- Binance CEO orders liquidation of $584 million FTT in retaliation for FTX CEO’s comments.

- Samuel Bankman-Fried, the CEO of FTX exchange stoked the ire of Binance’s chief with controversial regulatory proposals regarding DeFi.

- FTT price declined 13% week on week and the token is in a steady downtrend.

Binance CEO Changpeng Zhao (CZ) and FTX’s Samuel Bankman-Fried have locked horns over how cryptocurrencies should be regulated. The war of words entered the financial realm after CZ announced the mass liquidation of Binance’s holdings of FTX’s native token FTT.

Also read: Will re-listing on crypto exchanges trigger a bullish breakout in XRP price?

Binance liquidates FTT holdings, native token price declines

Binance, the world’s largest exchange by trade volume, liquidated $584 million in FTX exchange’s native token FTT in retaliation over comments made by Samuel Bankman-Fried, FTX exchange CEO about how the crypto and DeFi industry should bem regulated.

In October 2022, Sam Bankman-Fried directed regulators towards decentralized finance products and platforms but the crypto community criticized the CEO of FTX for his blueprint for regulatory oversight and industry standards addressing DeFi. He proposed that DeFi front-end providers, website hosts and even related marketers be required to register as traditional financial brokerages.

The implication of such a classification would subject DeFi users to Know Your Customer procedures and require enormous capital expenditure and resources. Opponents argue that since decentralized finance is currently self-regulated, any intervention from authorities could be considered redundant at best. Further, they say that ironically, it is centralized platforms and their opaque operations that require regulation the most.

CZ told his followers on Twitter that Binance is liquidating its holdings and it is a “post-exit risk management” move. CZ argues that after learning from the Terra collapse, Binance won’t support people who lobby against other industry players. Therefore, $584 million in FTT was liquidated by the exchange.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ Binance (@cz_binance) November 6, 2022

Binance, which previously owned a stake in FTX, exited from its position in 2021, receiving roughly $2.1 billion equivalent in a cash payout (BUSD and FTT). Due to the recent developments, the exchange decided to liquidate the FTT remaining on its books.

CZ announced that Binance wants to liquidate in a way that minimizes the market impact. Due to market conditions and limited liquidity, this will take a few months to complete. Binance always encourages collaboration between industry players and accordingly views FTX CEO’s move as potentially hurting the industry in the long term. As a result, Binance wants to wash its hands off the exchange’s native token.

