- Cryptocurrency exchanges are freezing assets linked to the Luna Foundation Guard after instructions from South Korean authorities.

- A group of South Korean investors has filed a lawsuit against Terraform Labs cofounders Do Kwon and Daniel Shin in light of the LUNA and UST crashes.

- South Korean legislators to meet Korea’s top five exchanges on May 25, to check status of LUNA and UST customer losses.

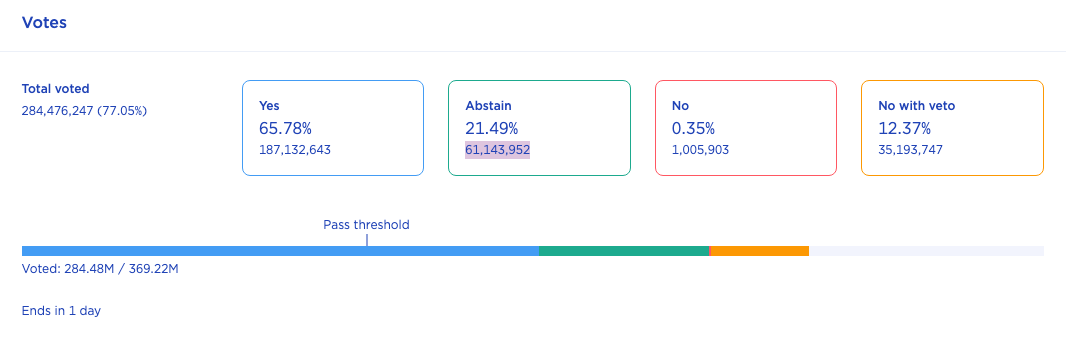

UPDATE: Terraform Labs is moving forward with its Ecosystem Revival Plan 2, which is expected to be completed on Friday, May 27th. Terra's LUNA 2.0 testnet is already live and once the launch of the new LUNA mainnet is completed, the rebirth of the native token as a genesis chain will be completed. Do Kwon and Terraform Labs reject the event being tagged as a hard fork, as the new blockchain will start with block 0 and abandon LUNA Classic. 30% of the new LUNA tokens will be awarded to both pre- and post-collapse LUNA and UST holders in a fixed manner. The vote for the LUNA recovery plan went through with 65% of positive votes amongst the Terra community despite the anger shown by plenty of investors affected by the Terra debacle two weeks ago.

Do Kwon faces legal proceedings in South Korea while endorsing a revival plan to fork Terra with a new token, excluding TerraUSD. On Wednesday, South Korean authorities are scheduled to meet cryptocurrency exchanges Upbit, Bithumb, Coinone, Korbit and Gopax after instructing them to freeze Luna Foundation Guard assets.

South Korean investors file lawsuit against Do Kwon and Daniel Shin

South Korean investors of the Terra community have started legal proceedings against Terraform Labs’ cofounders. Investors have filed a lawsuit against Do Kwon and Daniel Shin in response to the colossal crash of Terraform Lab’s LUNA and TerraUSD (UST). South Korean regulators have instructed cryptocurrency exchanges Upbit, Bithumb, Coinone, Korbit and Gopax to freeze assets linked to the Luna Foundation Guard (LFG). The authorities have scheduled a meeting with exchanges on May 25, 2022.

South Korea’s ruling party will discuss the Terra de-peg event and decide whether they should be held accountable for funds lost by investors in the LUNA, UST crash.

Police investigates Luna Foundation Guard

According to reports by KBS, the South Korean police is keen on freezing LFG’s assets and scrutinizing the loss of user funds in the colossal Terra crash. The Seoul Metropolitan Police Agency’s cybercrime investigation unit is the regulatory authority that asked exchanges to withhold funds held in Terra-affiliated wallets. According to the same KBS report, the police are suspicious of the misappropriation of corporate funds.

While the exchanges have no legal obligation to freeze funds, they could adhere to the South Korean police’s request.

Kwon promotes LUNA revival plan despite legal proceedings

Terraform Labs co-founder Do Kwon has recently surfaced online to remind LUNA holders that sending their LUNA to the burn address is not good. Kwon has asked the community to support the revival plan as voting ends on Wednesday.

65.78% of voters favor the Terra fork and the removal of algorithmic stablecoin UST from the LUNA ecosystem. According to voting data, nearly 35% of voters continue to reject or critique the idea of a fork.

Votes on plan for Rebirth of the Terra network

IMF head labels stablecoins a “pyramid” scheme

After the collapse of Terraform Lab’s algorithmic stablecoin, Kristalina Georgieva, managing director of the International Monetary Fund (IMF) said,

When we look at stablecoins this is the area where the big mess happened. If a stablecoin is backed with assets, one to one, it is stable. When it is not backed with assets, but it is promised to deliver 20% return, it’s a pyramid. What happens to pyramids? ... They eventually fall to pieces.

The UST’s de-peg and colossal crash of sister tokens wiped out $39.1 billion from market value of Terraform Labs tokens.

Weekly top gainers in crypto

FXStreet analysts have identified PEOPLE, KNC, and ANT as the top three cryptocurrencies in terms of gains over the past week. Analysts have evaluated the top gainers and losers of the week, predicting a recovery in cryptocurrencies after the recent bloodbath.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.