- Bitcoin price dipped 10% to record a new multi-month low at $25,166 before a quick pullback above the $26,300 level.

- The whiplash saw almost $820 million in total liquidations for long positions across the crypto market.

- This happened on the back of a wide range of macroeconomics, including Evergrande bankruptcy, SpaceX FUD, and Ripple vs. SEC news.

Bitcoin (BTC) price dipped below critical levels to test its range low during the afternoon hours of the US session. The slump was accompanied by heavy liquidations across the board, allowing retail traders to step in while longs closed their positions to avoid further losses.

Also Read: Breaking: Ripple price falls 30% after court approves SEC request for interlocutory appeal.

Bitcoin price dips 10%, accompanied by heavy liquidations

Bitcoin (BTC) price rallied south, losing a stark 10% before a quick retraction. The downward spike saw BTC break below two critical levels, $27,300 and $26,300 while retesting the June 16 lows around $25,166, equal lows that will be remembered as a crucial support level.

The rundown comes on the back of an eventful afternoon, with three crucial events making the theme on giant social media platform X:

- Unconfirmed news of Elon Musk’s SpaceX selling up to $373 million worth of Bitcoin following a report on Wall Street Journal.

The report read, “SpaceX wrote down the value of Bitcoin it owns by a total of $373 million last year and in 2021 and has sold the cryptocurrency.”

- China’s second-most prominent real estate giant, Evergrande, filing for Chapter 15 Bankruptcy protection in New York.

Notably, the company accounts for around 40% of Chinese home sales, most of which private property developers have defaulted since 2021.

While it makes sense to assume that China markets crash during the Asia session, the Evergrande news could already be priced, so late shorters may have missed the train.

- Federal Judge Analisa Torres greenlighted the US SEC’s request for interlocutory appeal just over a month after a partial ruling in favor of Ripple.

The SEC has 24 hours to file a motion with the court making the market jittery over a possible overturning of the July 13 ruling.

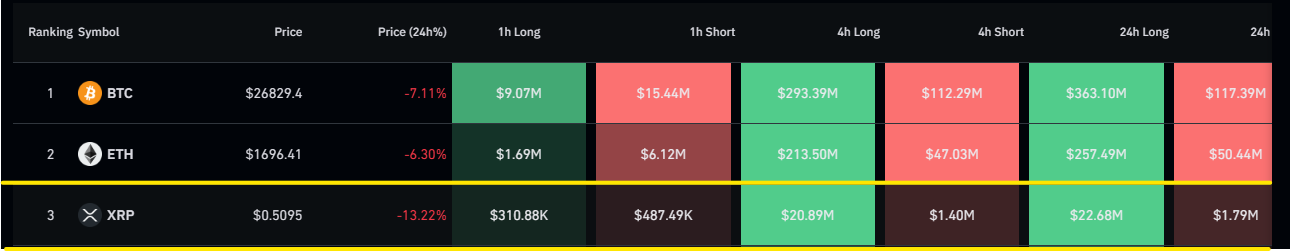

These three events could have caused around $820 million (close to $1 billion) in total liquidations for long positions.

Total liquidations

Long positions for Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) account for $363.10 million, $257.49 million, and $22.68 million, respectively.

Top 3 liquidations

Litecoin (LTC), the “Silver to Bitcoin’s Gold,” follows closely with $17.64 million longs liquidated, as reported.

Pullback gives retail traders an opportunity to step in

At the time of writing, Bitcoin price is $26,777 following the retraction, representing a 7% pullback from the intra-day low of $25,166. The pullback seems to have given retail traders a chance to step in after being sidelined. The Relative Strength Index (RSI) moving north points to rising momentum, possibly because of FOMO (fear of missing out), and could see the market change direction.

BTC/USDT 12-hour chart

If history is enough to go by, the RSI indicates a pattern that every time the RSI tested the level indicated in blue, Bitcoin price reacted with at least a 40% leap north. If the same plays over, BTC could ascend north, shatter the pink order block (supply zone), and flip it to a bullish breaker before a possible foray above the psychological $30,000 to hit $36,000 in a highly bullish case.

Nevertheless, the supply zone between $28,463 and $30,000 is a more conservative target. This would be the area to watch as the market still craves for a significant catalyst. Currently, the market still needs to cataryze the bleed from news around FTX, Digital Currency Group (DCG) and Genesis.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.