AUD/USD

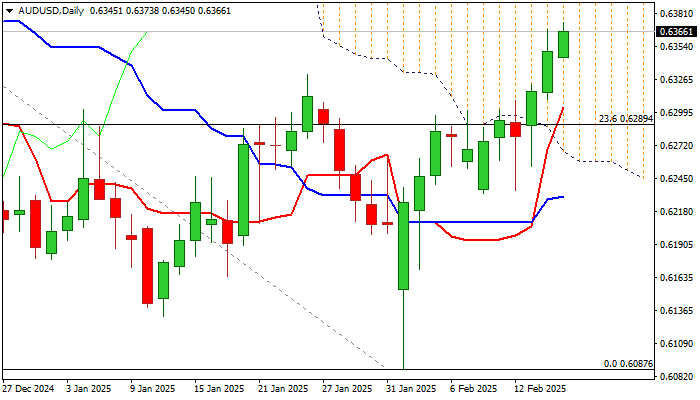

AUDUSD hit new 2025 high on Monday (the highest since mid-December) in extension of broader rally in past two weeks (up nearly 5% on bounce from the lowest level in almost four years).

Weaker US dollar continue to fuel Aussie dollar’s advance, which turned the picture on daily chart positive and generating initial reversal signal.

Near-term action is moving within thick daily Ichimoku cloud and underpinned by formation of daily Tenkan/Kijun-sen) bull-cross, focusing key resistances at 0.6410/14 (daily cloud top / Fibo 38.2% of 0.6942/0.6087 downtrend).

Break of these levels to confirm reversal signal, though increased headwinds should be expected at this zone on overbought conditions and RBA’s rate decision in early Tuesday.

The Australia’ central bank is widely expected to cut interest rates by 25 basis points on Tuesday’s policy meeting, in the first rate cut in more than four years that will mark the beginning of monetary policy easing cycle.

Former top of Jan 24 (0.6330) offers immediate support, with near term bias to remain biased higher as long as the price action stays above strong 0.6300/0.6290 support zone.

Res: 0.6414; 0.6441; 0.6500; 0.6515.

Sup: 0.6330; 0.6290; 0.6235; 0.6194.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Warming up or the RBA

AUD/USD added to the move higher and rose to new two-month peaks near 0.6370 on the back of the soft tone in the US Dollar and rising expectation ahead of the RBA’s interest rate decision.

EUR/USD: Next target comes at 1.0530

EUR/USD traded in an inconclusive fashion amid the equally vacillating development in the Greenback, returning to the sub-1.0500 region following reduced trading conditions in response to the US Presidents’ Day holiday.

Gold resumes the upside around $2,900

Gold prices leave behind Friday's marked pullback and regain some composure, managing to retest the $2,900 region per ounce troy amid the generalised absence of volatility on US Presidents' Day holiday.

Ethereum Price Forecast: ETH outperforms top cryptocurrencies, sees $1.1 billion in stablecoin inflows

Ethereum (ETH) is up 1% on Monday, stretching its weekly gains to nearly 3%, while other top blockchains experience losses. The top altcoin's recent outperformance can be attributed to rising stablecoin inflows and investment from institutional investors through ETH exchange-traded funds (ETFs).

Bitcoin Price Forecast: BTC stalemate soon coming to an end

Bitcoin price has been consolidating between $94,000 and $100,000 for almost two weeks. Amid this consolidation, investor sentiment remains indecisive, with US spot ETFs recording a $580.2 million net outflow last week, signaling institutional demand weakness.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.