FTT price in free fall

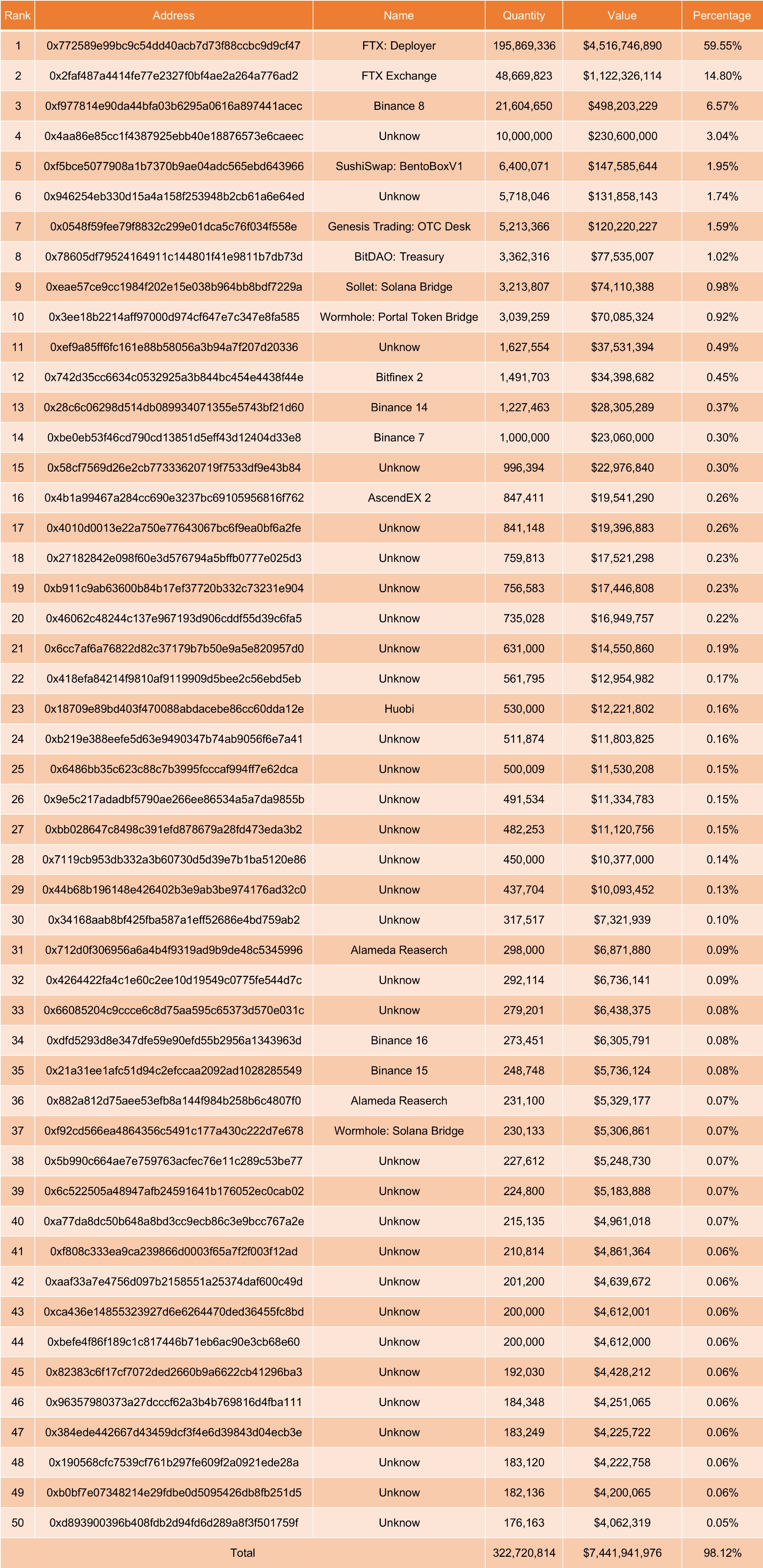

The debate between crypto influencers and the war waged by SBF against DeFi has adversely affected FTT price. The native token’s price plummeted 13% in the past week. The top 50 holders of FTT hold a total of 322.72 million tokens, accounting for $7.44 million, 98.12% of the total supply. FTT is highly concentrated in a small number of addresses.

FTT concentration in small number of addresses

Analysts at Lookonchain believe FTT’s high concentration in whale wallets could result in a massive crash in the token’s price once large wallet investors exit. Analysts have set a target of $9 for FTX exchange’s native token.

FTTUSD price chart

CapoOfCrypto, analyst and trader believes FTT price could decline to the $9 level. Since reserves of FTT across exchanges have a direct impact on price, the token is likely to crumble under selling pressure from key players like Binance and FTT whales.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Solana plunges as ETF speculators bet billions on XRP and DOGE

Solana (SOL) price tumbles as low as $180 on Monday, down over 9% in three consecutive days of losses. Bearish dominance in the SOL derivatives markets suggests the downtrend could extend in the week ahead.

Shiba Inu Price Analysis: SHIB whale demand declines 88% amid two-week consolidation phase

Shiba Inu (SHIB) price opened trading around the $0.000016 mark on Monday, having consolidated within a 5% tight range over the last two weeks.

Solana-based meme coin LIBRA controversy heats up, Argentina President hit by lawsuit

Argentina’s President Javier Milei faces charges of fraud for the promotion of LIBRA meme coin on the Solana blockchain. An on-chain intelligence tracker links LIBRA meme coin to MELANIA and claims that the creator extracted $100 million from the former.

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. US Bitcoin spot ETF data recorded a total net outflow of $580.2 million last week.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.