Bitcoin (BTC $29,098) reclaimed $29,000 overnight into May 4 as the United States banking crisis risked spawning new victims.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Gold, Bitcoin benefit from U.S. banking mayhem

Data from Cointelegraph Markets Pro and TradingView tracked a swift mood change for BTC/USD, which hit $29,242 on Bitstamp.

The pair had sunk to daily lows at the previous day’s Wall Street open as markets awaited the Federal Reserve’s decision on interest rates.

At the same time, more U.S. regional bank stocks were suffering, with the trend remaining as the Fed confirmed its much-anticipated 0.25% hike.

One lender, PacWest Bancorp, reportedly announced that it was considering a buyout, pressuring the regional bank sector even further while boosting havens, including Bitcoin.

Gold even hit new all-time highs as market commentators criticized the Fed’s approach and predicted the end of rate hikes altogether.

XAU/USD 1-month candle chart. Source: TradingView

“The biggest joke is the fact that Jerome Powell says that the banking system has improved and is healthy, sound and resilient. It’s the weakest it has ever been and another few banks have been falling apart after market,” Michaël van de Poppe, founder and CEO of trading firm Eight, reacted.

This was the last hike.

Van de Poppe referenced comments on the regional banking sector by Fed Chair Jerome Powell, which accompanied the rate decision.

“Conditions in that sector have broadly improved since early March, and the U.S banking system is sound and resilient,” he said in a statement prior to a subsequent press conference.

We will continue to monitor conditions in this sector. We are committed to learning the right lessons from this episode and will work to prevent events like these from happening again.

Others were far from convinced, however.

Arthur Hayes, the former CEO of derivatives exchange BitMEX, revealed that he was already hunting for failing regional banks. Markets, he argued, could depend on the next move by either Powell or Treasury Secretary Janet Yellen.

“You never know what is the trigger that causes Yellen or Powell to cave and bail everyone out. It’s all politics now and politics is more about power than rational decisions,” part of a tweet read.

Financial commentator Tedtalksmacro additionally noted that the Fed funds rate was now at its members’ own expected peak.

Back in March, the majority of FOMC participants said that the terminal rate for this tightening cycle would be 5-5.25% —> that’s where we are now. pic.twitter.com/50d4EMG7Fg

— tedtalksmacro (@tedtalksmacro) May 3, 2023

An “important signal”

Turning to Bitcoin: reclaiming $29,000 provided a much-needed bullish counterpoint to recent price action.

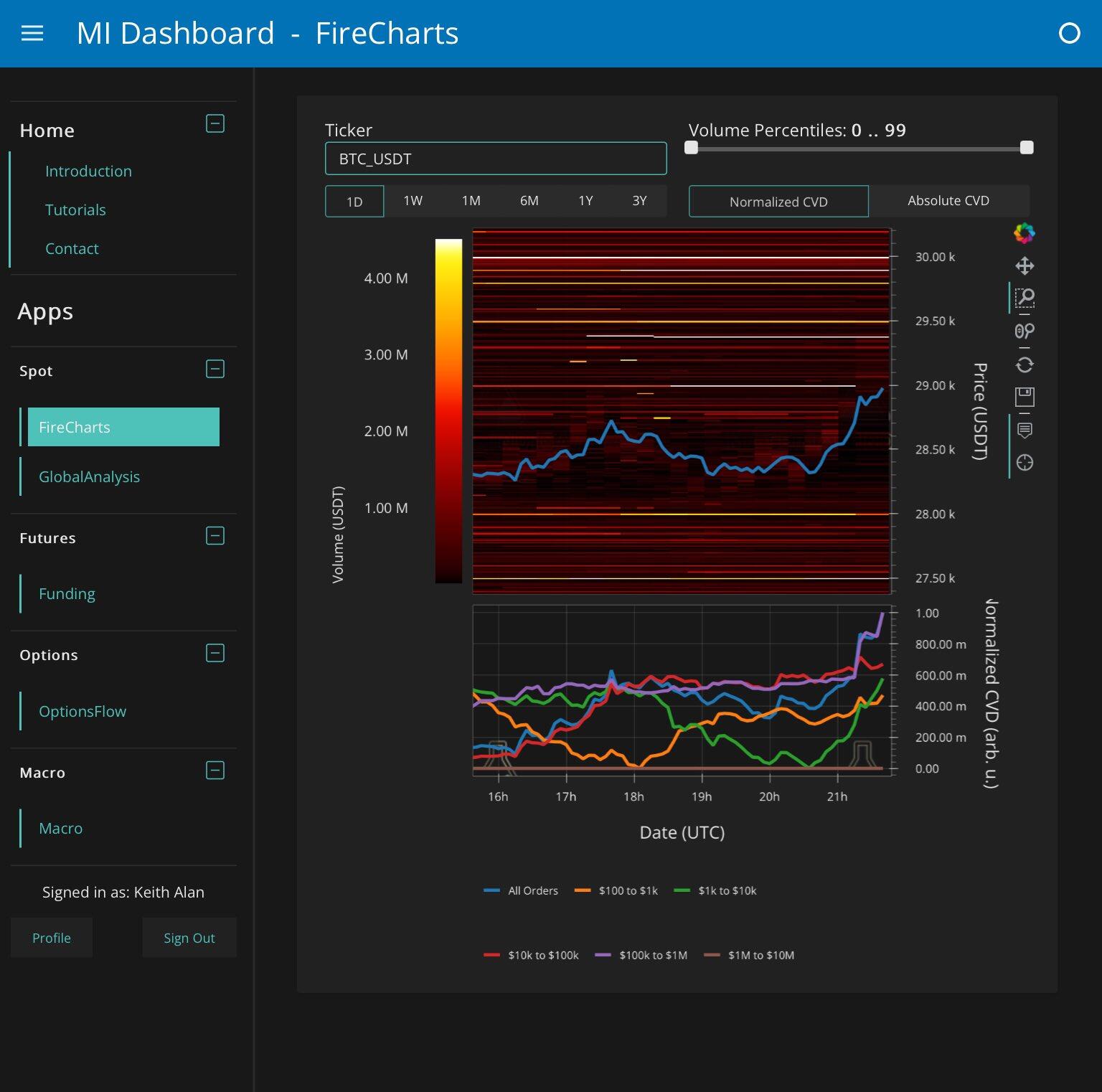

Eyeing changes in the Binance order book, monitoring resource Material Indicators showed that whale buying power had gained the upper hand through the news events.

“After clearing out most of liquidity in the range before the FOMC FED rate hike announcement, BTC whales had no problem eating through the remaining liquidity and reclaimed $29k,” it summarized.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Market participants thus hoped that further liquidity squeezes could come next, fueling a trip above the $30,000 barrier.

“Even though Gold is attacking ATHs, Bitcoin continues to outperform it,“ Checkmate, lead on-chain analyst at Glassnode, noted, having called gold’s new highs an “important signal.“

A tweet including Glassnode data showed the increase in BTC/XAU since the start of 2020.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.