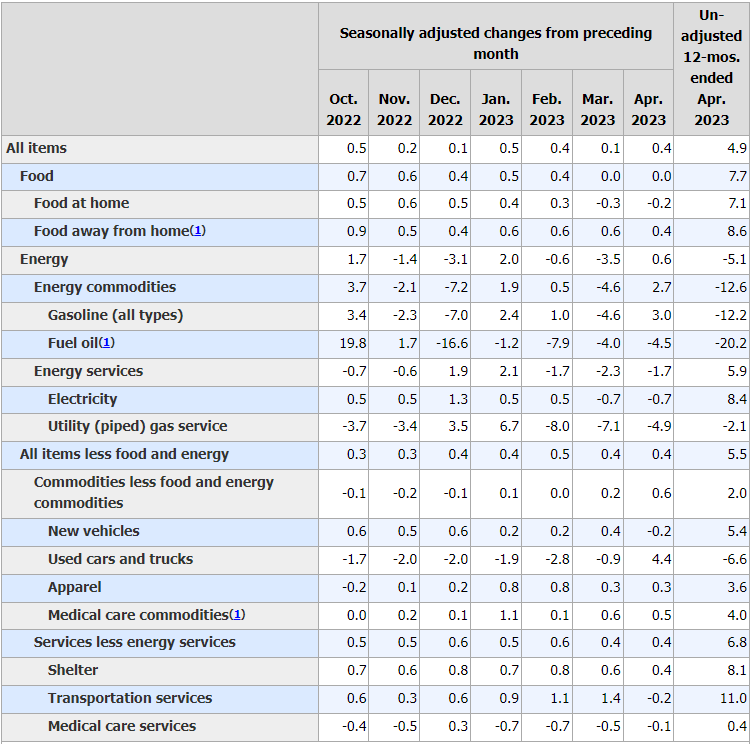

The US Bureau of Labor Statistics (BLS) reported on Wednesday that inflation in the US, as measured by the change in the Consumer Price Index (CPI), declined to 4.9% on a yearly basis in April from 5% in March. This reading came in slightly below the market expectation of 5%.

Further details of the publication revealed that the Core CPI inflation, which excludes volatile food and energy prices, edged lower to 5.5% from 5.6% as expected.

On a monthly basis, the CPI and the Core CPI rose 0.4%, matching analysts' estimates.

Follow our live coverage of the market reaction to US inflation data.

"The index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks and the index for gasoline," the BLS explained in its publication. "The increase in the gasoline index more than offset declines in other energy component indexes, and the energy index rose 0.6 percent in April."

Market reaction

The US Dollar (USD) came under renewed selling pressure after April inflation report and the US Dollar Index was last seen losing 0.3% on a daily basis at 101.30. Moreover, the benchmark 10-year US Treasury bond yield turned south and broke below 3.5%.

According to the CME Group FedWatch Tool, the probability of the Federal Reserve leaving its policy rate unchanged in June climbed to 85% from 79% earlier in the day.

Commenting on the inflation data, "the CPI report comes on top of the Nonfarm Payrolls (NFP) figures released less than a week ago, and together there is a compelling case for pausing," said FXStreet Analyst Yohay Elam. "Investors already see a growing chance of rate cuts, and that weighs on the Greenback. "

United States Consumer Price Index (MoM)

The Consumer Price Index released by the US Bureau of Labor Statistcs is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish). Read more.

Next release: Tue June 13th, 2023 12:30

Frequency: Monthly

Source: US Bureau of Labor Statistics

Why it matters to traders?

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank's directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

- Annualized Consumer Price Index in the US is expected to rise 5.0% in April, holding steady from March numbers.

- Core CPI inflation is foreseen at 5.5% YoY in April, down from March’s 5.6% clip.

- US Dollar set to rock as US CPI could have a significant impact on the Fed’s rate outlook.

The Consumer Price Index (CPI) data release for April, published by the US Bureau of Labor Statistics (BLS), is scheduled for May 10 at 12:30 GMT.

The United States Dollar (USD) has been attempting a tepid recovery after a strong April Nonfarm Payrolls report. The Loan Officer Survey, published by the Federal Reserve (Fed) on Monday, showed that US credit conditions were less gloomy than expected, which is also aiding the US Dollar rebound.

Markets now eagerly look forward to the inflation data to gauge how the Fed might adjust its monetary policy at its next meeting in June, looking for fresh USD valuations.

What to expect in the next CPI data report?

The US Consumer Price Index data, on an annualized basis, is foreseen to rise 5.0% in April, the same pace as in March. The Core CPI number, which excludes volatile food and energy prices, is expected to rise 5.5%, a tad below the 5.6% print reported in March.

Over the month, the headline Consumer Price Index is foreseen to accelerate, with a 0.4% increase expected in April, up from the 0.1% increase registered in March. However, the Core CPI is expected to keep rising 0.4%, the same pace as the previous month.

