,000 and flip the 50-day EMA line into a support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.