- ApeCoin price continues to face difficulties moving above a critical resistance level at $13.

- Two trade ideas identified yesterday have been resolved.

- A new long opportunity exists – but downside risks remain a major concern.

ApeCoin price action has traded mostly sideways throughout the Saturday session, sticking to a range between $13.80 and $12.40. The bulls attempted to break out Friday but were denied and pushed back down. However, bears were unable or unwilling to capitalize on that weakness. So indecision is now the name of the game.

ApeCoin price develops a strong bullish reversal pattern on its Point and Figure chart

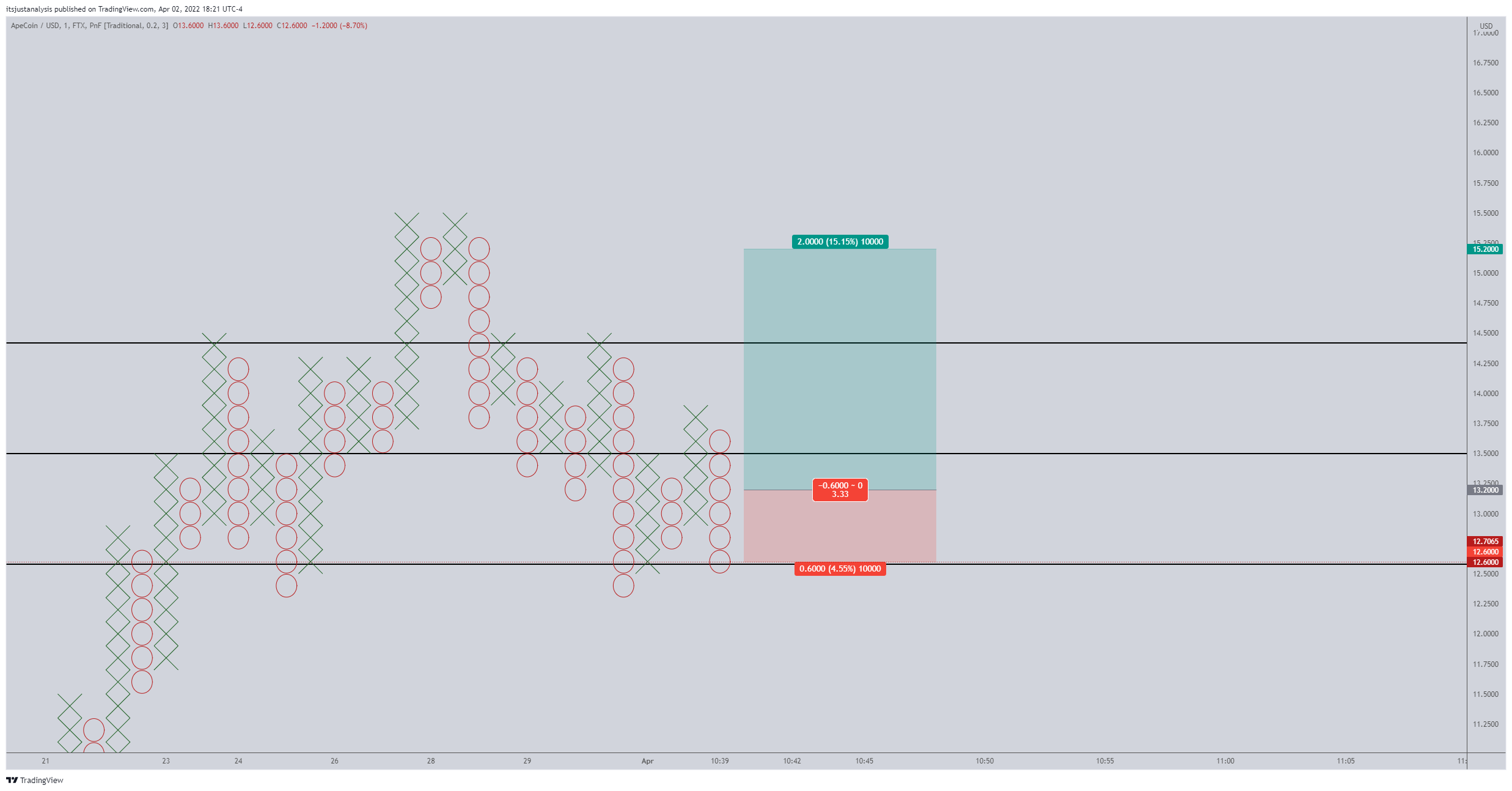

ApeCoin price had two intraday setups on the $0.20/3-box reversal Point and Figure chart on Friday, one long and one short. The long entry triggered and moved up two boxes before returning lower and hitting the trailing stop at break even. The short entry was invalidated because the long side triggered first. Now, a new long opportunity presents itself for ApeCoin bulls.

The hypothetical long entry for ApeCoin price is a buy stop order at $13.20, a stop-loss order at $12.60, and a profit target at $15.20. The trade represents a 3.33:1 reward for the risk. The setup is based on the entry from a Point and Figure pattern known as a Bearish Fakeout.

APE/USDT $0.20/3-box Reversal Point and Figure Chart

The trade is invalidated if the current O-column moves down to $12.20 before the long entry is triggered. A two to three-box trailing stop for ApeCoin price would help protect any profit made post entry.

From an Ichimoku perspective, the whipsaws and indecision make perfect sense. ApeCoin price is inside the 4-hour Ichimoku Cloud. The Cloud represents indecision, volatility, congestion, fakeouts, and a myriad of other negative trading behaviors.

APE/USDT 4-hour Ichimoku Kinko Hyo Chart

In a nutshell, the Ichimoku Cloud is where trading accounts die until there is a clear breakout above the Ichimoku Cloud at $14 or below the Ichimoku Cloud at $12.60, painful trading conditions are likely to continue.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Turn off Solana and win $400,000 - Solana Foundation executive announces offer

Solana has been touted as an Ethereum killer, but as with every blockchain in the crypto market, the network does not come without its fair share of issues. While many who get hacked or exploited deal with the issues after the fact, Solana intends to get a step ahead by making a very lucrative offer to white hat hackers.

Grayscale vs. SEC deadline: Commission faces a midnight Friday deadline to challenge August 29 loss

Grayscale Investments secured a resounding victory in its longstanding case against the US Securities and Exchange Commission in late August. The lawsuit started in October after the firm approached the D.C. Circuit Court pushing to have its Bitcoin Trust converted to an Exchange-traded fund.

Loom Network price hits strong weekly resistance after 32% surge as LOOM ranks high on Korea’s Upbit

Loom Network token is highly bullish, passing as a rather lucrative investment for scalping traders, buying and selling the asset within a short period to make small profits.

Voyager founder charged by CFTC for fraud and by FTC for misleading investors that lost $1 billion

Voyager was among the first crypto companies to collapse and file for bankruptcy in 2022. While the platform has been making efforts to return its customers' assets since then, it looks like the regulatory bodies are not willing to be patient.

Bitcoin: Can BTC bears challenge crypto’s 2023 bull rally?

Bitcoin (BTC) price is at a critical juncture in the weekly time frame, where bulls and bears are battling for control. However, a multi-time-frame analysis shows that BTC is bullish daily and is likely to rally higher.