The US CPI data will hold the utmost relevance for the Federal Reserve, as the US central bank made it clear at its May 3 policy meeting that “it will take data a dependent approach to determine the extent of further rate hikes” as elevated inflation levels and the banking sector stress remain in focus. The Fed raised the target range for the federal funds rate by the expected 25 basis points (bps) to 5.0%-5.25%. Federal Reserve Chairman Jerome Powell, however, adopted a cautious tone during his press conference, noting that the Fed is prepared to adjust the stance of monetary policy as appropriate if risks emerge.

US bank shares plunged last week, as a crisis of confidence in the country's banking sector continued. Shares in California-based PacWest plunged 50%, while Western Alliance stock also tumbled nearly 40%. The sell-off in bank shares gathered steam this week after First Republic was seized by regulators and sold to America's biggest bank, JPMorgan Chase.

Analysts at TD Securities provide a brief preview of the key macro data and explain: “Market attention this week will focus on April CPI data following a payrolls report that was less strong than the headline beat would suggest. We look for core-price inflation to stay firm again, with the index rising a strong 0.4% MoM for a second straight month, as goods inflation likely continued to gain momentum.”

When will be the Consumer Price Index report and how could it affect EUR/USD?

The CPI data report is scheduled for release at 12:30 GMT, on May 10. A softer-than-expected reading, especially in the monthly core inflation, could ramp expectations for a Fed rate cut in the second half of this year. According to the CME Group FedWatch Tool, markets are currently pricing roughly a 90% probability of a Federal Reserve pause in June while seeing a 33% chance of a rate cut as early as July.

Last week’s US Nonfarm Payrolls blowout and Jerome Powell’s commentary pushed back on market expectations of a rate cut this year but the overnight index swaps (OIS) only partially trimmed rate-cut expectations for July. The headline US Nonfarm Payrolls (NFP) jumped by 253K in April, better than both the 179K expected and the previous figure of 165K. The Unemployment Rate unexpectedly ticked lower to 3.4% in April while the annualized Average Hourly Earnings rose to 4.4% in the reported month vs. 4.2% expected.

The wage inflation unexpectedly accelerated in April and, therefore, the April CPI data will be closely examined to determine whether the Fed could stay on hold for longer before opting for rate cuts later this year.

A downbeat CPI print will reinforce market expectations of Fed rate cuts sooner (than later), re-fuelling the US Dollar downtrend. This, in turn, should allow the EUR/USD pair to resume its bullish momentum, targeting the 1.1100 level yet again. On the other hand, surprisingly stronger inflation data from the United States could lead to a re-pricing of the Fed's interest rates outlook, in turn, offering an additional leg to the ongoing recovery in the US Dollar.

The US Dollar is set to rock on immediate market reaction, as any meaningful divergence from the expected readings should infuse extreme volatility in the markets and allow traders to grab short-term opportunities around the EUR/USD pair.

Meanwhile, Dhwani Mehta, Asian Session Lead Analyst at FXStreet, offers a brief technical outlook for the major and explains: “EUR/USD settled below the critical short-term 21-Day Moving Average (DMA) support at 1.0997 on Tuesday. With the 14-day Relative Strength Index (RSI), however, still defending the midline, Euro buyers remain hopeful.

Dhwani also outlines important technical levels to trade the EUR/USD pair: “On the upside, EUR/USD buyers need to find a foothold above the bullish 21 DMA support-turned resistance, above which Monday’s high of 1.1053 could be challenged. A sustained break above the latter will re-open doors toward the yearly high of 1.1095.”

CPI data related content

-

EUR/USD is holding at the floor of near-term range ahead of US inflation data

-

USD Index Price Analysis: Strong support remains around 101.00

- US CPI Preview: An upside surprise will add further impetus for the Dollar over the short-term – MUFG

About the Consumer Price Index

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0500, looks to post weekly losses

EUR/USD extended its daily decline toward 1.0500 in the second half of the American session, pressured by the souring market mood. Despite the bullish action seen earlier in the week, the pair remains on track to register weekly losses.

GBP/USD falls below 1.2150 as USD rebounds

Following an earlier recovery attempt, GBP/USD turned south and declined below 1.2100 in the second half of the day on Friday. The negative shift seen in risk mood amid rising geopolitical tensions helps the US Dollar outperform its rivals and hurts the pair.

Gold advances to fresh multi-week highs above $1,920

Gold extended its daily rally and climbed above $1,920 for the first time in over two weeks on Friday. Escalating geopolitical tensions ahead of the weekend weigh on T-bond yields and provide a boost to XAU/USD, which remains on track to gain nearly 5% this week.

Bitcoin could be an alternative to US-listed companies but not in the short term

Bitcoin has dipped below $27,000, adding to the subdued cryptocurrency market sentiment. While short-term price concerns persist, analysts predict a rebound based on historical figures.

Nvidia Stock Forecast: NVDA slips as Biden administration attempts to close AI chip loophole

Nvida's stock price opened marginally lower on Friday after Reuters reported that the Biden administration is attempting to close a loophole that allowed Chinese companies access to state-of-the-art computer chips used for AI.